PROBLEM 4 13 points On January 1 2017 Smart Corp had Common

Solution

Solution:

Date

Account Titles and Explanation

Debit

Credit

Jan.15

Retained Earnings (120,000 Shares *$2)

$240,000

Cash Dividend Payable

$240,000

(To record declaration of Cash dividend $2 each share)

Jan.31

No Entry is required on Record Date

Feb.12

Cash Dividend Payable

$240,000

Cash

$240,000

( To record cash dividend paid declared on Jan.15)

April.14

Retained Earnings

$201,600

Stock Dividend Distributable

$201,600

(to record declaration of stock dividend 12%)

(Number of Outstanding Shares before stock dividend 120,000 Shares x 12% * Market Price $14)

(Number of Outstanding Shares after stock dividend = 120,000 + 14,400 = 134,400 Shares)

April.30

No Entry is required on Record Date

May.15

Stock Dividend Distributable

$201,600

Common Stock (Number of Shares distributed 14,400 Shares * Par Value $12)

$172,800

Paid in Capital in Excess of Par - Common Stock (Bal fig)

$28,800

July.5

Memorandum: A 3 for 1 stock split increase the number of shares of common stock outstanding from 134,400 Shares to 403,200 Shares and reduced the par value from $12 to $4 per share ($12 par value / 3 stock for 1). The new 268,800 Shares were distributed

Dec.1

Retained Earnings (403,200 Shares *$0.60)

$241,920

Cash Dividend Payable

$241,920

(To record declaration of Cash dividend $0.60 each share)

Dec.15

No Entry is required on Record Date

Dec.31

Income Summary Statement

$210,000

Retained Earnigns

$210,000

(To record closing entry of Income transferred from Income Summary to Retained Earnings)

Hope the above calculations, working and explanations are clear to you and help you in understanding the concept of question.... please rate my answer...in case any doubt, post a comment and I will try to resolve the doubt ASAP…thank you

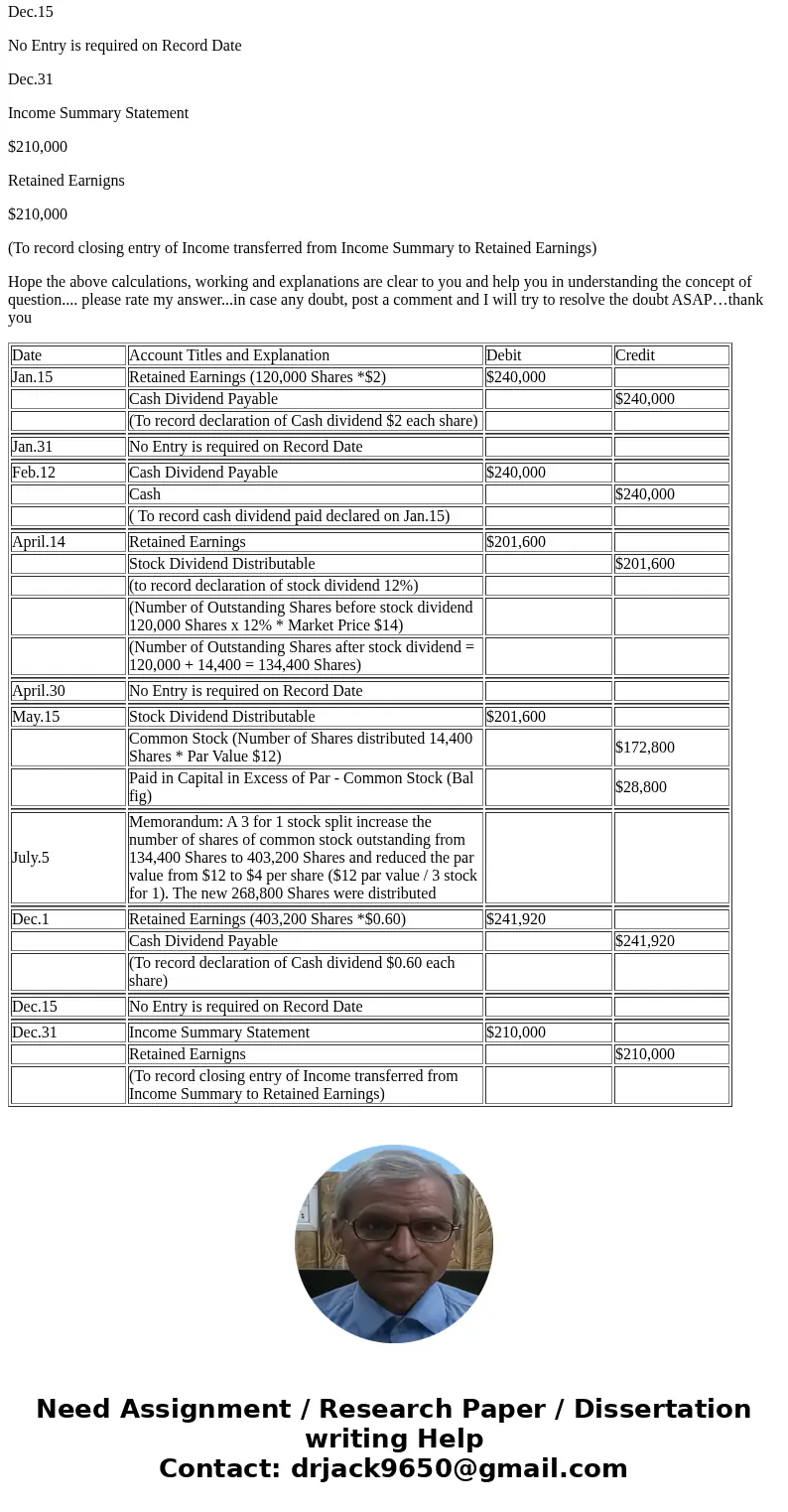

| Date | Account Titles and Explanation | Debit | Credit |

| Jan.15 | Retained Earnings (120,000 Shares *$2) | $240,000 | |

| Cash Dividend Payable | $240,000 | ||

| (To record declaration of Cash dividend $2 each share) | |||

| Jan.31 | No Entry is required on Record Date | ||

| Feb.12 | Cash Dividend Payable | $240,000 | |

| Cash | $240,000 | ||

| ( To record cash dividend paid declared on Jan.15) | |||

| April.14 | Retained Earnings | $201,600 | |

| Stock Dividend Distributable | $201,600 | ||

| (to record declaration of stock dividend 12%) | |||

| (Number of Outstanding Shares before stock dividend 120,000 Shares x 12% * Market Price $14) | |||

| (Number of Outstanding Shares after stock dividend = 120,000 + 14,400 = 134,400 Shares) | |||

| April.30 | No Entry is required on Record Date | ||

| May.15 | Stock Dividend Distributable | $201,600 | |

| Common Stock (Number of Shares distributed 14,400 Shares * Par Value $12) | $172,800 | ||

| Paid in Capital in Excess of Par - Common Stock (Bal fig) | $28,800 | ||

| July.5 | Memorandum: A 3 for 1 stock split increase the number of shares of common stock outstanding from 134,400 Shares to 403,200 Shares and reduced the par value from $12 to $4 per share ($12 par value / 3 stock for 1). The new 268,800 Shares were distributed | ||

| Dec.1 | Retained Earnings (403,200 Shares *$0.60) | $241,920 | |

| Cash Dividend Payable | $241,920 | ||

| (To record declaration of Cash dividend $0.60 each share) | |||

| Dec.15 | No Entry is required on Record Date | ||

| Dec.31 | Income Summary Statement | $210,000 | |

| Retained Earnigns | $210,000 | ||

| (To record closing entry of Income transferred from Income Summary to Retained Earnings) |

Homework Sourse

Homework Sourse