Assume that on January 2 2014 Potter of Michigan purchased f

Assume that on January? 2, 2014?, Potter of Michigan purchased fixtures for $ 8600 ?cash, expecting the fixtures to remain in service for five years. Potter has depreciated the fixtures on a? double-declining-balance basis, with $ 1100 estimated residual value. On October 31?, 2015?, Potter sold the fixtures for $ 2 800 cash. Record both the depreciation expense on the fixtures for 2015 and the sale of the fixtures. Apart from your journal? entry, also show how to compute the gain or loss on Potter?\'s disposal of these fixtures.

Solution

Journal Entries

Date

General Journal

Debit

Credit

.january 2 2014

Fixtures

$ 8,600.00

Cash

$ 8,600.00

(Fixtures Purchased)

.December 31 2014

Depreciation Expense-Fixtures

$ 3,440.00

Accumulated Depreciation-Fixtures

$ 3,440.00

(Depreciation Expense Charged)

.October 31 2015

Depreciation Expense-Fixtures

$ 1,720.00

Accumulated Depreciation-Fixtures

$ 1,720.00

(Depreciation Expense Charged for 10 Months)

.October 31 2015

Cash

$ 2,800.00

Loss on sale of Asset

$ 640.00

Accumulated depreciation -Fixtures

$ 5,160.00

Fixtures

$ 8,600.00

(Asset Sold and Loss Booked)

A

Cost

$ 8,600.00

B

Residual Value

$ 1,100.00

C=A - B

Depreciable base

$ 7,500.00

D

Life [in years]

5

E=C/D

Annual SLM depreciation

$ 1,500.00

F=E/C

SLM Rate

20.00%

G=F x 2

DDB Rate

40.00%

Year

Beginning Book Value

Depreciation rate

Depreciation expense

Ending Book Value

Accumulated Depreciation

2014

$ 8,600.00

40.00%

$ 3,440.00

$ 5,160.00

$ 3,440.00

2015

$ 5,160.00

40.00%

$ 1,720.00

$ 3,440.00

$ 5,160.00

Written down value of asset

$ 3,440.00

Sales Value

$ 2,800.00

Loss

$ 640.00

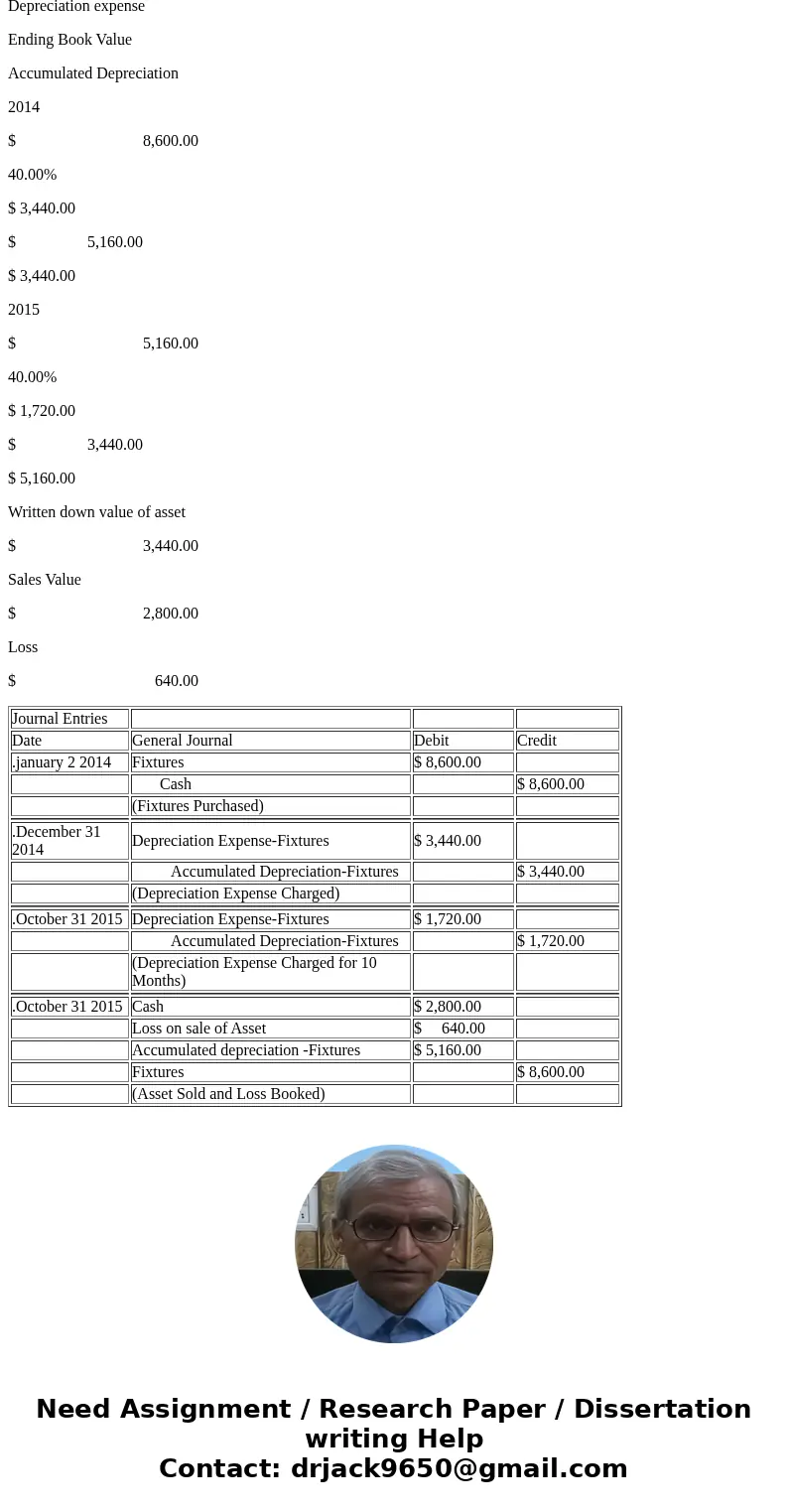

| Journal Entries | |||

| Date | General Journal | Debit | Credit |

| .january 2 2014 | Fixtures | $ 8,600.00 | |

| Cash | $ 8,600.00 | ||

| (Fixtures Purchased) | |||

| .December 31 2014 | Depreciation Expense-Fixtures | $ 3,440.00 | |

| Accumulated Depreciation-Fixtures | $ 3,440.00 | ||

| (Depreciation Expense Charged) | |||

| .October 31 2015 | Depreciation Expense-Fixtures | $ 1,720.00 | |

| Accumulated Depreciation-Fixtures | $ 1,720.00 | ||

| (Depreciation Expense Charged for 10 Months) | |||

| .October 31 2015 | Cash | $ 2,800.00 | |

| Loss on sale of Asset | $ 640.00 | ||

| Accumulated depreciation -Fixtures | $ 5,160.00 | ||

| Fixtures | $ 8,600.00 | ||

| (Asset Sold and Loss Booked) |

Homework Sourse

Homework Sourse