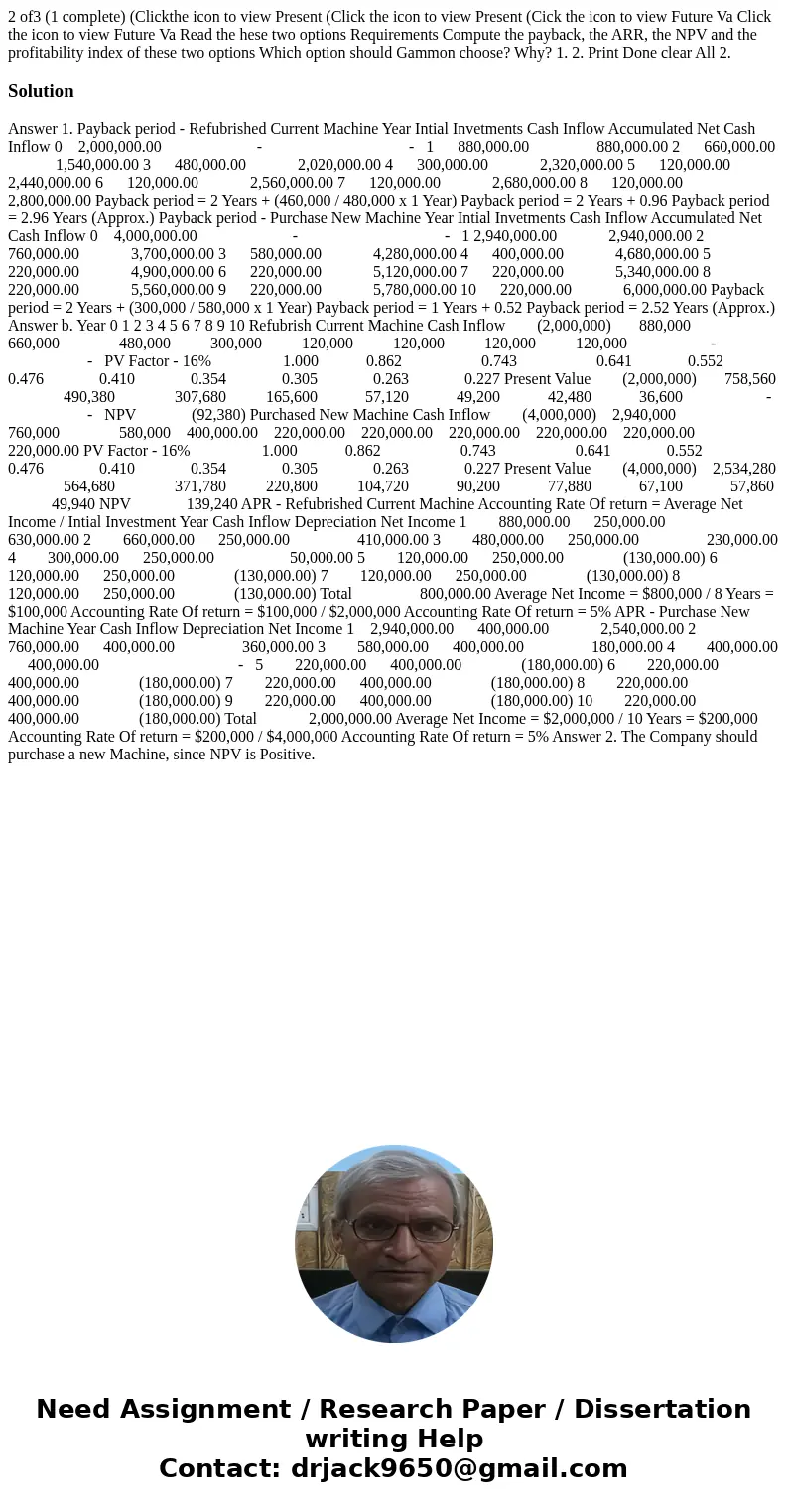

2 of3 (1 complete) (Clickthe icon to view Present (Click the icon to view Present (Cick the icon to view Future Va Click the icon to view Future Va Read the hese two options Requirements Compute the payback, the ARR, the NPV and the profitability index of these two options Which option should Gammon choose? Why? 1. 2. Print Done clear All 2.

Answer 1. Payback period - Refubrished Current Machine Year Intial Invetments Cash Inflow Accumulated Net Cash Inflow 0 2,000,000.00 - - 1 880,000.00 880,000.00 2 660,000.00 1,540,000.00 3 480,000.00 2,020,000.00 4 300,000.00 2,320,000.00 5 120,000.00 2,440,000.00 6 120,000.00 2,560,000.00 7 120,000.00 2,680,000.00 8 120,000.00 2,800,000.00 Payback period = 2 Years + (460,000 / 480,000 x 1 Year) Payback period = 2 Years + 0.96 Payback period = 2.96 Years (Approx.) Payback period - Purchase New Machine Year Intial Invetments Cash Inflow Accumulated Net Cash Inflow 0 4,000,000.00 - - 1 2,940,000.00 2,940,000.00 2 760,000.00 3,700,000.00 3 580,000.00 4,280,000.00 4 400,000.00 4,680,000.00 5 220,000.00 4,900,000.00 6 220,000.00 5,120,000.00 7 220,000.00 5,340,000.00 8 220,000.00 5,560,000.00 9 220,000.00 5,780,000.00 10 220,000.00 6,000,000.00 Payback period = 2 Years + (300,000 / 580,000 x 1 Year) Payback period = 1 Years + 0.52 Payback period = 2.52 Years (Approx.) Answer b. Year 0 1 2 3 4 5 6 7 8 9 10 Refubrish Current Machine Cash Inflow (2,000,000) 880,000 660,000 480,000 300,000 120,000 120,000 120,000 120,000 - - PV Factor - 16% 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 Present Value (2,000,000) 758,560 490,380 307,680 165,600 57,120 49,200 42,480 36,600 - - NPV (92,380) Purchased New Machine Cash Inflow (4,000,000) 2,940,000 760,000 580,000 400,000.00 220,000.00 220,000.00 220,000.00 220,000.00 220,000.00 220,000.00 PV Factor - 16% 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 Present Value (4,000,000) 2,534,280 564,680 371,780 220,800 104,720 90,200 77,880 67,100 57,860 49,940 NPV 139,240 APR - Refubrished Current Machine Accounting Rate Of return = Average Net Income / Intial Investment Year Cash Inflow Depreciation Net Income 1 880,000.00 250,000.00 630,000.00 2 660,000.00 250,000.00 410,000.00 3 480,000.00 250,000.00 230,000.00 4 300,000.00 250,000.00 50,000.00 5 120,000.00 250,000.00 (130,000.00) 6 120,000.00 250,000.00 (130,000.00) 7 120,000.00 250,000.00 (130,000.00) 8 120,000.00 250,000.00 (130,000.00) Total 800,000.00 Average Net Income = $800,000 / 8 Years = $100,000 Accounting Rate Of return = $100,000 / $2,000,000 Accounting Rate Of return = 5% APR - Purchase New Machine Year Cash Inflow Depreciation Net Income 1 2,940,000.00 400,000.00 2,540,000.00 2 760,000.00 400,000.00 360,000.00 3 580,000.00 400,000.00 180,000.00 4 400,000.00 400,000.00 - 5 220,000.00 400,000.00 (180,000.00) 6 220,000.00 400,000.00 (180,000.00) 7 220,000.00 400,000.00 (180,000.00) 8 220,000.00 400,000.00 (180,000.00) 9 220,000.00 400,000.00 (180,000.00) 10 220,000.00 400,000.00 (180,000.00) Total 2,000,000.00 Average Net Income = $2,000,000 / 10 Years = $200,000 Accounting Rate Of return = $200,000 / $4,000,000 Accounting Rate Of return = 5% Answer 2. The Company should purchase a new Machine, since NPV is Positive.

Homework Sourse

Homework Sourse