Required information The following information applies to th

Required information The following information applies to the questions displayed below. Cardinal Company is considering a five-year project that would require a $2,945,000 investment in equipment with a useful life of five years and no salvage value. The company\'s discount rate is 18%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: $2,873,000 1,019,000 1,854,000 Advertising, salaries, and other fixed out-of-pocket costs Depreciation $754,000 589,000 Total fixed expenses Net operating income 1,343,000 $ 511,000 Click here to view Exhibit 138-1 and Exhibit 138-2, to determine the appropriate discount factor(s) using table.

Solution

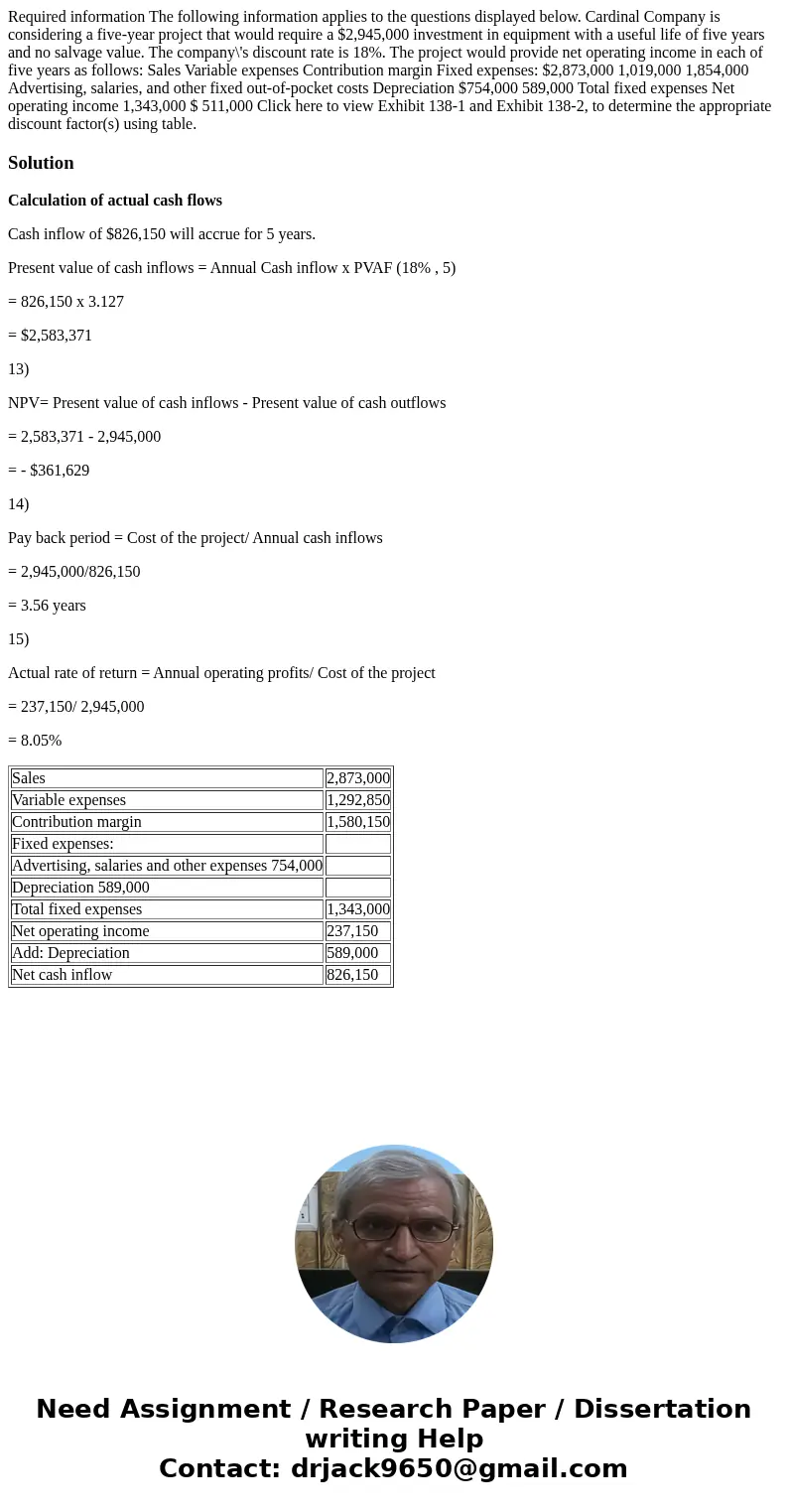

Calculation of actual cash flows

Cash inflow of $826,150 will accrue for 5 years.

Present value of cash inflows = Annual Cash inflow x PVAF (18% , 5)

= 826,150 x 3.127

= $2,583,371

13)

NPV= Present value of cash inflows - Present value of cash outflows

= 2,583,371 - 2,945,000

= - $361,629

14)

Pay back period = Cost of the project/ Annual cash inflows

= 2,945,000/826,150

= 3.56 years

15)

Actual rate of return = Annual operating profits/ Cost of the project

= 237,150/ 2,945,000

= 8.05%

| Sales | 2,873,000 |

| Variable expenses | 1,292,850 |

| Contribution margin | 1,580,150 |

| Fixed expenses: | |

| Advertising, salaries and other expenses 754,000 | |

| Depreciation 589,000 | |

| Total fixed expenses | 1,343,000 |

| Net operating income | 237,150 |

| Add: Depreciation | 589,000 |

| Net cash inflow | 826,150 |

Homework Sourse

Homework Sourse