1 Answer questions on the following likekind exchanges fill

1. Answer questions on the following like-kind exchanges (fill out the blanks)

Adjusted basis of old asset

Boot given

FMV of new asset

Boot received

Realized

Gain/(loss)

Recognized gain

Postponed

Gain/(loss)

New basis of received property

a.

17000

0

14000

0

b.

15000

0

29000

0

c.

4000

6000

8000

500

d.

16000

0

28000

0

e.

7000

0

12000

4000

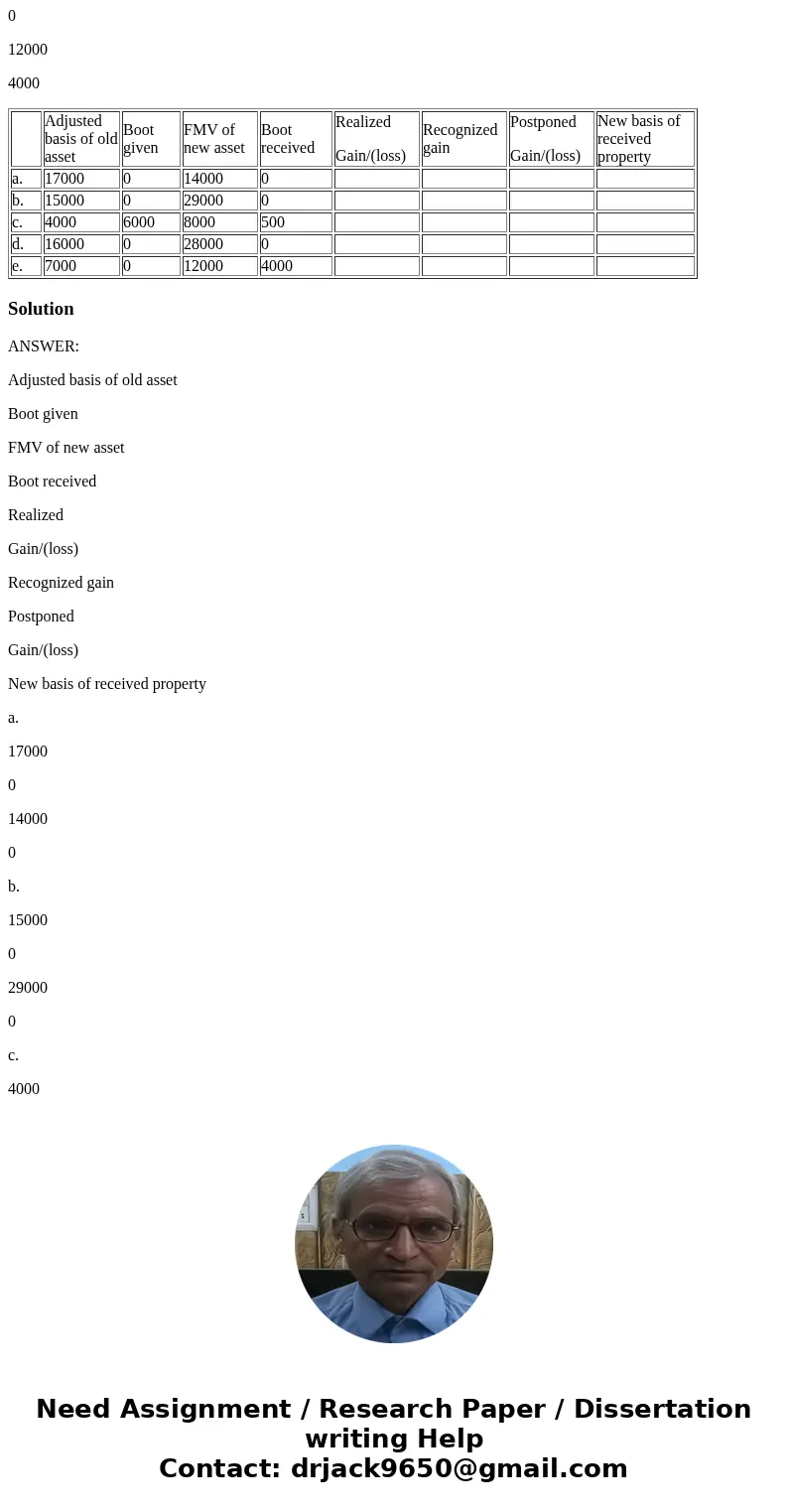

| Adjusted basis of old asset | Boot given | FMV of new asset | Boot received | Realized Gain/(loss) | Recognized gain | Postponed Gain/(loss) | New basis of received property | |

| a. | 17000 | 0 | 14000 | 0 | ||||

| b. | 15000 | 0 | 29000 | 0 | ||||

| c. | 4000 | 6000 | 8000 | 500 | ||||

| d. | 16000 | 0 | 28000 | 0 | ||||

| e. | 7000 | 0 | 12000 | 4000 |

Solution

ANSWER:

Adjusted basis of old asset

Boot given

FMV of new asset

Boot received

Realized

Gain/(loss)

Recognized gain

Postponed

Gain/(loss)

New basis of received property

a.

17000

0

14000

0

b.

15000

0

29000

0

c.

4000

6000

8000

500

d.

16000

0

28000

0

e.

7000

0

12000

4000

EXPLANATION:

STEP 1:CALCULATION OF REALIZED GAIN/(LOSS)

realized gain/(loss)=(FMV of new asset+boot recieved)-(adjusted basis of old asset+boot given)

a.(14000+0)-(17000+0)=(3000)

realized loss=3000

b.(29000+0)-(15000+0)=14000

realized gain =14000

c.(8000+500)-(4000+6000)=(1500)

realized loss=1500

d.(28000+0)-(16000+0)=12000

realized gain =12000

e.(12000+4000)-(7000+0)=9000

realized gain =9000

STEP 2:CALCULATION OF RECOGNIZED GAIN

recognized gain=lesser of boot recieved or realized gain

a.0

b.lesser of 0 or 14000

hence 0

c.0

d.lesser of 0 or 12000

hence 0

e lesser of 4000 or 9000

hence 4000

STEP 3:CALCULATION OF POSTPONED GAIN/(LOSS)-

postponed gain/(loss)=relized gain/(loss) -recognized gain/(loss)

a.postponed loss=3000-0

=3000

b.postponed gain=14000-0

=14000

c.postponed loss=1500-0

=1500

d.postponed gain=12000-0

=12000

e.postponed gain=9000-4000

=5000

STEP 4: CALCULATION OF NEW BASIS OF PROPERTY RECIEVED-

new basis of property recieved=FMV-postponed gain or FMV +postponed loss

a.17000+3000=20000

b.15000-14000=1000

c.4000+1500=5500

d.16000-12000=4000

e.7000-5000=2000

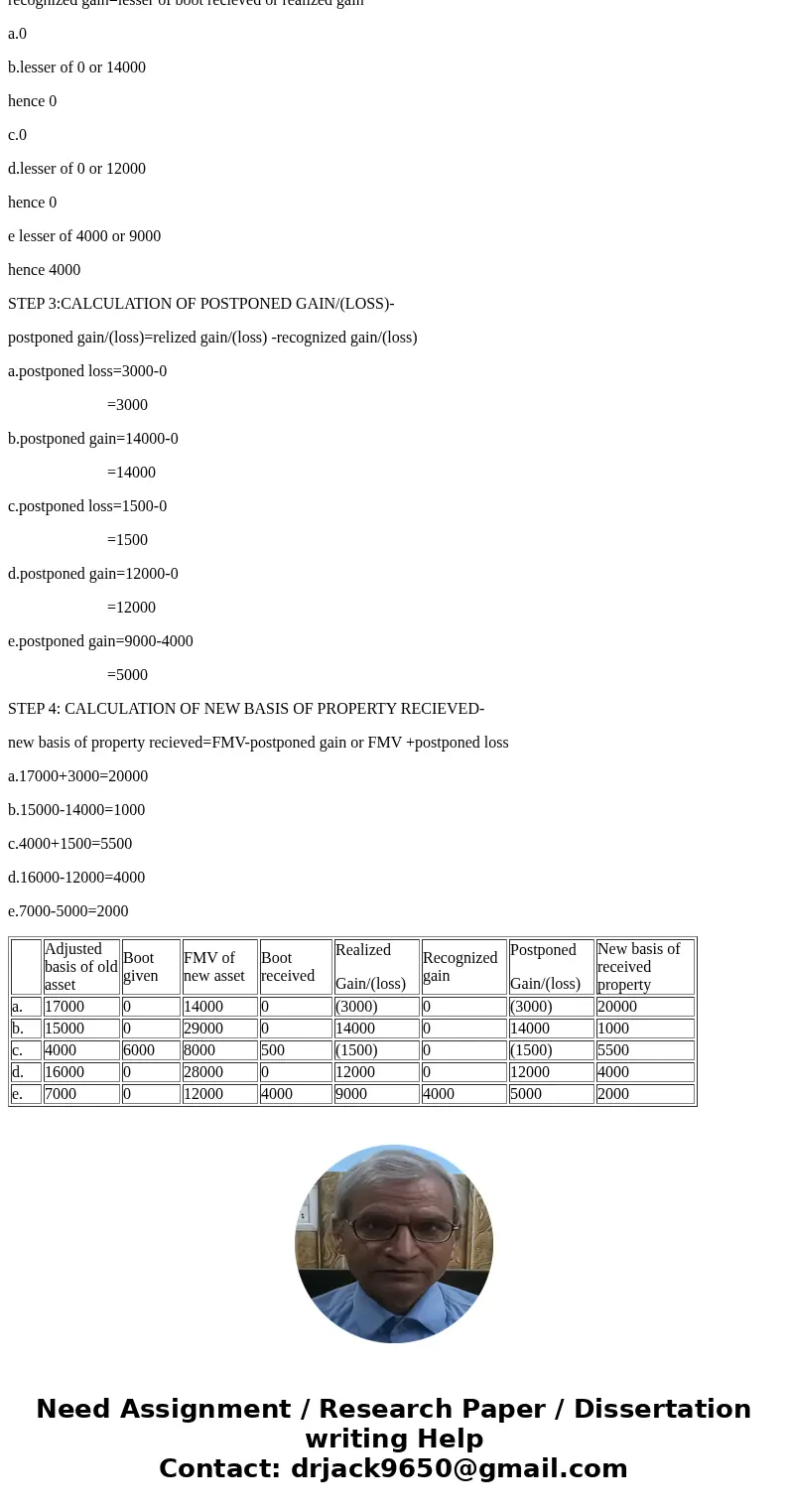

| Adjusted basis of old asset | Boot given | FMV of new asset | Boot received | Realized Gain/(loss) | Recognized gain | Postponed Gain/(loss) | New basis of received property | |

| a. | 17000 | 0 | 14000 | 0 | (3000) | 0 | (3000) | 20000 |

| b. | 15000 | 0 | 29000 | 0 | 14000 | 0 | 14000 | 1000 |

| c. | 4000 | 6000 | 8000 | 500 | (1500) | 0 | (1500) | 5500 |

| d. | 16000 | 0 | 28000 | 0 | 12000 | 0 | 12000 | 4000 |

| e. | 7000 | 0 | 12000 | 4000 | 9000 | 4000 | 5000 | 2000 |

Homework Sourse

Homework Sourse