Instructions The net income reported on the income statement

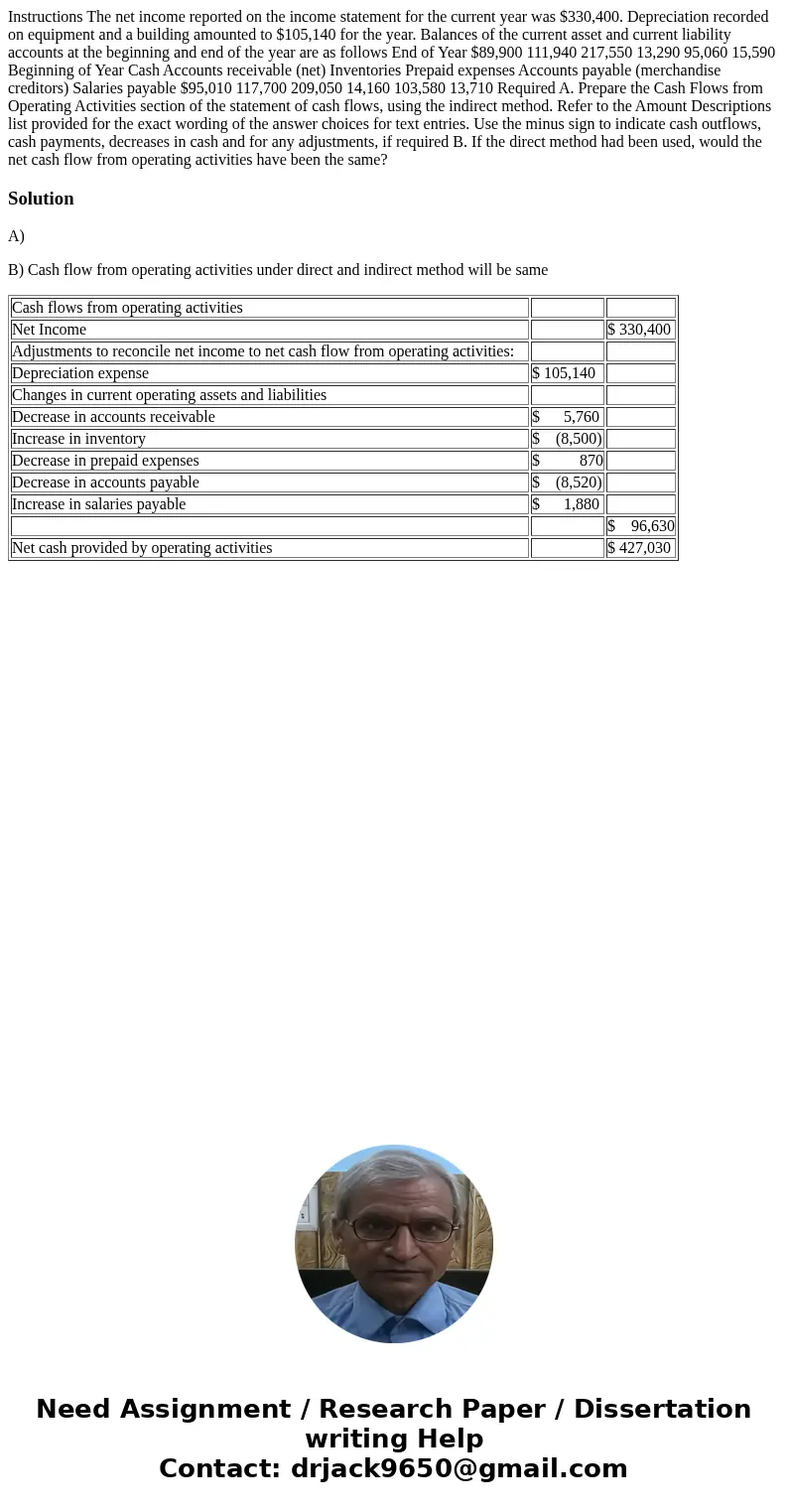

Instructions The net income reported on the income statement for the current year was $330,400. Depreciation recorded on equipment and a building amounted to $105,140 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows End of Year $89,900 111,940 217,550 13,290 95,060 15,590 Beginning of Year Cash Accounts receivable (net) Inventories Prepaid expenses Accounts payable (merchandise creditors) Salaries payable $95,010 117,700 209,050 14,160 103,580 13,710 Required A. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required B. If the direct method had been used, would the net cash flow from operating activities have been the same?

Solution

A)

B) Cash flow from operating activities under direct and indirect method will be same

| Cash flows from operating activities | ||

| Net Income | $ 330,400 | |

| Adjustments to reconcile net income to net cash flow from operating activities: | ||

| Depreciation expense | $ 105,140 | |

| Changes in current operating assets and liabilities | ||

| Decrease in accounts receivable | $ 5,760 | |

| Increase in inventory | $ (8,500) | |

| Decrease in prepaid expenses | $ 870 | |

| Decrease in accounts payable | $ (8,520) | |

| Increase in salaries payable | $ 1,880 | |

| $ 96,630 | ||

| Net cash provided by operating activities | $ 427,030 |

Homework Sourse

Homework Sourse