Exercise 164 Manufacturing cost data for Orlando Company whi

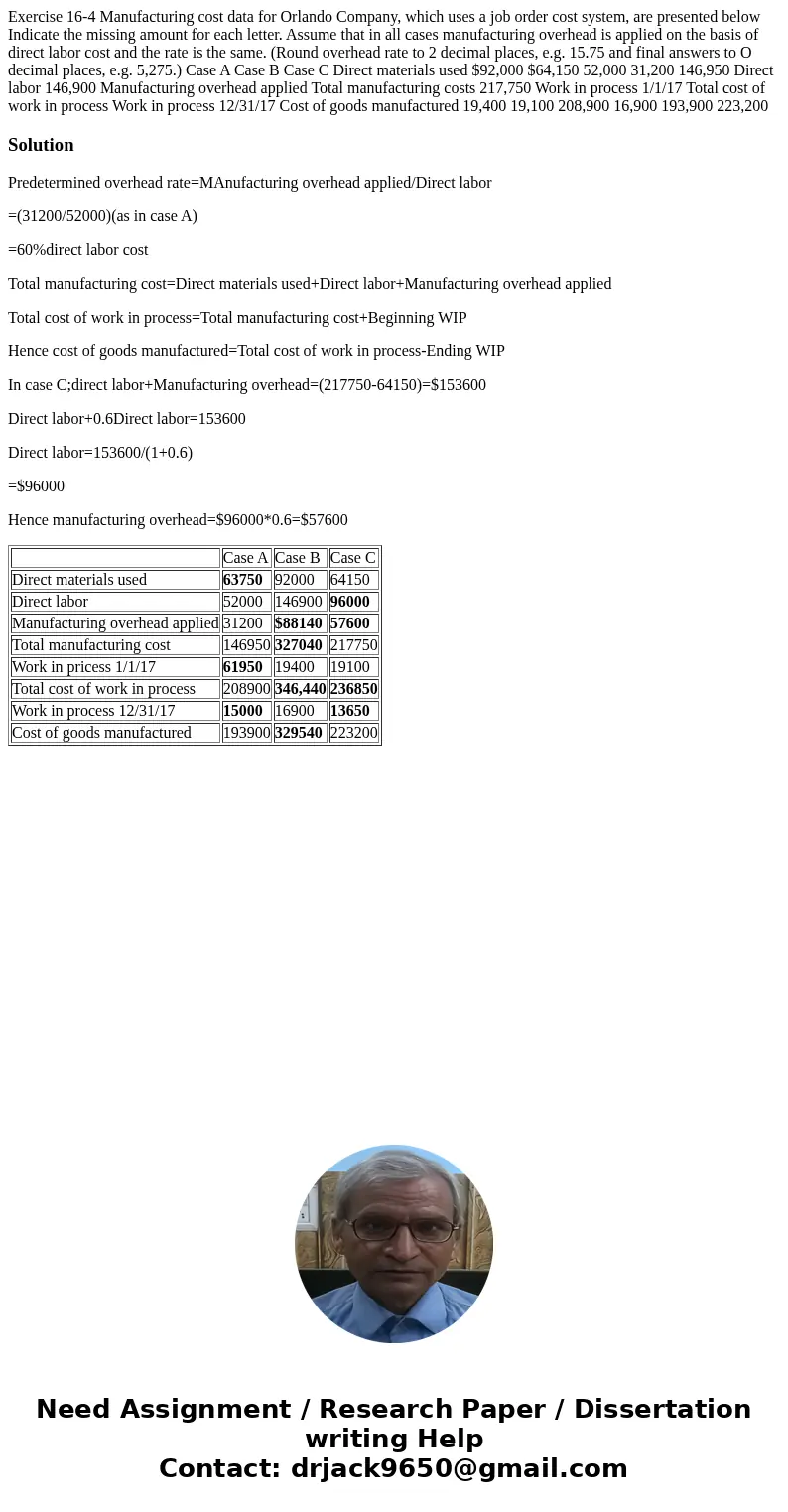

Exercise 16-4 Manufacturing cost data for Orlando Company, which uses a job order cost system, are presented below Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost and the rate is the same. (Round overhead rate to 2 decimal places, e.g. 15.75 and final answers to O decimal places, e.g. 5,275.) Case A Case B Case C Direct materials used $92,000 $64,150 52,000 31,200 146,950 Direct labor 146,900 Manufacturing overhead applied Total manufacturing costs 217,750 Work in process 1/1/17 Total cost of work in process Work in process 12/31/17 Cost of goods manufactured 19,400 19,100 208,900 16,900 193,900 223,200

Solution

Predetermined overhead rate=MAnufacturing overhead applied/Direct labor

=(31200/52000)(as in case A)

=60%direct labor cost

Total manufacturing cost=Direct materials used+Direct labor+Manufacturing overhead applied

Total cost of work in process=Total manufacturing cost+Beginning WIP

Hence cost of goods manufactured=Total cost of work in process-Ending WIP

In case C;direct labor+Manufacturing overhead=(217750-64150)=$153600

Direct labor+0.6Direct labor=153600

Direct labor=153600/(1+0.6)

=$96000

Hence manufacturing overhead=$96000*0.6=$57600

| Case A | Case B | Case C | |

| Direct materials used | 63750 | 92000 | 64150 |

| Direct labor | 52000 | 146900 | 96000 |

| Manufacturing overhead applied | 31200 | $88140 | 57600 |

| Total manufacturing cost | 146950 | 327040 | 217750 |

| Work in pricess 1/1/17 | 61950 | 19400 | 19100 |

| Total cost of work in process | 208900 | 346,440 | 236850 |

| Work in process 12/31/17 | 15000 | 16900 | 13650 |

| Cost of goods manufactured | 193900 | 329540 | 223200 |

Homework Sourse

Homework Sourse