The two approaches to determining the uncollectible accounts

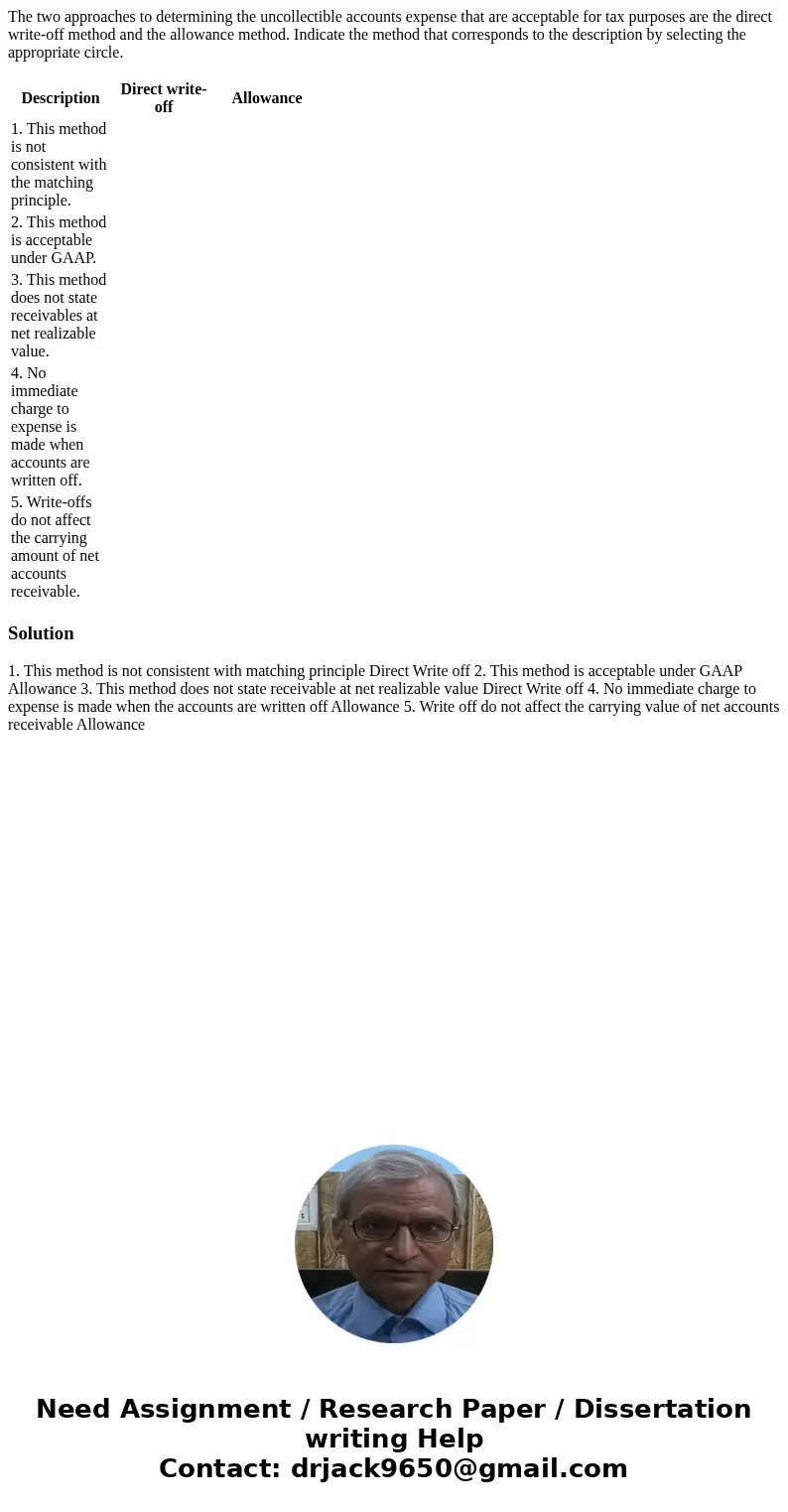

The two approaches to determining the uncollectible accounts expense that are acceptable for tax purposes are the direct write-off method and the allowance method. Indicate the method that corresponds to the description by selecting the appropriate circle.

| Description | Direct write-off | Allowance |

|---|---|---|

| 1. This method is not consistent with the matching principle. | ||

| 2. This method is acceptable under GAAP. | ||

| 3. This method does not state receivables at net realizable value. | ||

| 4. No immediate charge to expense is made when accounts are written off. | ||

| 5. Write-offs do not affect the carrying amount of net accounts receivable. |

Solution

1. This method is not consistent with matching principle Direct Write off 2. This method is acceptable under GAAP Allowance 3. This method does not state receivable at net realizable value Direct Write off 4. No immediate charge to expense is made when the accounts are written off Allowance 5. Write off do not affect the carrying value of net accounts receivable Allowance

Homework Sourse

Homework Sourse