Additional Problem 3 Part Level Submission Fol lowing is inf

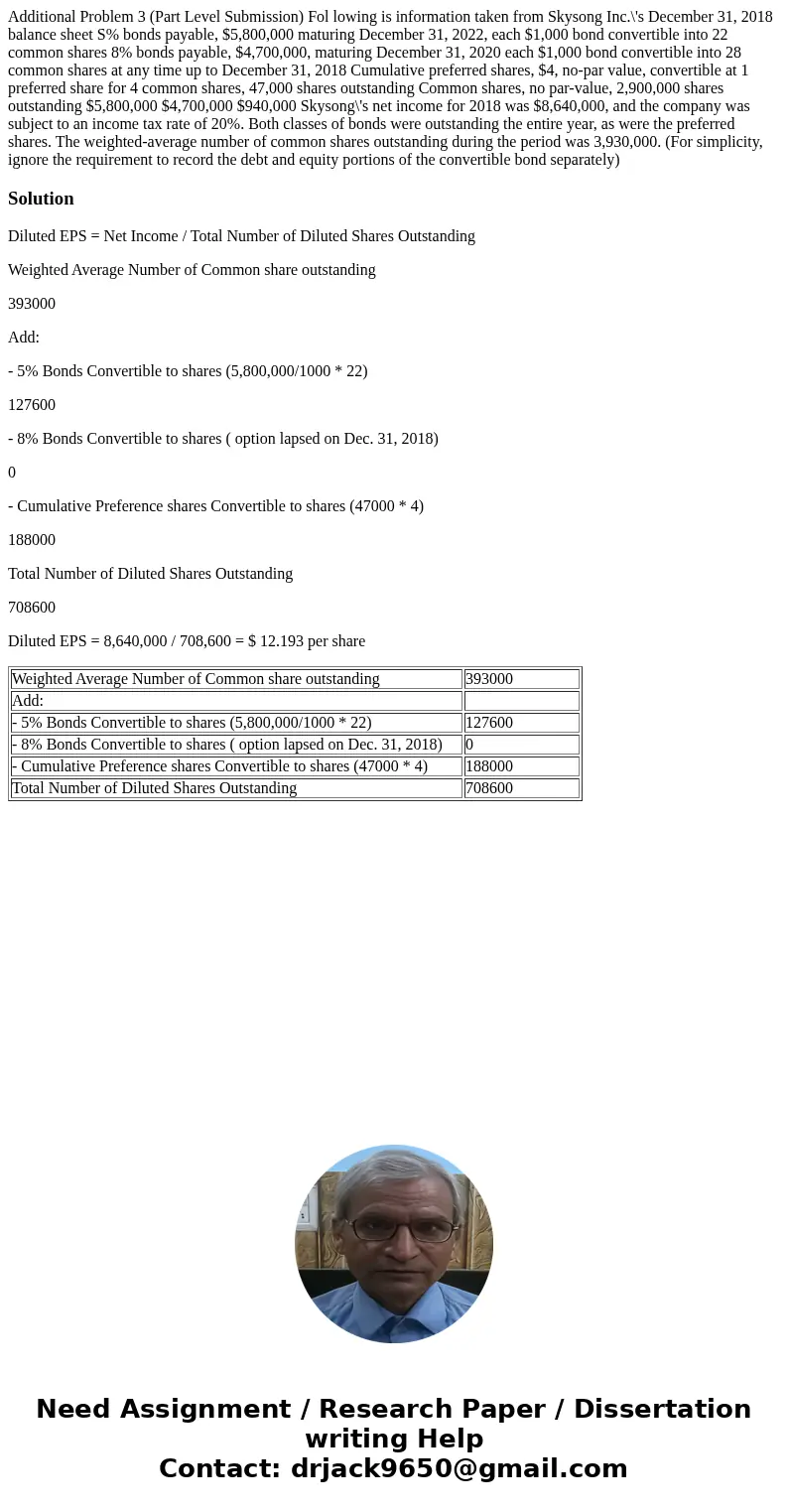

Additional Problem 3 (Part Level Submission) Fol lowing is information taken from Skysong Inc.\'s December 31, 2018 balance sheet S% bonds payable, $5,800,000 maturing December 31, 2022, each $1,000 bond convertible into 22 common shares 8% bonds payable, $4,700,000, maturing December 31, 2020 each $1,000 bond convertible into 28 common shares at any time up to December 31, 2018 Cumulative preferred shares, $4, no-par value, convertible at 1 preferred share for 4 common shares, 47,000 shares outstanding Common shares, no par-value, 2,900,000 shares outstanding $5,800,000 $4,700,000 $940,000 Skysong\'s net income for 2018 was $8,640,000, and the company was subject to an income tax rate of 20%. Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average number of common shares outstanding during the period was 3,930,000. (For simplicity, ignore the requirement to record the debt and equity portions of the convertible bond separately)

Solution

Diluted EPS = Net Income / Total Number of Diluted Shares Outstanding

Weighted Average Number of Common share outstanding

393000

Add:

- 5% Bonds Convertible to shares (5,800,000/1000 * 22)

127600

- 8% Bonds Convertible to shares ( option lapsed on Dec. 31, 2018)

0

- Cumulative Preference shares Convertible to shares (47000 * 4)

188000

Total Number of Diluted Shares Outstanding

708600

Diluted EPS = 8,640,000 / 708,600 = $ 12.193 per share

| Weighted Average Number of Common share outstanding | 393000 |

| Add: | |

| - 5% Bonds Convertible to shares (5,800,000/1000 * 22) | 127600 |

| - 8% Bonds Convertible to shares ( option lapsed on Dec. 31, 2018) | 0 |

| - Cumulative Preference shares Convertible to shares (47000 * 4) | 188000 |

| Total Number of Diluted Shares Outstanding | 708600 |

Homework Sourse

Homework Sourse