The following selected information is from Ellerby Companys

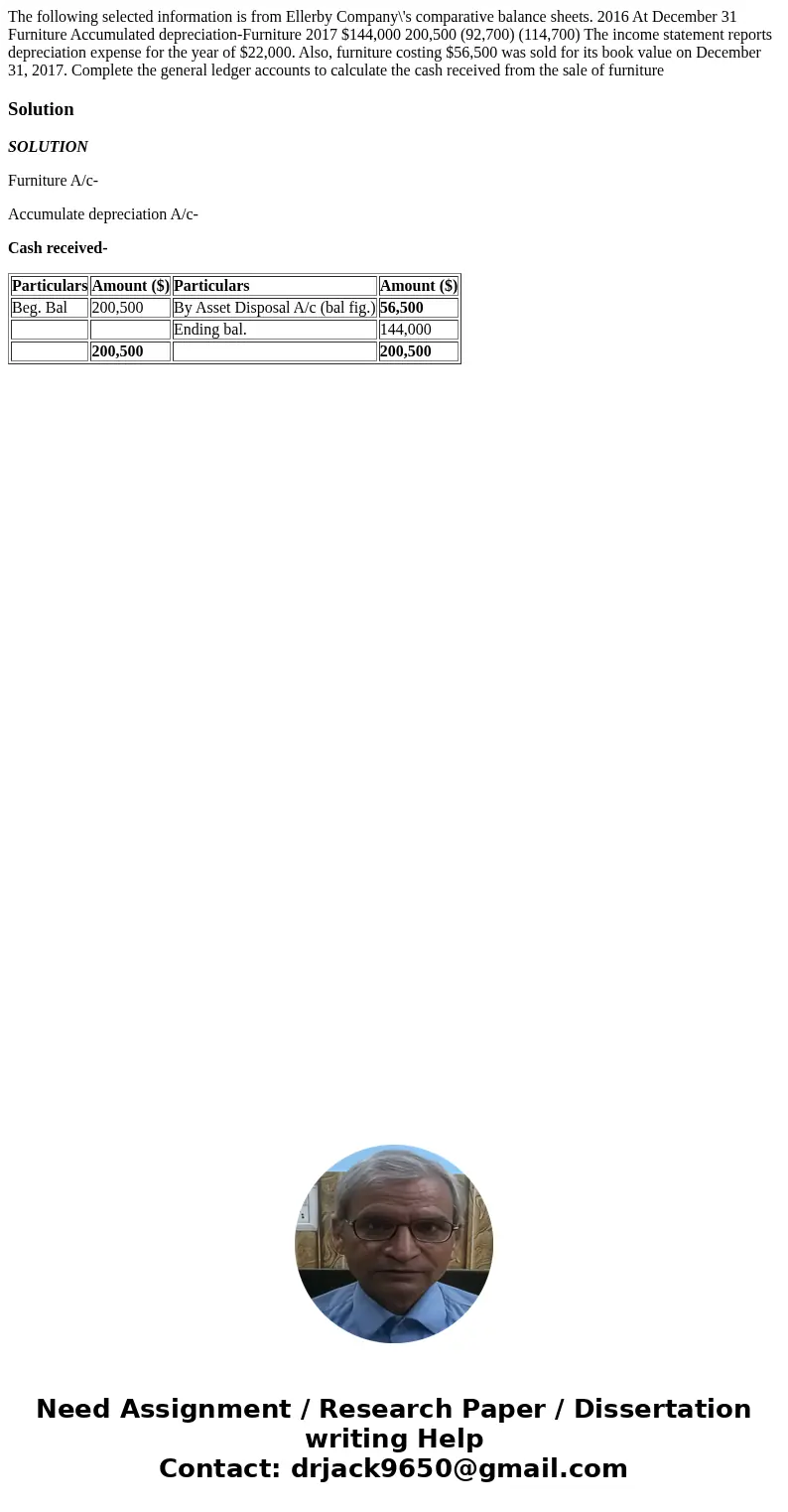

The following selected information is from Ellerby Company\'s comparative balance sheets. 2016 At December 31 Furniture Accumulated depreciation-Furniture 2017 $144,000 200,500 (92,700) (114,700) The income statement reports depreciation expense for the year of $22,000. Also, furniture costing $56,500 was sold for its book value on December 31, 2017. Complete the general ledger accounts to calculate the cash received from the sale of furniture

Solution

SOLUTION

Furniture A/c-

Accumulate depreciation A/c-

Cash received-

| Particulars | Amount ($) | Particulars | Amount ($) |

| Beg. Bal | 200,500 | By Asset Disposal A/c (bal fig.) | 56,500 |

| Ending bal. | 144,000 | ||

| 200,500 | 200,500 |

Homework Sourse

Homework Sourse