Internal Rate of Return A project is estimated to cost 36223

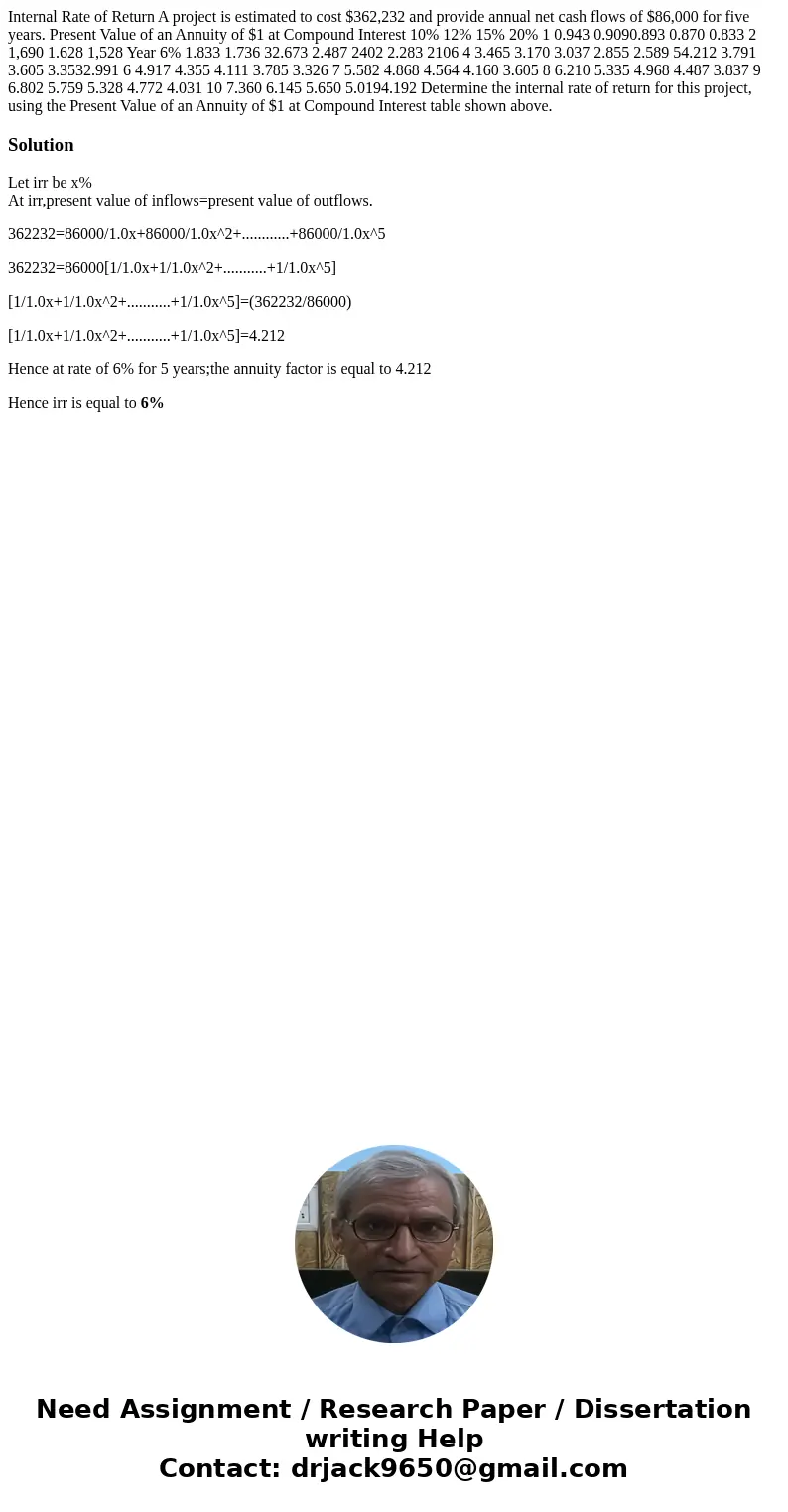

Internal Rate of Return A project is estimated to cost $362,232 and provide annual net cash flows of $86,000 for five years. Present Value of an Annuity of $1 at Compound Interest 10% 12% 15% 20% 1 0.943 0.9090.893 0.870 0.833 2 1,690 1.628 1,528 Year 6% 1.833 1.736 32.673 2.487 2402 2.283 2106 4 3.465 3.170 3.037 2.855 2.589 54.212 3.791 3.605 3.3532.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.0194.192 Determine the internal rate of return for this project, using the Present Value of an Annuity of $1 at Compound Interest table shown above.

Solution

Let irr be x%

At irr,present value of inflows=present value of outflows.

362232=86000/1.0x+86000/1.0x^2+............+86000/1.0x^5

362232=86000[1/1.0x+1/1.0x^2+...........+1/1.0x^5]

[1/1.0x+1/1.0x^2+...........+1/1.0x^5]=(362232/86000)

[1/1.0x+1/1.0x^2+...........+1/1.0x^5]=4.212

Hence at rate of 6% for 5 years;the annuity factor is equal to 4.212

Hence irr is equal to 6%

Homework Sourse

Homework Sourse