SalesRelated and PurchaseRelated Transactions Using Perpetua

Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System

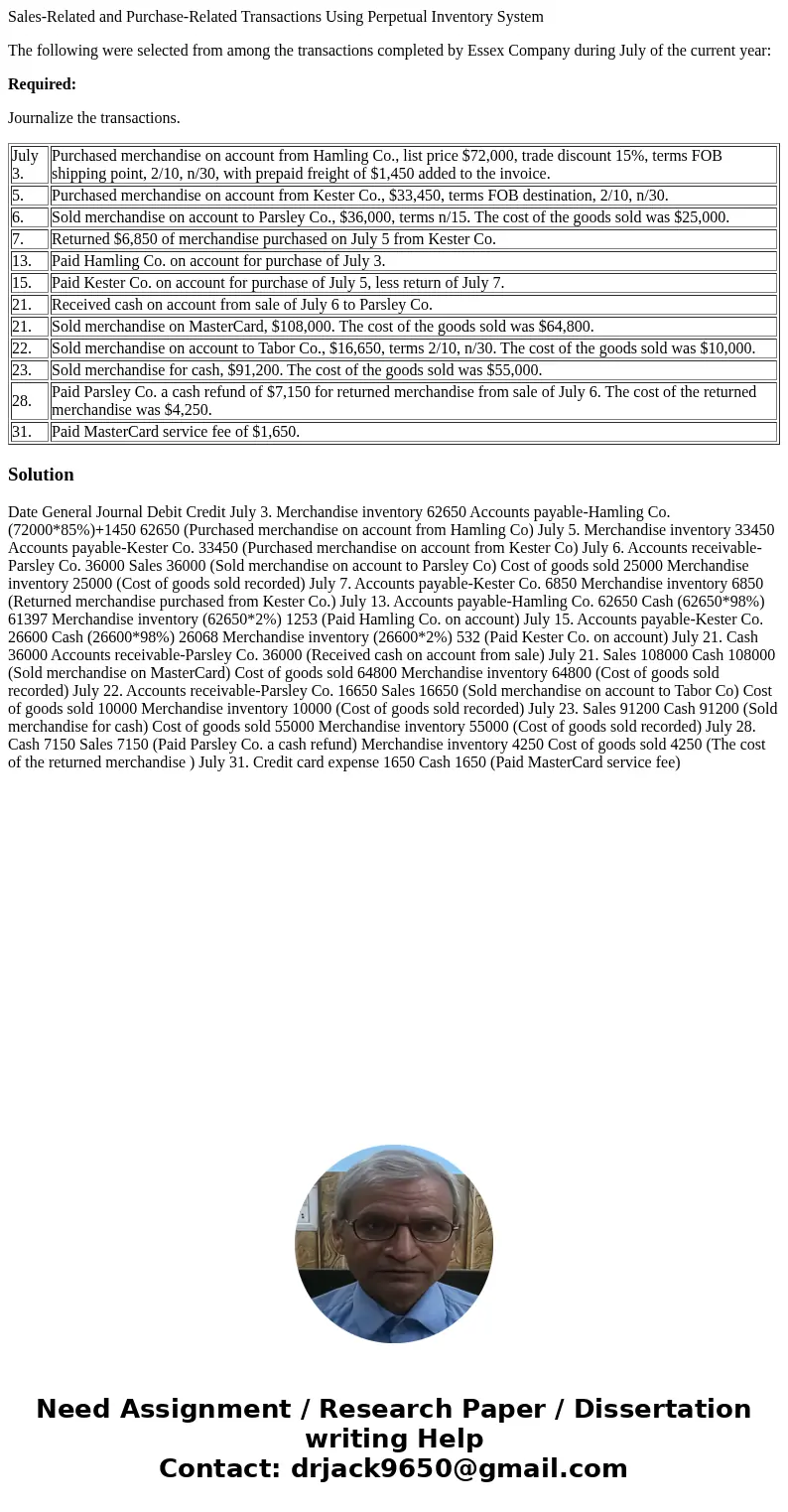

The following were selected from among the transactions completed by Essex Company during July of the current year:

Required:

Journalize the transactions.

| July 3. | Purchased merchandise on account from Hamling Co., list price $72,000, trade discount 15%, terms FOB shipping point, 2/10, n/30, with prepaid freight of $1,450 added to the invoice. |

| 5. | Purchased merchandise on account from Kester Co., $33,450, terms FOB destination, 2/10, n/30. |

| 6. | Sold merchandise on account to Parsley Co., $36,000, terms n/15. The cost of the goods sold was $25,000. |

| 7. | Returned $6,850 of merchandise purchased on July 5 from Kester Co. |

| 13. | Paid Hamling Co. on account for purchase of July 3. |

| 15. | Paid Kester Co. on account for purchase of July 5, less return of July 7. |

| 21. | Received cash on account from sale of July 6 to Parsley Co. |

| 21. | Sold merchandise on MasterCard, $108,000. The cost of the goods sold was $64,800. |

| 22. | Sold merchandise on account to Tabor Co., $16,650, terms 2/10, n/30. The cost of the goods sold was $10,000. |

| 23. | Sold merchandise for cash, $91,200. The cost of the goods sold was $55,000. |

| 28. | Paid Parsley Co. a cash refund of $7,150 for returned merchandise from sale of July 6. The cost of the returned merchandise was $4,250. |

| 31. | Paid MasterCard service fee of $1,650. |

Solution

Date General Journal Debit Credit July 3. Merchandise inventory 62650 Accounts payable-Hamling Co. (72000*85%)+1450 62650 (Purchased merchandise on account from Hamling Co) July 5. Merchandise inventory 33450 Accounts payable-Kester Co. 33450 (Purchased merchandise on account from Kester Co) July 6. Accounts receivable-Parsley Co. 36000 Sales 36000 (Sold merchandise on account to Parsley Co) Cost of goods sold 25000 Merchandise inventory 25000 (Cost of goods sold recorded) July 7. Accounts payable-Kester Co. 6850 Merchandise inventory 6850 (Returned merchandise purchased from Kester Co.) July 13. Accounts payable-Hamling Co. 62650 Cash (62650*98%) 61397 Merchandise inventory (62650*2%) 1253 (Paid Hamling Co. on account) July 15. Accounts payable-Kester Co. 26600 Cash (26600*98%) 26068 Merchandise inventory (26600*2%) 532 (Paid Kester Co. on account) July 21. Cash 36000 Accounts receivable-Parsley Co. 36000 (Received cash on account from sale) July 21. Sales 108000 Cash 108000 (Sold merchandise on MasterCard) Cost of goods sold 64800 Merchandise inventory 64800 (Cost of goods sold recorded) July 22. Accounts receivable-Parsley Co. 16650 Sales 16650 (Sold merchandise on account to Tabor Co) Cost of goods sold 10000 Merchandise inventory 10000 (Cost of goods sold recorded) July 23. Sales 91200 Cash 91200 (Sold merchandise for cash) Cost of goods sold 55000 Merchandise inventory 55000 (Cost of goods sold recorded) July 28. Cash 7150 Sales 7150 (Paid Parsley Co. a cash refund) Merchandise inventory 4250 Cost of goods sold 4250 (The cost of the returned merchandise ) July 31. Credit card expense 1650 Cash 1650 (Paid MasterCard service fee)

Homework Sourse

Homework Sourse