Two different companies Ripper and Berners entered into the

Two different companies, Ripper and Berners, entered into the following inventory transactions during December. Both companies use a perpetual inventory system.

December 3 – Ripper Corporation sold inventory on account to Berners Corp. for $496,000, terms 2/10, n/30. This inventory originally cost Ripper $314,000.

December 8 – Berners Corp. returned inventory to Ripper Corporation for a credit of $3,900. Ripper returned this inventory to inventory at its original cost of $2,469.

Prepare the journal entries to record these transactions on the books of Ripper Corporation. (If no entry is required for a transaction/event, select \"No Journal Entry Required\" in the first account field.)

| Two different companies, Ripper and Berners, entered into the following inventory transactions during December. Both companies use a perpetual inventory system. |

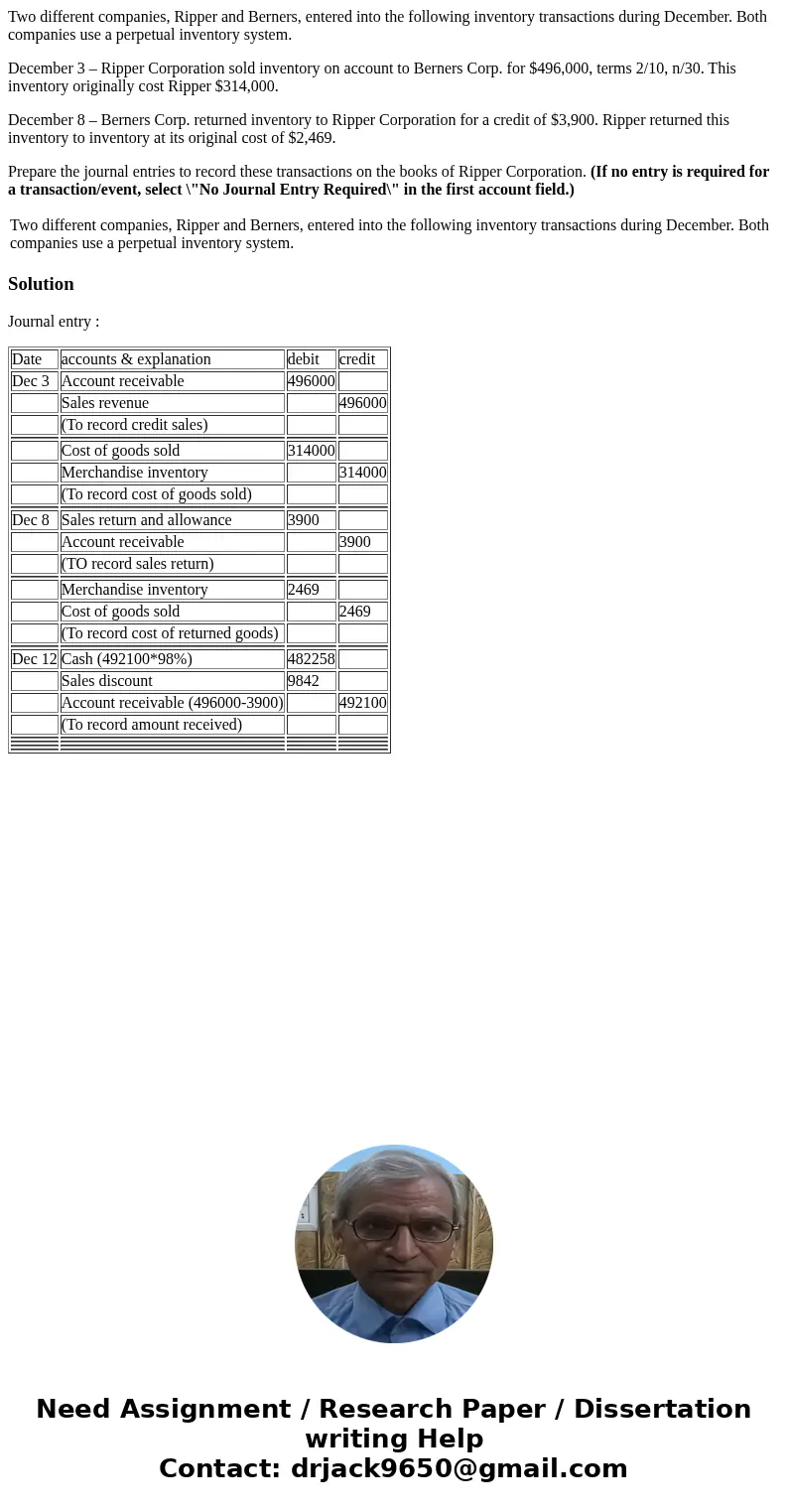

Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| Dec 3 | Account receivable | 496000 | |

| Sales revenue | 496000 | ||

| (To record credit sales) | |||

| Cost of goods sold | 314000 | ||

| Merchandise inventory | 314000 | ||

| (To record cost of goods sold) | |||

| Dec 8 | Sales return and allowance | 3900 | |

| Account receivable | 3900 | ||

| (TO record sales return) | |||

| Merchandise inventory | 2469 | ||

| Cost of goods sold | 2469 | ||

| (To record cost of returned goods) | |||

| Dec 12 | Cash (492100*98%) | 482258 | |

| Sales discount | 9842 | ||

| Account receivable (496000-3900) | 492100 | ||

| (To record amount received) | |||

Homework Sourse

Homework Sourse