zuestion 9 Joes Computers is deciding whether to invest in p

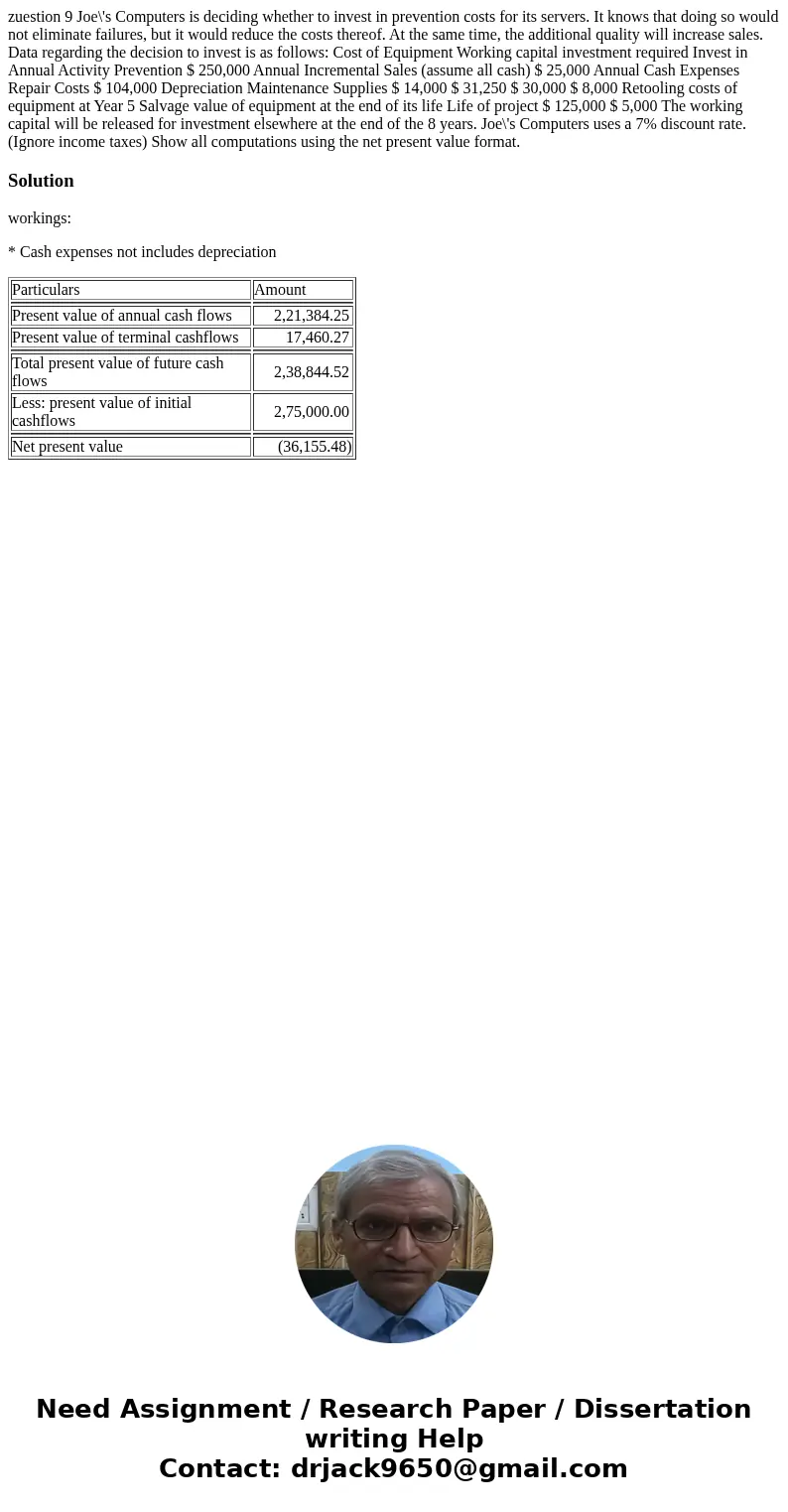

zuestion 9 Joe\'s Computers is deciding whether to invest in prevention costs for its servers. It knows that doing so would not eliminate failures, but it would reduce the costs thereof. At the same time, the additional quality will increase sales. Data regarding the decision to invest is as follows: Cost of Equipment Working capital investment required Invest in Annual Activity Prevention $ 250,000 Annual Incremental Sales (assume all cash) $ 25,000 Annual Cash Expenses Repair Costs $ 104,000 Depreciation Maintenance Supplies $ 14,000 $ 31,250 $ 30,000 $ 8,000 Retooling costs of equipment at Year 5 Salvage value of equipment at the end of its life Life of project $ 125,000 $ 5,000 The working capital will be released for investment elsewhere at the end of the 8 years. Joe\'s Computers uses a 7% discount rate. (Ignore income taxes) Show all computations using the net present value format.

Solution

workings:

* Cash expenses not includes depreciation

| Particulars | Amount |

| Present value of annual cash flows | 2,21,384.25 |

| Present value of terminal cashflows | 17,460.27 |

| Total present value of future cash flows | 2,38,844.52 |

| Less: present value of initial cashflows | 2,75,000.00 |

| Net present value | (36,155.48) |

Homework Sourse

Homework Sourse