Hornets is a struggling industry until a young business stud

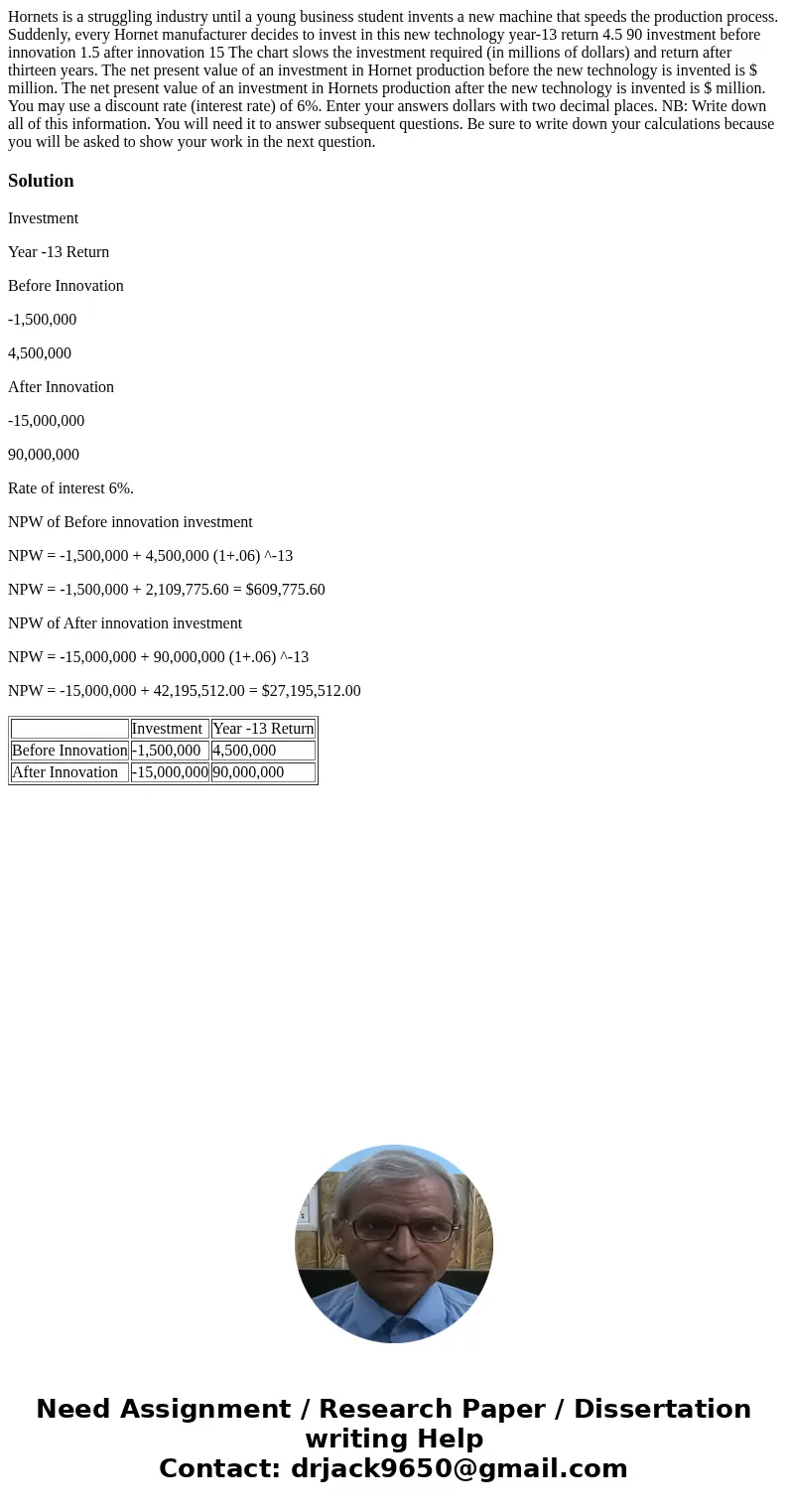

Hornets is a struggling industry until a young business student invents a new machine that speeds the production process. Suddenly, every Hornet manufacturer decides to invest in this new technology year-13 return 4.5 90 investment before innovation 1.5 after innovation 15 The chart slows the investment required (in millions of dollars) and return after thirteen years. The net present value of an investment in Hornet production before the new technology is invented is $ million. The net present value of an investment in Hornets production after the new technology is invented is $ million. You may use a discount rate (interest rate) of 6%. Enter your answers dollars with two decimal places. NB: Write down all of this information. You will need it to answer subsequent questions. Be sure to write down your calculations because you will be asked to show your work in the next question.

Solution

Investment

Year -13 Return

Before Innovation

-1,500,000

4,500,000

After Innovation

-15,000,000

90,000,000

Rate of interest 6%.

NPW of Before innovation investment

NPW = -1,500,000 + 4,500,000 (1+.06) ^-13

NPW = -1,500,000 + 2,109,775.60 = $609,775.60

NPW of After innovation investment

NPW = -15,000,000 + 90,000,000 (1+.06) ^-13

NPW = -15,000,000 + 42,195,512.00 = $27,195,512.00

| Investment | Year -13 Return | |

| Before Innovation | -1,500,000 | 4,500,000 |

| After Innovation | -15,000,000 | 90,000,000 |

Homework Sourse

Homework Sourse