The following information is related to New Lane Companys fi

The following information is related to New Lane Company\'s fiscal year 2017.

Income Statement:

Net Income $300,000

Depreciation Expense 30,000

Loss on Sale of Plant Assets 10,000

Interest Expense 500

Balance Sheet - 12/31/17:

Accounts Payable Increase 4,000

Accounts Receivable Increase 5,000

Plant Assets - Purchased 200,000

Plant Assets – Proceeds

from sale 100,000

Additional Information:

Cash Balance - 12/31/2016: $50,000

Common Stock exchanged for outstanding Long-Term Notes Payable of $150,000

Dividends paid were $30,000

Use this information to prepare the Statement of Cash Flows for New Lane\'s Company using the indirect method.

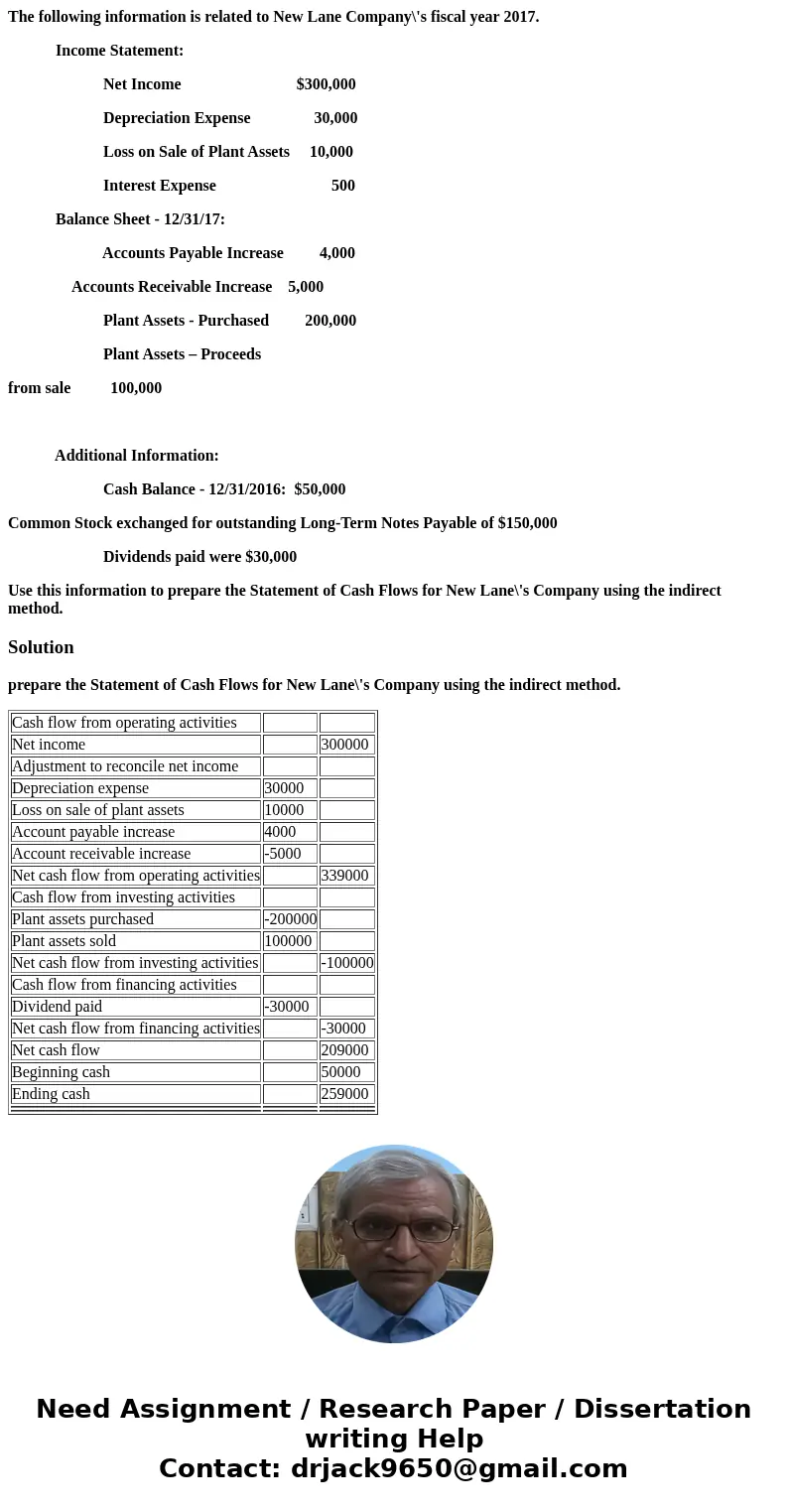

Solution

prepare the Statement of Cash Flows for New Lane\'s Company using the indirect method.

| Cash flow from operating activities | ||

| Net income | 300000 | |

| Adjustment to reconcile net income | ||

| Depreciation expense | 30000 | |

| Loss on sale of plant assets | 10000 | |

| Account payable increase | 4000 | |

| Account receivable increase | -5000 | |

| Net cash flow from operating activities | 339000 | |

| Cash flow from investing activities | ||

| Plant assets purchased | -200000 | |

| Plant assets sold | 100000 | |

| Net cash flow from investing activities | -100000 | |

| Cash flow from financing activities | ||

| Dividend paid | -30000 | |

| Net cash flow from financing activities | -30000 | |

| Net cash flow | 209000 | |

| Beginning cash | 50000 | |

| Ending cash | 259000 | |

Homework Sourse

Homework Sourse