7 FITB0472 Prepare general I entries to record the follo exp

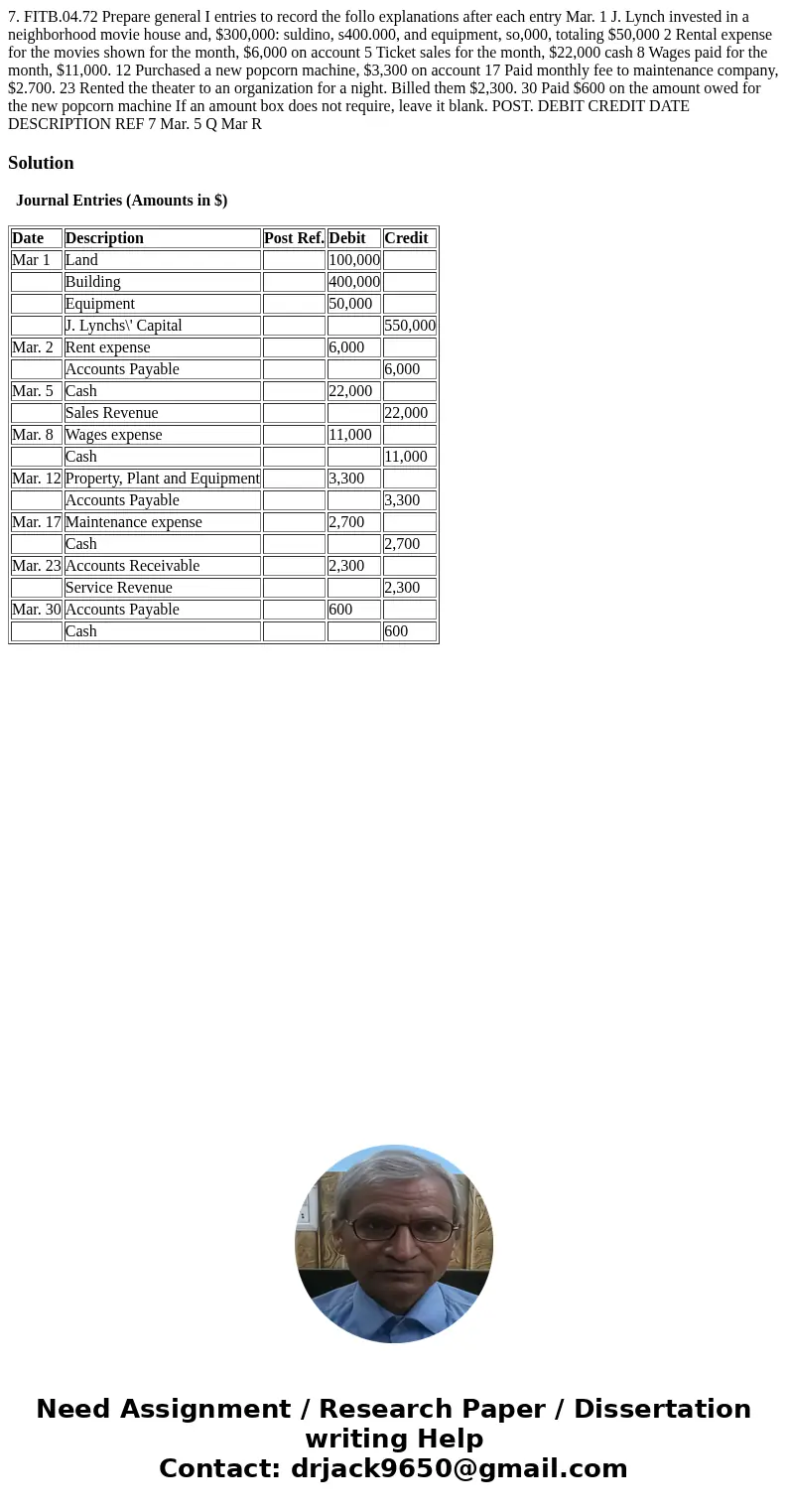

7. FITB.04.72 Prepare general I entries to record the follo explanations after each entry Mar. 1 J. Lynch invested in a neighborhood movie house and, $300,000: suldino, s400.000, and equipment, so,000, totaling $50,000 2 Rental expense for the movies shown for the month, $6,000 on account 5 Ticket sales for the month, $22,000 cash 8 Wages paid for the month, $11,000. 12 Purchased a new popcorn machine, $3,300 on account 17 Paid monthly fee to maintenance company, $2.700. 23 Rented the theater to an organization for a night. Billed them $2,300. 30 Paid $600 on the amount owed for the new popcorn machine If an amount box does not require, leave it blank. POST. DEBIT CREDIT DATE DESCRIPTION REF 7 Mar. 5 Q Mar R

Solution

Journal Entries (Amounts in $)

| Date | Description | Post Ref. | Debit | Credit |

| Mar 1 | Land | 100,000 | ||

| Building | 400,000 | |||

| Equipment | 50,000 | |||

| J. Lynchs\' Capital | 550,000 | |||

| Mar. 2 | Rent expense | 6,000 | ||

| Accounts Payable | 6,000 | |||

| Mar. 5 | Cash | 22,000 | ||

| Sales Revenue | 22,000 | |||

| Mar. 8 | Wages expense | 11,000 | ||

| Cash | 11,000 | |||

| Mar. 12 | Property, Plant and Equipment | 3,300 | ||

| Accounts Payable | 3,300 | |||

| Mar. 17 | Maintenance expense | 2,700 | ||

| Cash | 2,700 | |||

| Mar. 23 | Accounts Receivable | 2,300 | ||

| Service Revenue | 2,300 | |||

| Mar. 30 | Accounts Payable | 600 | ||

| Cash | 600 |

Homework Sourse

Homework Sourse