Equipment replacement decision Birney Products Ltd purchased

Solution

PVAF for 10 years @ 16% = 4.833

PVIF at 10th year @ 16% = 0.2267

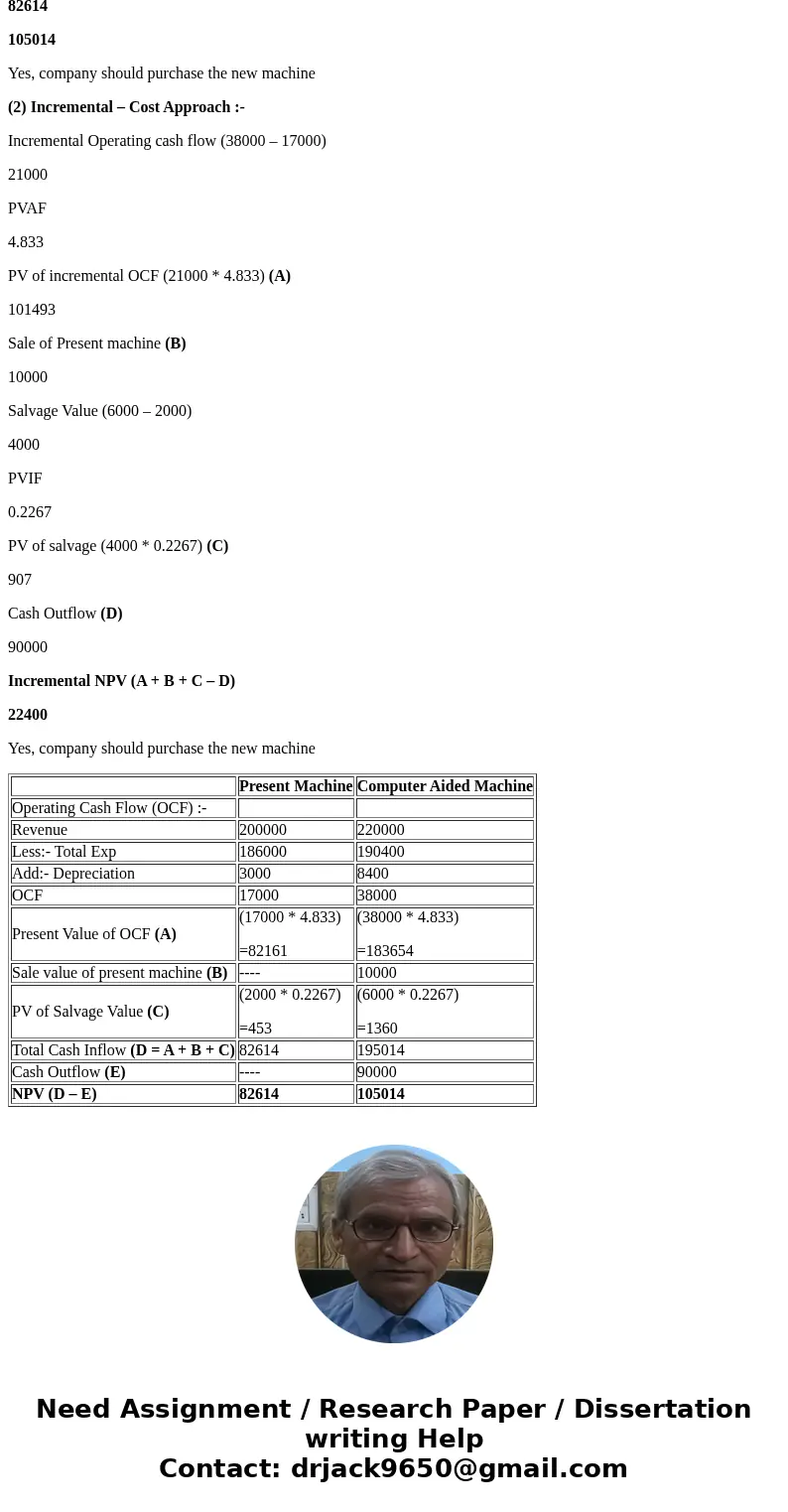

(1) Total cost Approach :-

Present Machine

Computer Aided Machine

Operating Cash Flow (OCF) :-

Revenue

200000

220000

Less:- Total Exp

186000

190400

Add:- Depreciation

3000

8400

OCF

17000

38000

Present Value of OCF (A)

(17000 * 4.833)

=82161

(38000 * 4.833)

=183654

Sale value of present machine (B)

----

10000

PV of Salvage Value (C)

(2000 * 0.2267)

=453

(6000 * 0.2267)

=1360

Total Cash Inflow (D = A + B + C)

82614

195014

Cash Outflow (E)

----

90000

NPV (D – E)

82614

105014

Yes, company should purchase the new machine

(2) Incremental – Cost Approach :-

Incremental Operating cash flow (38000 – 17000)

21000

PVAF

4.833

PV of incremental OCF (21000 * 4.833) (A)

101493

Sale of Present machine (B)

10000

Salvage Value (6000 – 2000)

4000

PVIF

0.2267

PV of salvage (4000 * 0.2267) (C)

907

Cash Outflow (D)

90000

Incremental NPV (A + B + C – D)

22400

Yes, company should purchase the new machine

| Present Machine | Computer Aided Machine | |

| Operating Cash Flow (OCF) :- | ||

| Revenue | 200000 | 220000 |

| Less:- Total Exp | 186000 | 190400 |

| Add:- Depreciation | 3000 | 8400 |

| OCF | 17000 | 38000 |

| Present Value of OCF (A) | (17000 * 4.833) =82161 | (38000 * 4.833) =183654 |

| Sale value of present machine (B) | ---- | 10000 |

| PV of Salvage Value (C) | (2000 * 0.2267) =453 | (6000 * 0.2267) =1360 |

| Total Cash Inflow (D = A + B + C) | 82614 | 195014 |

| Cash Outflow (E) | ---- | 90000 |

| NPV (D – E) | 82614 | 105014 |

Homework Sourse

Homework Sourse