You have just been hired as a new management trainee by Earr

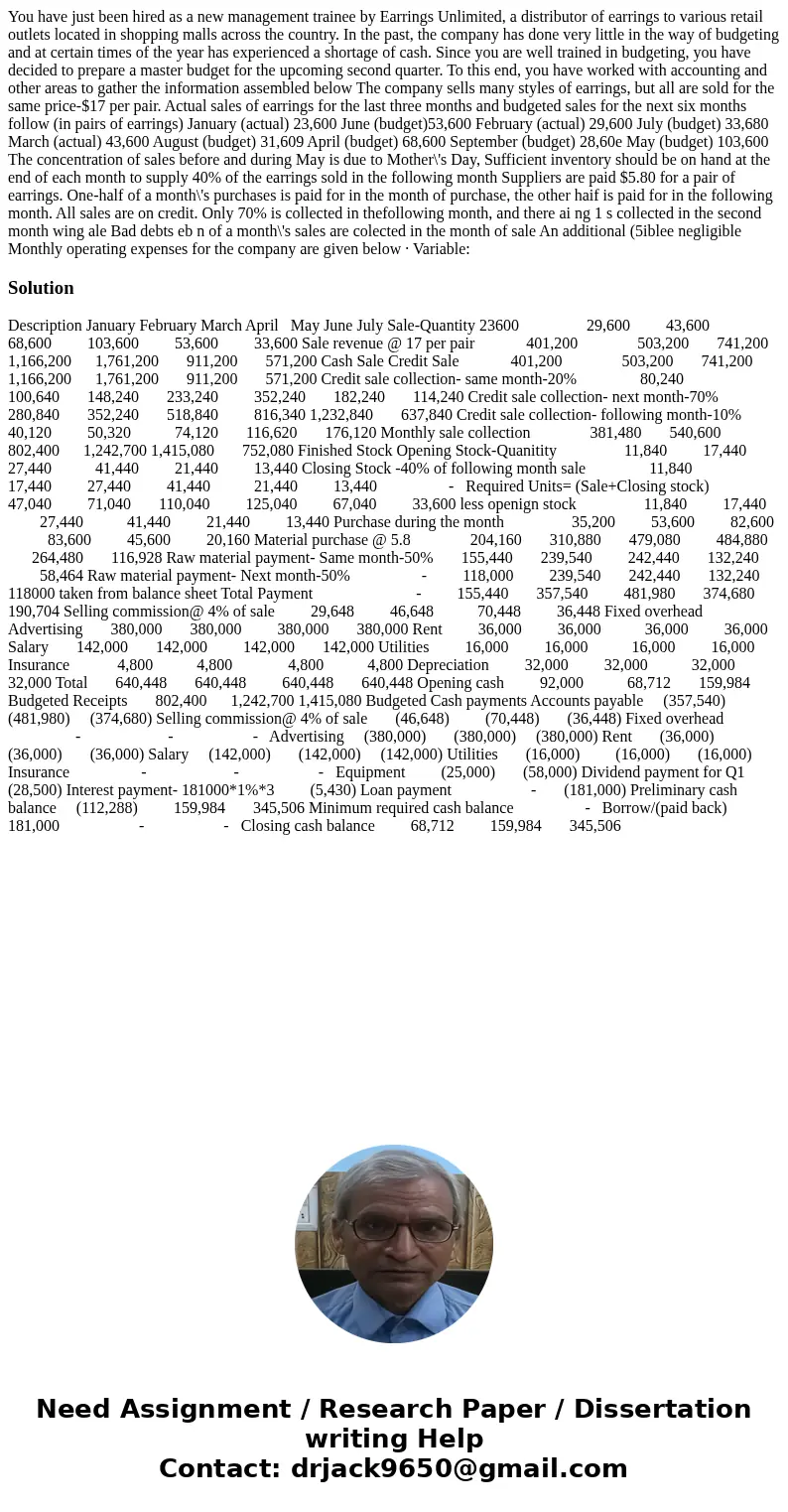

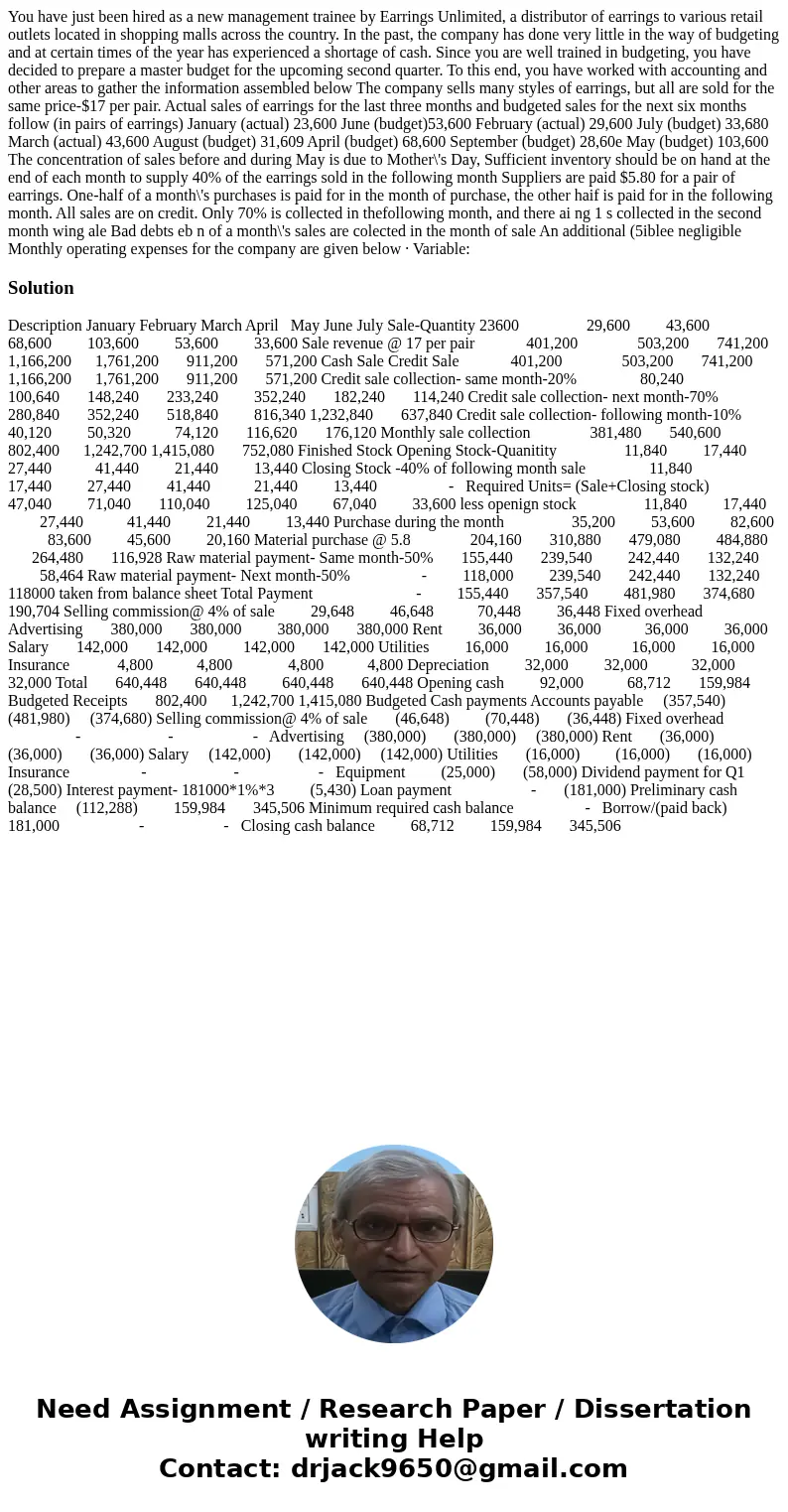

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below The company sells many styles of earrings, but all are sold for the same price-$17 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings) January (actual) 23,600 June (budget)53,600 February (actual) 29,600 July (budget) 33,680 March (actual) 43,600 August (budget) 31,609 April (budget) 68,600 September (budget) 28,60e May (budget) 103,600 The concentration of sales before and during May is due to Mother\'s Day, Sufficient inventory should be on hand at the end of each month to supply 40% of the earrings sold in the following month Suppliers are paid $5.80 for a pair of earrings. One-half of a month\'s purchases is paid for in the month of purchase, the other haif is paid for in the following month. All sales are on credit. Only 70% is collected in thefollowing month, and there ai ng 1 s collected in the second month wing ale Bad debts eb n of a month\'s sales are colected in the month of sale An additional (5iblee negligible Monthly operating expenses for the company are given below · Variable:

Solution

Description January February March April May June July Sale-Quantity 23600 29,600 43,600 68,600 103,600 53,600 33,600 Sale revenue @ 17 per pair 401,200 503,200 741,200 1,166,200 1,761,200 911,200 571,200 Cash Sale Credit Sale 401,200 503,200 741,200 1,166,200 1,761,200 911,200 571,200 Credit sale collection- same month-20% 80,240 100,640 148,240 233,240 352,240 182,240 114,240 Credit sale collection- next month-70% 280,840 352,240 518,840 816,340 1,232,840 637,840 Credit sale collection- following month-10% 40,120 50,320 74,120 116,620 176,120 Monthly sale collection 381,480 540,600 802,400 1,242,700 1,415,080 752,080 Finished Stock Opening Stock-Quanitity 11,840 17,440 27,440 41,440 21,440 13,440 Closing Stock -40% of following month sale 11,840 17,440 27,440 41,440 21,440 13,440 - Required Units= (Sale+Closing stock) 47,040 71,040 110,040 125,040 67,040 33,600 less openign stock 11,840 17,440 27,440 41,440 21,440 13,440 Purchase during the month 35,200 53,600 82,600 83,600 45,600 20,160 Material purchase @ 5.8 204,160 310,880 479,080 484,880 264,480 116,928 Raw material payment- Same month-50% 155,440 239,540 242,440 132,240 58,464 Raw material payment- Next month-50% - 118,000 239,540 242,440 132,240 118000 taken from balance sheet Total Payment - 155,440 357,540 481,980 374,680 190,704 Selling commission@ 4% of sale 29,648 46,648 70,448 36,448 Fixed overhead Advertising 380,000 380,000 380,000 380,000 Rent 36,000 36,000 36,000 36,000 Salary 142,000 142,000 142,000 142,000 Utilities 16,000 16,000 16,000 16,000 Insurance 4,800 4,800 4,800 4,800 Depreciation 32,000 32,000 32,000 32,000 Total 640,448 640,448 640,448 640,448 Opening cash 92,000 68,712 159,984 Budgeted Receipts 802,400 1,242,700 1,415,080 Budgeted Cash payments Accounts payable (357,540) (481,980) (374,680) Selling commission@ 4% of sale (46,648) (70,448) (36,448) Fixed overhead - - - Advertising (380,000) (380,000) (380,000) Rent (36,000) (36,000) (36,000) Salary (142,000) (142,000) (142,000) Utilities (16,000) (16,000) (16,000) Insurance - - - Equipment (25,000) (58,000) Dividend payment for Q1 (28,500) Interest payment- 181000*1%*3 (5,430) Loan payment - (181,000) Preliminary cash balance (112,288) 159,984 345,506 Minimum required cash balance - Borrow/(paid back) 181,000 - - Closing cash balance 68,712 159,984 345,506

Homework Sourse

Homework Sourse