The Sal Corporation had the following account balances on Ap

The Sal Corporation had the following account balances on April 30.

$8,700

$260,000

$4,800

$25,200

$9,000

$18,000

$42,000

$2,700

$2,500

$4,800

$3,900

$31,000

Determine the amount of cash the company expects to collect from customers who owed the company on April 30.

$31,000

$22,000

$27,100

$18,100

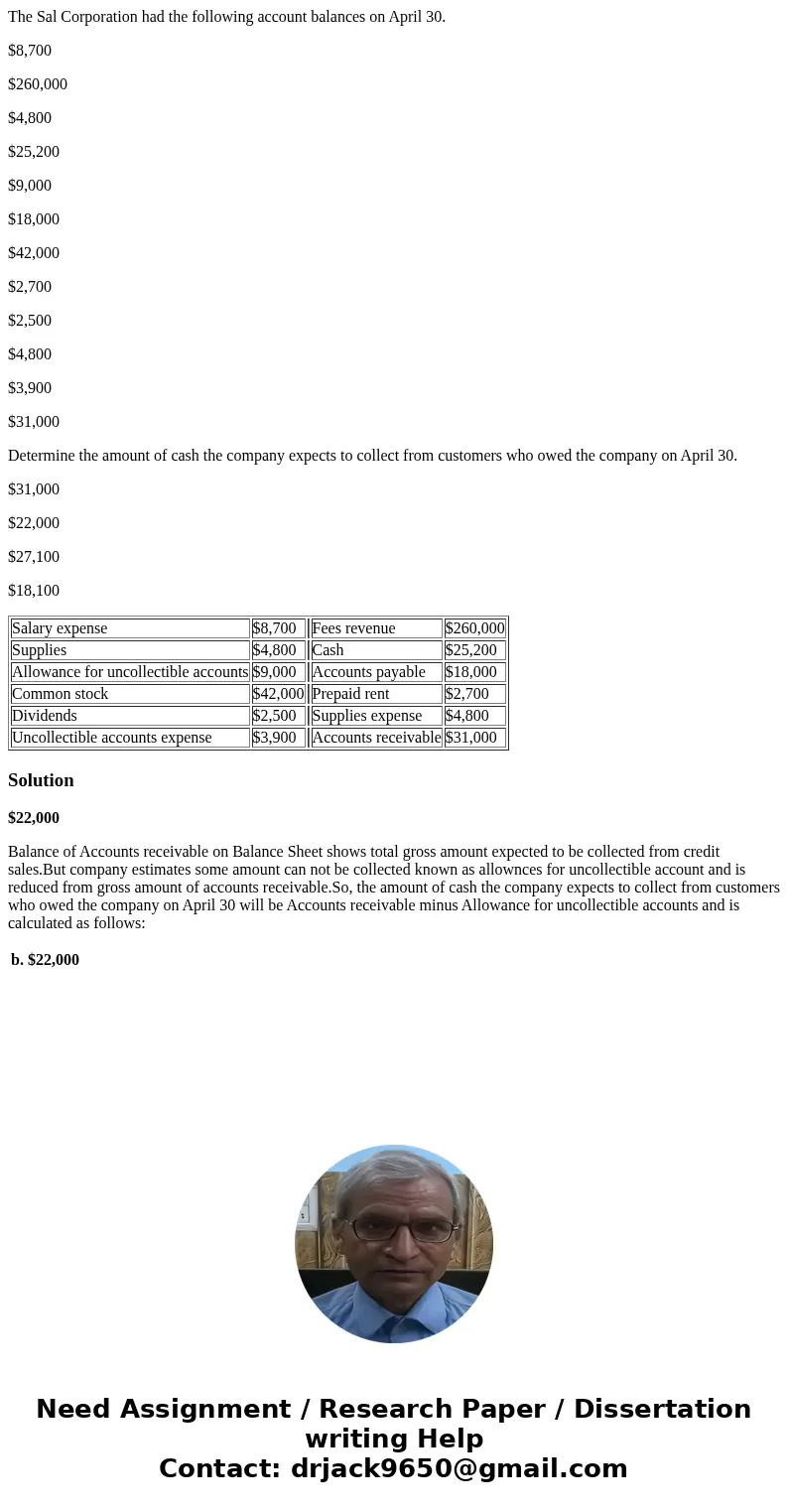

| Salary expense | $8,700 | Fees revenue | $260,000 | |

| Supplies | $4,800 | Cash | $25,200 | |

| Allowance for uncollectible accounts | $9,000 | Accounts payable | $18,000 | |

| Common stock | $42,000 | Prepaid rent | $2,700 | |

| Dividends | $2,500 | Supplies expense | $4,800 | |

| Uncollectible accounts expense | $3,900 | Accounts receivable | $31,000 |

Solution

$22,000

Balance of Accounts receivable on Balance Sheet shows total gross amount expected to be collected from credit sales.But company estimates some amount can not be collected known as allownces for uncollectible account and is reduced from gross amount of accounts receivable.So, the amount of cash the company expects to collect from customers who owed the company on April 30 will be Accounts receivable minus Allowance for uncollectible accounts and is calculated as follows:

| b. | $22,000 |

Homework Sourse

Homework Sourse