How much must you deposit each year into your retirement acc

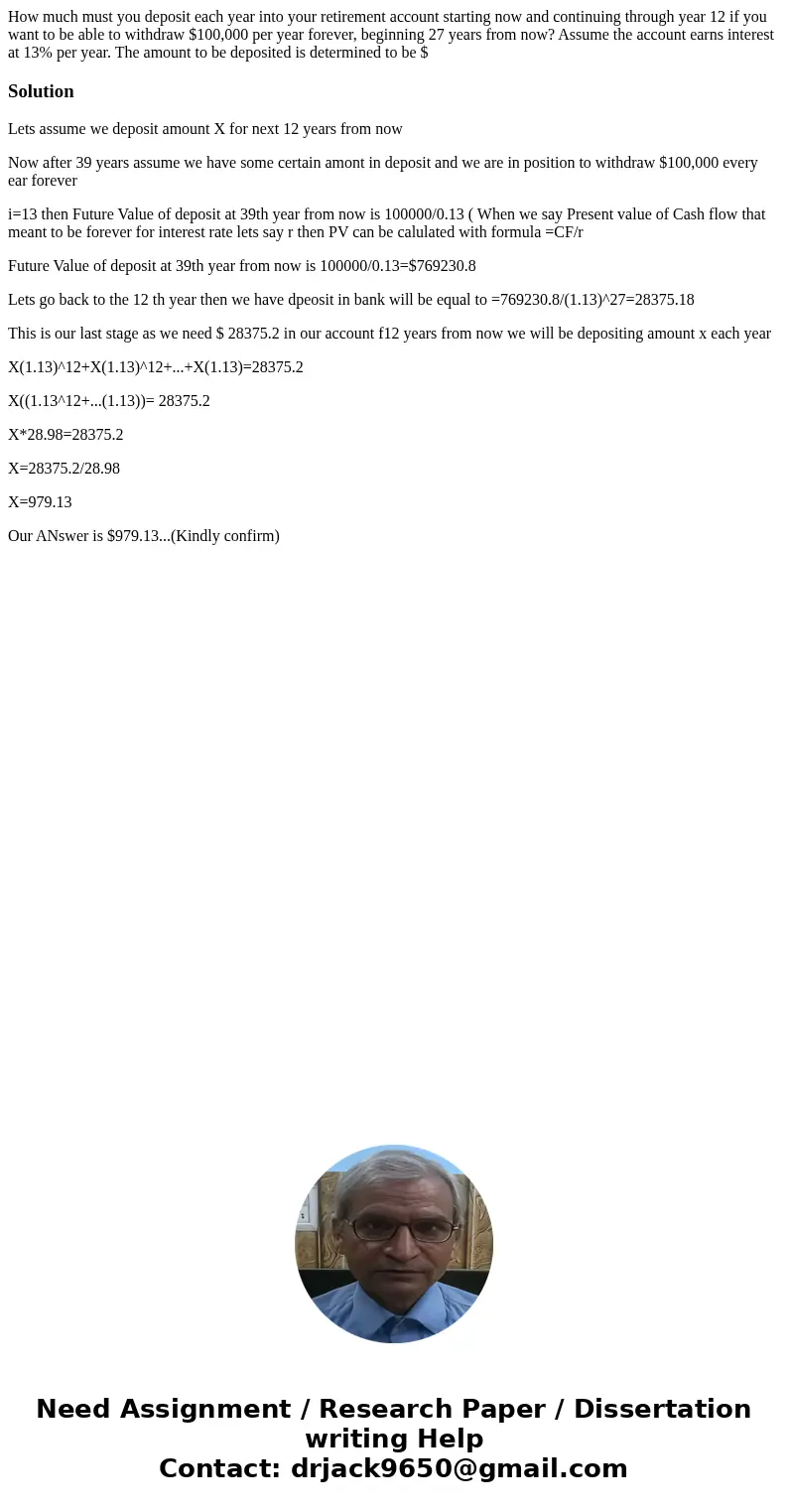

How much must you deposit each year into your retirement account starting now and continuing through year 12 if you want to be able to withdraw $100,000 per year forever, beginning 27 years from now? Assume the account earns interest at 13% per year. The amount to be deposited is determined to be $

Solution

Lets assume we deposit amount X for next 12 years from now

Now after 39 years assume we have some certain amont in deposit and we are in position to withdraw $100,000 every ear forever

i=13 then Future Value of deposit at 39th year from now is 100000/0.13 ( When we say Present value of Cash flow that meant to be forever for interest rate lets say r then PV can be calulated with formula =CF/r

Future Value of deposit at 39th year from now is 100000/0.13=$769230.8

Lets go back to the 12 th year then we have dpeosit in bank will be equal to =769230.8/(1.13)^27=28375.18

This is our last stage as we need $ 28375.2 in our account f12 years from now we will be depositing amount x each year

X(1.13)^12+X(1.13)^12+...+X(1.13)=28375.2

X((1.13^12+...(1.13))= 28375.2

X*28.98=28375.2

X=28375.2/28.98

X=979.13

Our ANswer is $979.13...(Kindly confirm)

Homework Sourse

Homework Sourse