Morningstarcom is a useful personal and business investment

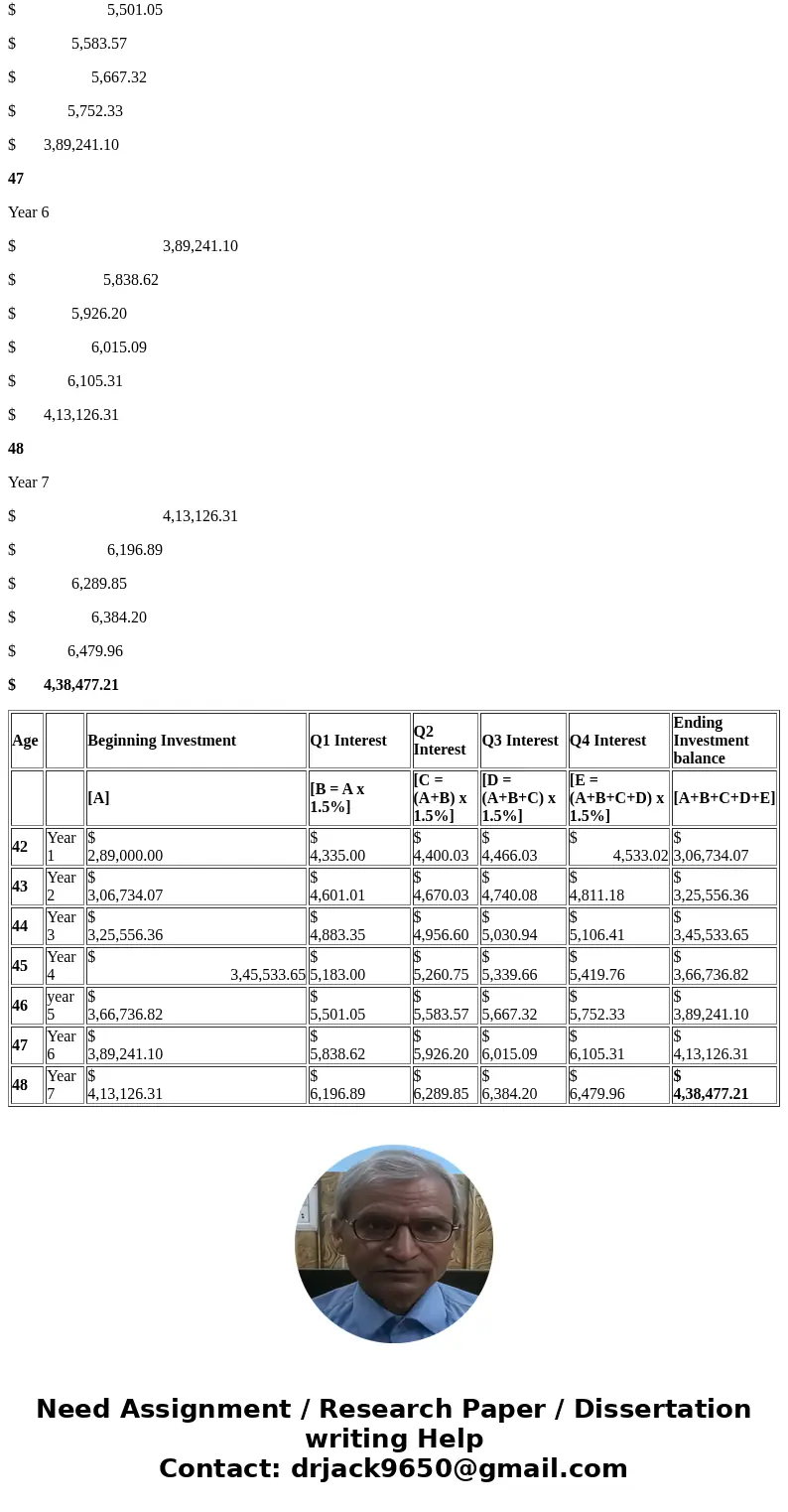

Morningstar.com is a useful personal and business investment site with in-depth detail on personal financial planning. After reading a March 19, 2009, article, “Preparing a Portfolio for Retirement,” Arlene Supple, 41 years old, is evaluating her retirement portfolio. She paid her house off in anticipation of an early retirement. In addition, she has invested wisely in her company’s 403k, a Roth IRA, municipal bonds, and certificates of deposit. She has amassed $289,000 in her diversified portfolio. Today, she has the opportunity to deposit her money at 6% compounded quarterly. Assume she retires at 48 years old. How much will her investment be worth? (Do not round intermediate calculations. Round your answer to the nearest cent.) Future value $

Solution

Answer

Quarterly interest = 6% x1/4 = 1.5% per quarter

Age

Beginning Investment

Q1 Interest

Q2 Interest

Q3 Interest

Q4 Interest

Ending Investment balance

[A]

[B = A x 1.5%]

[C = (A+B) x 1.5%]

[D = (A+B+C) x 1.5%]

[E = (A+B+C+D) x 1.5%]

[A+B+C+D+E]

42

Year 1

$ 2,89,000.00

$ 4,335.00

$ 4,400.03

$ 4,466.03

$ 4,533.02

$ 3,06,734.07

43

Year 2

$ 3,06,734.07

$ 4,601.01

$ 4,670.03

$ 4,740.08

$ 4,811.18

$ 3,25,556.36

44

Year 3

$ 3,25,556.36

$ 4,883.35

$ 4,956.60

$ 5,030.94

$ 5,106.41

$ 3,45,533.65

45

Year 4

$ 3,45,533.65

$ 5,183.00

$ 5,260.75

$ 5,339.66

$ 5,419.76

$ 3,66,736.82

46

year 5

$ 3,66,736.82

$ 5,501.05

$ 5,583.57

$ 5,667.32

$ 5,752.33

$ 3,89,241.10

47

Year 6

$ 3,89,241.10

$ 5,838.62

$ 5,926.20

$ 6,015.09

$ 6,105.31

$ 4,13,126.31

48

Year 7

$ 4,13,126.31

$ 6,196.89

$ 6,289.85

$ 6,384.20

$ 6,479.96

$ 4,38,477.21

| Age | Beginning Investment | Q1 Interest | Q2 Interest | Q3 Interest | Q4 Interest | Ending Investment balance | |

| [A] | [B = A x 1.5%] | [C = (A+B) x 1.5%] | [D = (A+B+C) x 1.5%] | [E = (A+B+C+D) x 1.5%] | [A+B+C+D+E] | ||

| 42 | Year 1 | $ 2,89,000.00 | $ 4,335.00 | $ 4,400.03 | $ 4,466.03 | $ 4,533.02 | $ 3,06,734.07 |

| 43 | Year 2 | $ 3,06,734.07 | $ 4,601.01 | $ 4,670.03 | $ 4,740.08 | $ 4,811.18 | $ 3,25,556.36 |

| 44 | Year 3 | $ 3,25,556.36 | $ 4,883.35 | $ 4,956.60 | $ 5,030.94 | $ 5,106.41 | $ 3,45,533.65 |

| 45 | Year 4 | $ 3,45,533.65 | $ 5,183.00 | $ 5,260.75 | $ 5,339.66 | $ 5,419.76 | $ 3,66,736.82 |

| 46 | year 5 | $ 3,66,736.82 | $ 5,501.05 | $ 5,583.57 | $ 5,667.32 | $ 5,752.33 | $ 3,89,241.10 |

| 47 | Year 6 | $ 3,89,241.10 | $ 5,838.62 | $ 5,926.20 | $ 6,015.09 | $ 6,105.31 | $ 4,13,126.31 |

| 48 | Year 7 | $ 4,13,126.31 | $ 6,196.89 | $ 6,289.85 | $ 6,384.20 | $ 6,479.96 | $ 4,38,477.21 |

Homework Sourse

Homework Sourse