On May 1 2018 Green Corporation issued 1000000 of 12 bonds d

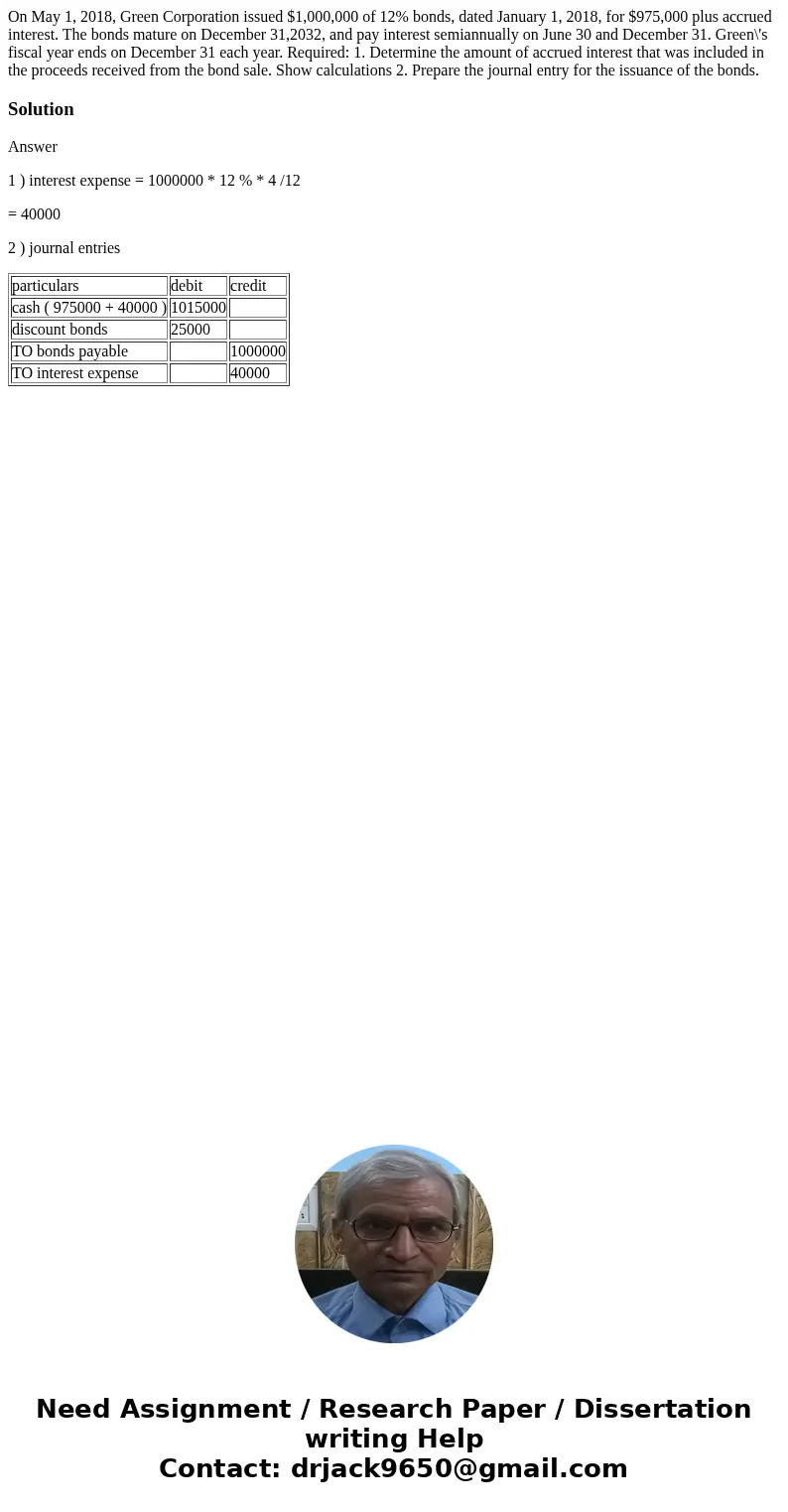

On May 1, 2018, Green Corporation issued $1,000,000 of 12% bonds, dated January 1, 2018, for $975,000 plus accrued interest. The bonds mature on December 31,2032, and pay interest semiannually on June 30 and December 31. Green\'s fiscal year ends on December 31 each year. Required: 1. Determine the amount of accrued interest that was included in the proceeds received from the bond sale. Show calculations 2. Prepare the journal entry for the issuance of the bonds.

Solution

Answer

1 ) interest expense = 1000000 * 12 % * 4 /12

= 40000

2 ) journal entries

| particulars | debit | credit |

| cash ( 975000 + 40000 ) | 1015000 | |

| discount bonds | 25000 | |

| TO bonds payable | 1000000 | |

| TO interest expense | 40000 |

Homework Sourse

Homework Sourse