6 There are three mutually exclusive schemes A B and C and t

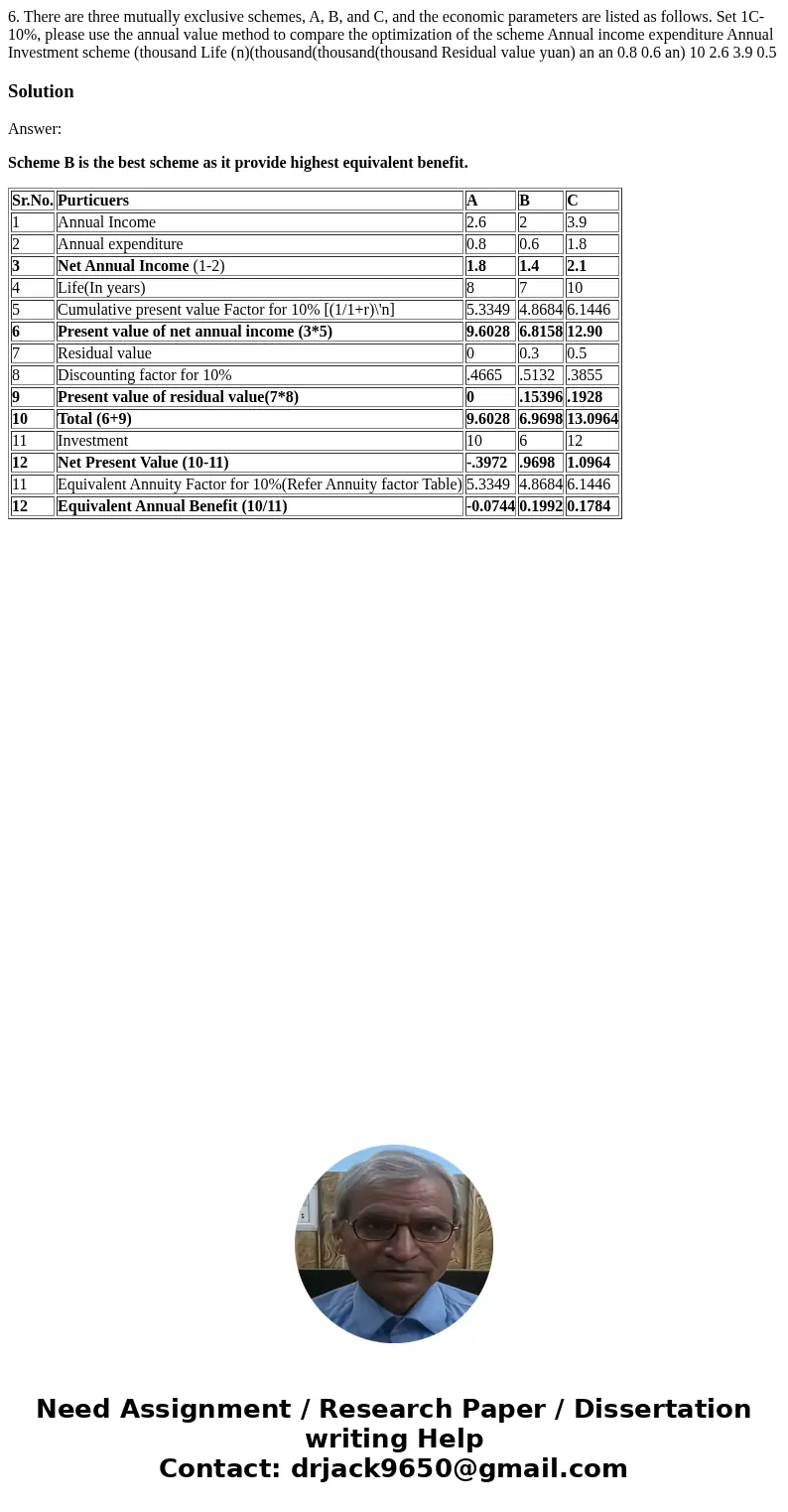

6. There are three mutually exclusive schemes, A, B, and C, and the economic parameters are listed as follows. Set 1C-10%, please use the annual value method to compare the optimization of the scheme Annual income expenditure Annual Investment scheme (thousand Life (n)(thousand(thousand(thousand Residual value yuan) an an 0.8 0.6 an) 10 2.6 3.9 0.5

Solution

Answer:

Scheme B is the best scheme as it provide highest equivalent benefit.

| Sr.No. | Purticuers | A | B | C |

| 1 | Annual Income | 2.6 | 2 | 3.9 |

| 2 | Annual expenditure | 0.8 | 0.6 | 1.8 |

| 3 | Net Annual Income (1-2) | 1.8 | 1.4 | 2.1 |

| 4 | Life(In years) | 8 | 7 | 10 |

| 5 | Cumulative present value Factor for 10% [(1/1+r)\'n] | 5.3349 | 4.8684 | 6.1446 |

| 6 | Present value of net annual income (3*5) | 9.6028 | 6.8158 | 12.90 |

| 7 | Residual value | 0 | 0.3 | 0.5 |

| 8 | Discounting factor for 10% | .4665 | .5132 | .3855 |

| 9 | Present value of residual value(7*8) | 0 | .15396 | .1928 |

| 10 | Total (6+9) | 9.6028 | 6.9698 | 13.0964 |

| 11 | Investment | 10 | 6 | 12 |

| 12 | Net Present Value (10-11) | -.3972 | .9698 | 1.0964 |

| 11 | Equivalent Annuity Factor for 10%(Refer Annuity factor Table) | 5.3349 | 4.8684 | 6.1446 |

| 12 | Equivalent Annual Benefit (10/11) | -0.0744 | 0.1992 | 0.1784 |

Homework Sourse

Homework Sourse