2Preparation of statement of cash flows format provided 15 p

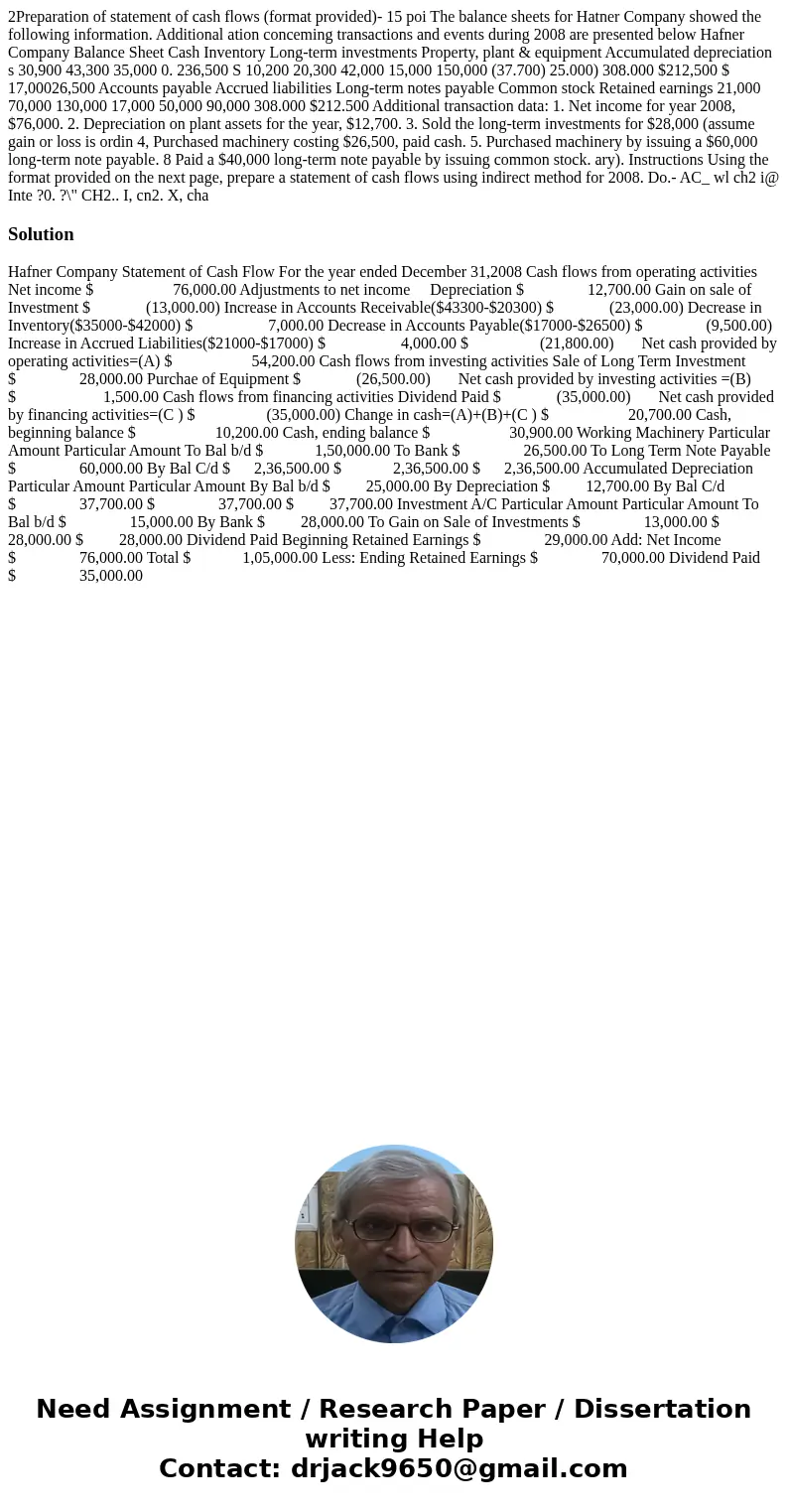

2Preparation of statement of cash flows (format provided)- 15 poi The balance sheets for Hatner Company showed the following information. Additional ation conceming transactions and events during 2008 are presented below Hafner Company Balance Sheet Cash Inventory Long-term investments Property, plant & equipment Accumulated depreciation s 30,900 43,300 35,000 0. 236,500 S 10,200 20,300 42,000 15,000 150,000 (37.700) 25.000) 308.000 $212,500 $ 17,00026,500 Accounts payable Accrued liabilities Long-term notes payable Common stock Retained earnings 21,000 70,000 130,000 17,000 50,000 90,000 308.000 $212.500 Additional transaction data: 1. Net income for year 2008, $76,000. 2. Depreciation on plant assets for the year, $12,700. 3. Sold the long-term investments for $28,000 (assume gain or loss is ordin 4, Purchased machinery costing $26,500, paid cash. 5. Purchased machinery by issuing a $60,000 long-term note payable. 8 Paid a $40,000 long-term note payable by issuing common stock. ary). Instructions Using the format provided on the next page, prepare a statement of cash flows using indirect method for 2008. Do.- AC_ wl ch2 i@ Inte ?0. ?\" CH2.. I, cn2. X, cha

Solution

Hafner Company Statement of Cash Flow For the year ended December 31,2008 Cash flows from operating activities Net income $ 76,000.00 Adjustments to net income Depreciation $ 12,700.00 Gain on sale of Investment $ (13,000.00) Increase in Accounts Receivable($43300-$20300) $ (23,000.00) Decrease in Inventory($35000-$42000) $ 7,000.00 Decrease in Accounts Payable($17000-$26500) $ (9,500.00) Increase in Accrued Liabilities($21000-$17000) $ 4,000.00 $ (21,800.00) Net cash provided by operating activities=(A) $ 54,200.00 Cash flows from investing activities Sale of Long Term Investment $ 28,000.00 Purchae of Equipment $ (26,500.00) Net cash provided by investing activities =(B) $ 1,500.00 Cash flows from financing activities Dividend Paid $ (35,000.00) Net cash provided by financing activities=(C ) $ (35,000.00) Change in cash=(A)+(B)+(C ) $ 20,700.00 Cash, beginning balance $ 10,200.00 Cash, ending balance $ 30,900.00 Working Machinery Particular Amount Particular Amount To Bal b/d $ 1,50,000.00 To Bank $ 26,500.00 To Long Term Note Payable $ 60,000.00 By Bal C/d $ 2,36,500.00 $ 2,36,500.00 $ 2,36,500.00 Accumulated Depreciation Particular Amount Particular Amount By Bal b/d $ 25,000.00 By Depreciation $ 12,700.00 By Bal C/d $ 37,700.00 $ 37,700.00 $ 37,700.00 Investment A/C Particular Amount Particular Amount To Bal b/d $ 15,000.00 By Bank $ 28,000.00 To Gain on Sale of Investments $ 13,000.00 $ 28,000.00 $ 28,000.00 Dividend Paid Beginning Retained Earnings $ 29,000.00 Add: Net Income $ 76,000.00 Total $ 1,05,000.00 Less: Ending Retained Earnings $ 70,000.00 Dividend Paid $ 35,000.00

Homework Sourse

Homework Sourse