The unadjusted trial balance as of December 31 2018 for the

Solution

Debit

credit

Debit

credit

Debit

credit

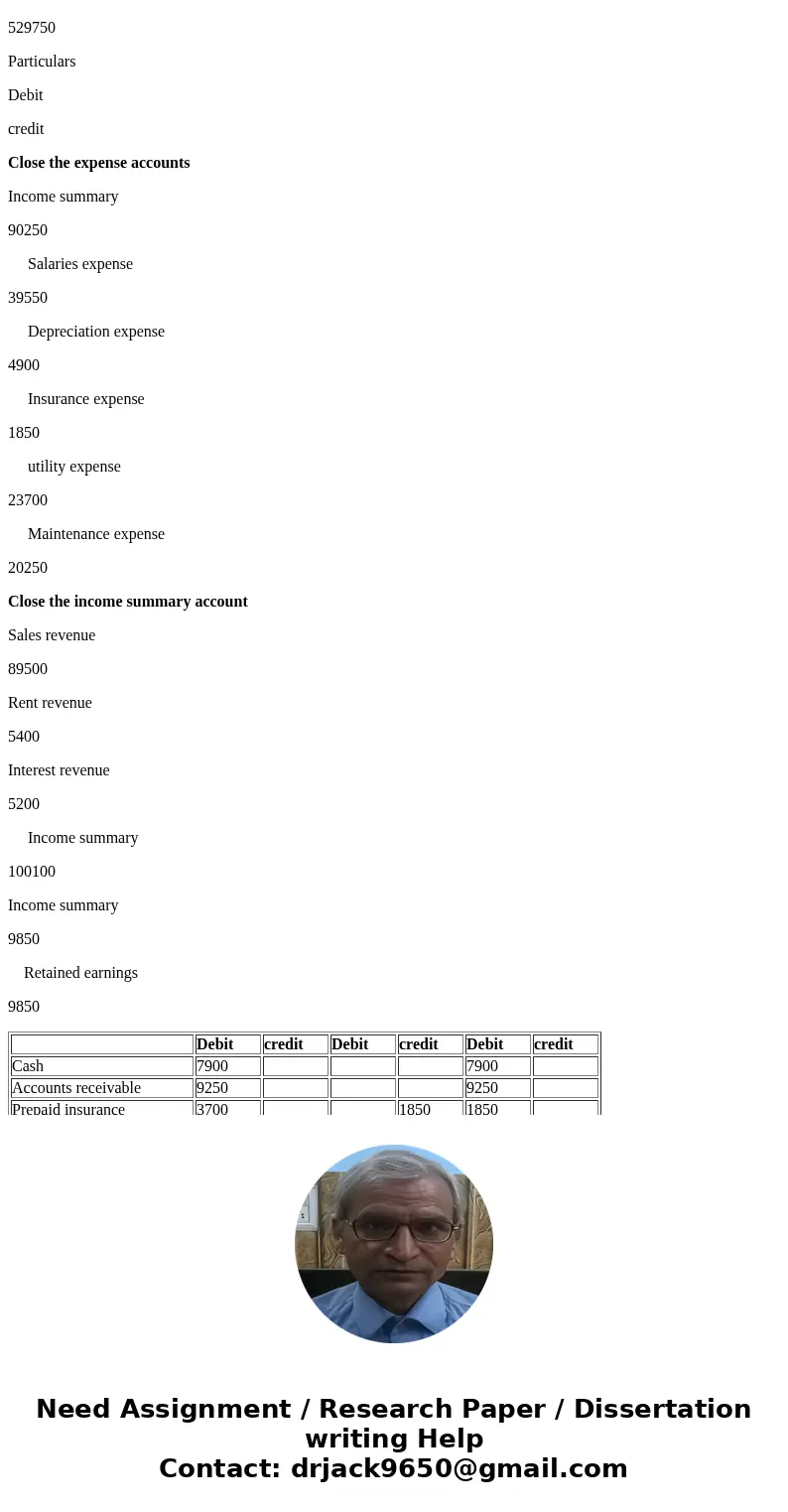

Cash

7900

7900

Accounts receivable

9250

9250

Prepaid insurance

3700

1850

1850

Land

Building

240000

240000

Building

72500

72500

Accumulated depreciation

29000

580

29580

Office equipment

108000

108000

Accumulated depreciation

43200

4320

47520

Accounts Payable

30600

30600

Salaries and wages payable

0

1550

1550

Deferred rent revenue

0

1200

1200

Common stock

270000

270000

Retained earnings

49200

49200

Sales revenue

89500

89500

Interest revenue

5200

5200

Rent revenue

6600

1200

5400

Salaries and wages expense

38000

1550

39550

Depreciation expense

0

4900

4900

Insurance expense

0

1850

1850

utility expense

23700

23700

Maintenance expense

20250

20250

523300

523300

529750

529750

Particulars

Debit

credit

Close the expense accounts

Income summary

90250

Salaries expense

39550

Depreciation expense

4900

Insurance expense

1850

utility expense

23700

Maintenance expense

20250

Close the income summary account

Sales revenue

89500

Rent revenue

5400

Interest revenue

5200

Income summary

100100

Income summary

9850

Retained earnings

9850

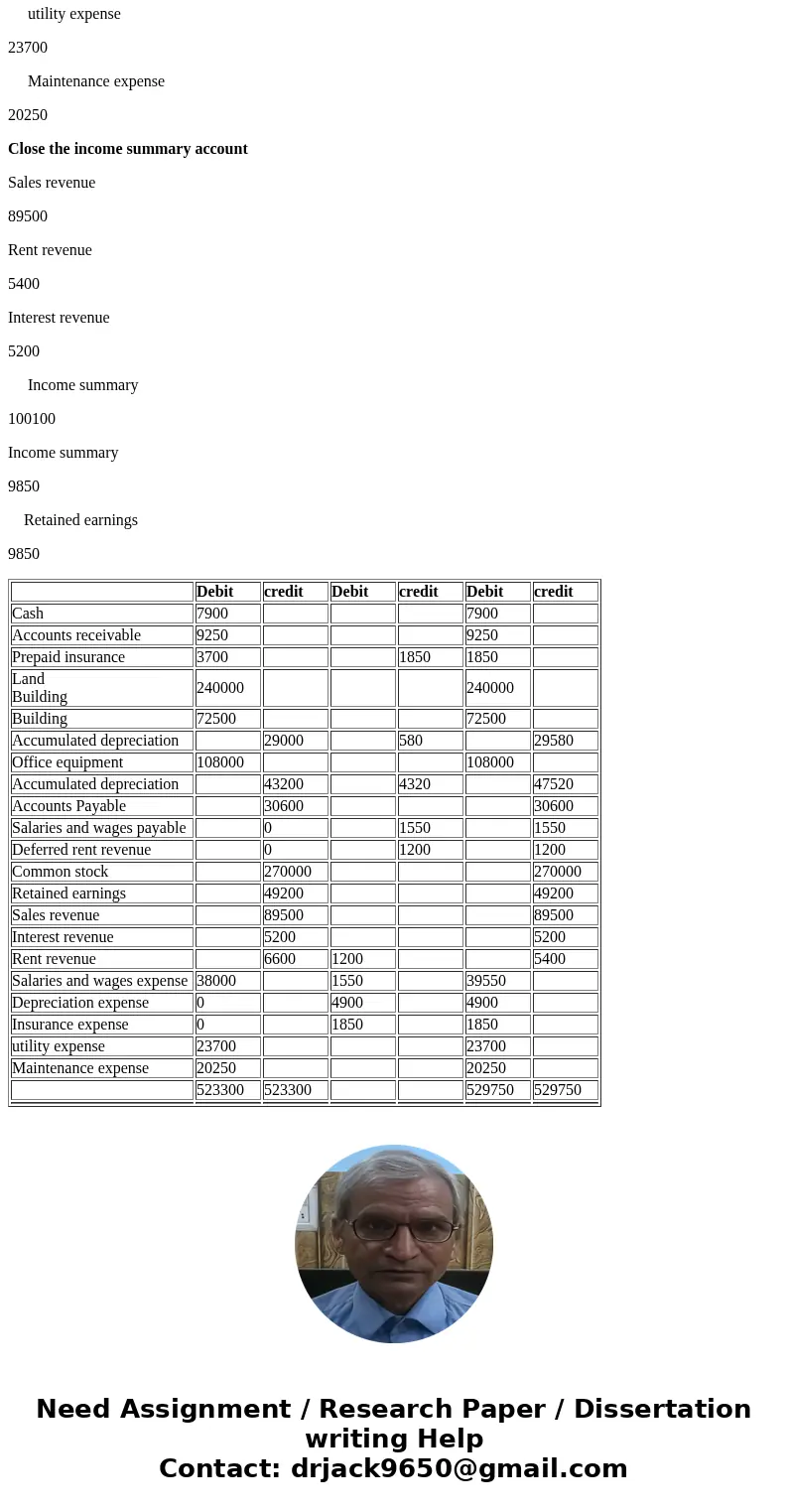

Debit

credit

Debit

credit

Debit

credit

Cash

7900

7900

Accounts receivable

9250

9250

Prepaid insurance

3700

1850

1850

Land

Building

240000

240000

Building

72500

72500

Accumulated depreciation

29000

580

29580

Office equipment

108000

108000

Accumulated depreciation

43200

4320

47520

Accounts Payable

30600

30600

Salaries and wages payable

0

1550

1550

Deferred rent revenue

0

1200

1200

Common stock

270000

270000

Retained earnings

49200

49200

Sales revenue

89500

89500

Interest revenue

5200

5200

Rent revenue

6600

1200

5400

Salaries and wages expense

38000

1550

39550

Depreciation expense

0

4900

4900

Insurance expense

0

1850

1850

utility expense

23700

23700

Maintenance expense

20250

20250

523300

523300

529750

529750

Particulars

Debit

credit

Close the expense accounts

Income summary

90250

Salaries expense

39550

Depreciation expense

4900

Insurance expense

1850

utility expense

23700

Maintenance expense

20250

Close the income summary account

Sales revenue

89500

Rent revenue

5400

Interest revenue

5200

Income summary

100100

Income summary

9850

Retained earnings

9850

| Debit | credit | Debit | credit | Debit | credit | |

| Cash | 7900 | 7900 | ||||

| Accounts receivable | 9250 | 9250 | ||||

| Prepaid insurance | 3700 | 1850 | 1850 | |||

| Land | 240000 | 240000 | ||||

| Building | 72500 | 72500 | ||||

| Accumulated depreciation | 29000 | 580 | 29580 | |||

| Office equipment | 108000 | 108000 | ||||

| Accumulated depreciation | 43200 | 4320 | 47520 | |||

| Accounts Payable | 30600 | 30600 | ||||

| Salaries and wages payable | 0 | 1550 | 1550 | |||

| Deferred rent revenue | 0 | 1200 | 1200 | |||

| Common stock | 270000 | 270000 | ||||

| Retained earnings | 49200 | 49200 | ||||

| Sales revenue | 89500 | 89500 | ||||

| Interest revenue | 5200 | 5200 | ||||

| Rent revenue | 6600 | 1200 | 5400 | |||

| Salaries and wages expense | 38000 | 1550 | 39550 | |||

| Depreciation expense | 0 | 4900 | 4900 | |||

| Insurance expense | 0 | 1850 | 1850 | |||

| utility expense | 23700 | 23700 | ||||

| Maintenance expense | 20250 | 20250 | ||||

| 523300 | 523300 | 529750 | 529750 | |||

Homework Sourse

Homework Sourse