ODell Enterprises manufactures lenses for telescopes ODell i

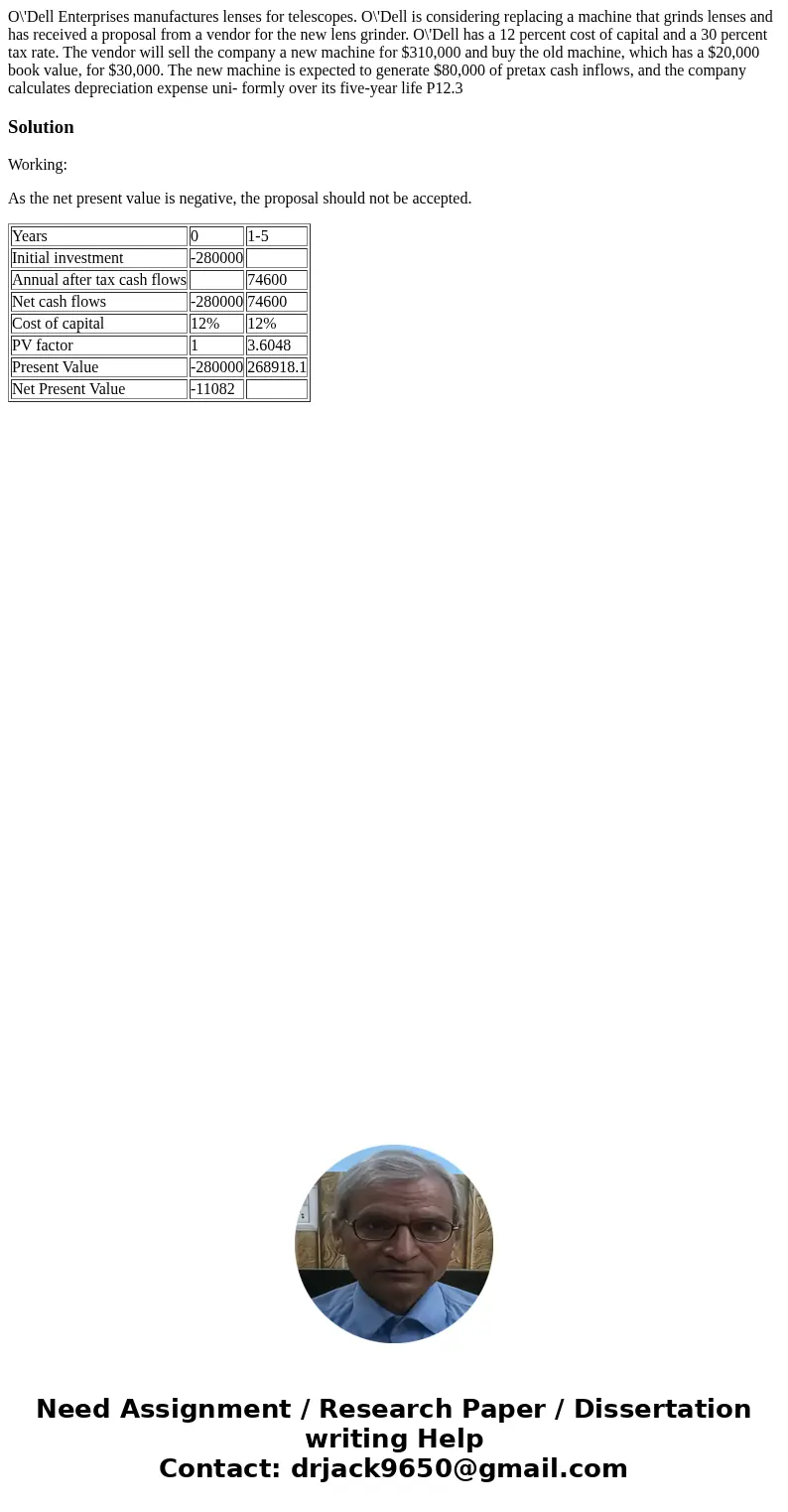

O\'Dell Enterprises manufactures lenses for telescopes. O\'Dell is considering replacing a machine that grinds lenses and has received a proposal from a vendor for the new lens grinder. O\'Dell has a 12 percent cost of capital and a 30 percent tax rate. The vendor will sell the company a new machine for $310,000 and buy the old machine, which has a $20,000 book value, for $30,000. The new machine is expected to generate $80,000 of pretax cash inflows, and the company calculates depreciation expense uni- formly over its five-year life P12.3

Solution

Working:

As the net present value is negative, the proposal should not be accepted.

| Years | 0 | 1-5 |

| Initial investment | -280000 | |

| Annual after tax cash flows | 74600 | |

| Net cash flows | -280000 | 74600 |

| Cost of capital | 12% | 12% |

| PV factor | 1 | 3.6048 |

| Present Value | -280000 | 268918.1 |

| Net Present Value | -11082 |

Homework Sourse

Homework Sourse