On January 1 2017 Sheridan Corporation purchased 30 of the c

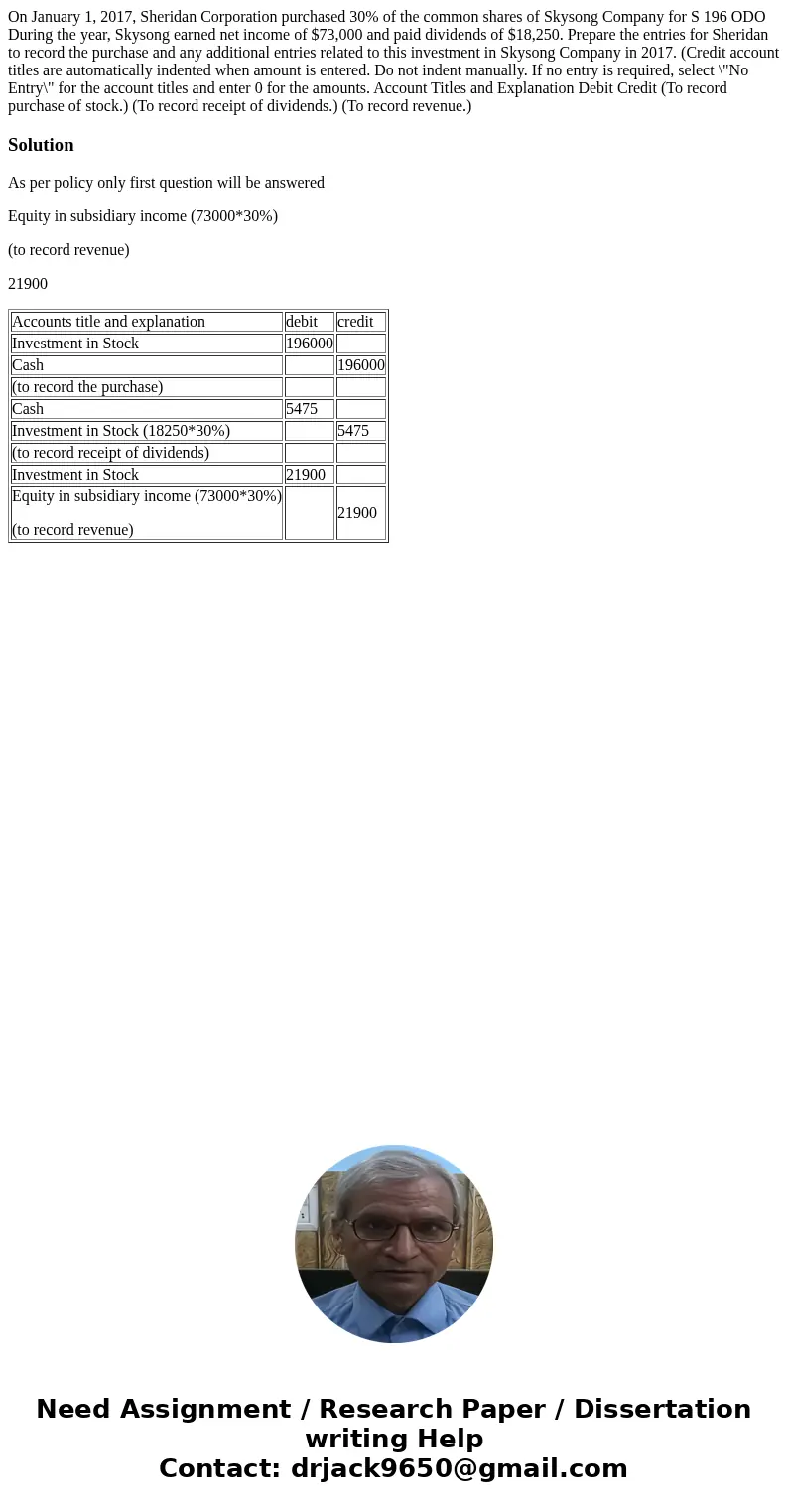

On January 1, 2017, Sheridan Corporation purchased 30% of the common shares of Skysong Company for S 196 ODO During the year, Skysong earned net income of $73,000 and paid dividends of $18,250. Prepare the entries for Sheridan to record the purchase and any additional entries related to this investment in Skysong Company in 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Account Titles and Explanation Debit Credit (To record purchase of stock.) (To record receipt of dividends.) (To record revenue.)

Solution

As per policy only first question will be answered

Equity in subsidiary income (73000*30%)

(to record revenue)

21900

| Accounts title and explanation | debit | credit |

| Investment in Stock | 196000 | |

| Cash | 196000 | |

| (to record the purchase) | ||

| Cash | 5475 | |

| Investment in Stock (18250*30%) | 5475 | |

| (to record receipt of dividends) | ||

| Investment in Stock | 21900 | |

| Equity in subsidiary income (73000*30%) (to record revenue) | 21900 |

Homework Sourse

Homework Sourse