On November 19 Nicholson Company receives a 21000 60day 10 n

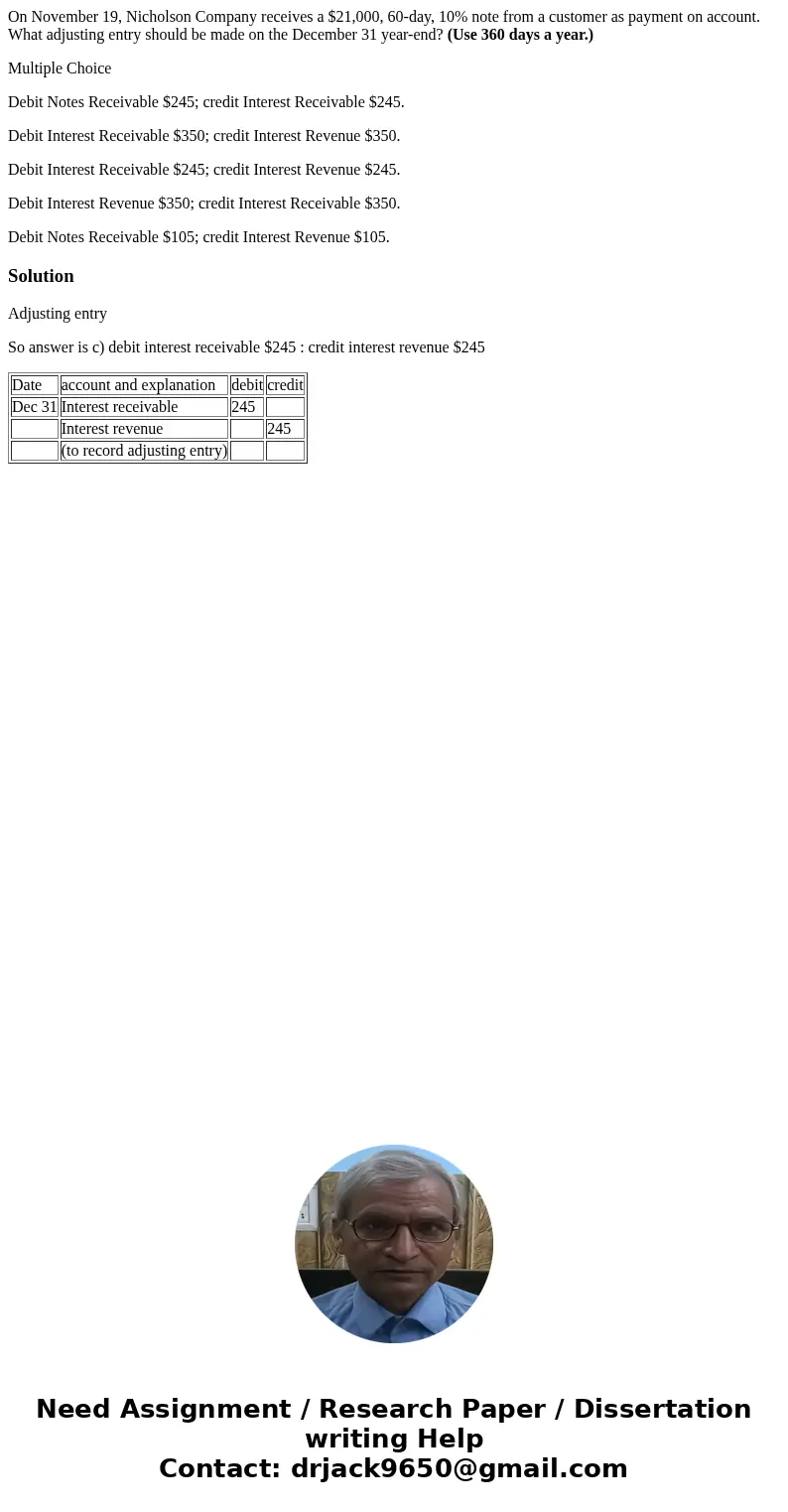

On November 19, Nicholson Company receives a $21,000, 60-day, 10% note from a customer as payment on account. What adjusting entry should be made on the December 31 year-end? (Use 360 days a year.)

Multiple Choice

Debit Notes Receivable $245; credit Interest Receivable $245.

Debit Interest Receivable $350; credit Interest Revenue $350.

Debit Interest Receivable $245; credit Interest Revenue $245.

Debit Interest Revenue $350; credit Interest Receivable $350.

Debit Notes Receivable $105; credit Interest Revenue $105.

Solution

Adjusting entry

So answer is c) debit interest receivable $245 : credit interest revenue $245

| Date | account and explanation | debit | credit |

| Dec 31 | Interest receivable | 245 | |

| Interest revenue | 245 | ||

| (to record adjusting entry) |

Homework Sourse

Homework Sourse