MaindoinvokertakeAssignmentSessionLocatorassignmenttakeinpro

Main.do?invoker-&takeAssignmentSessionLocator-assignment-take;&inprogress; false eBook Budgeted Income Statement and Balance Sheet As a preliminary to requesting budget estimates of sales, costs, and expenses for the fiscal year beginring January 1, 20Y9, the following tentative trial balance as of December 31, 206, is prepared by the Accounting Department of Regina Soap Ca : Cash Accounts Receivable Finithed Goods Work in Process 85,000 125,600 69,300 32,500 48,900 2,600 325,000 Materiais Prepaid Expenses Flant and Equipment Accumulated Depreciation-Plant and Equipment $156,200 52,000 80,000 299,700 ?) Accounts Payable Common Stock, $30 pa Retained Earnings Factory output and sales for 2019 e eupected to tai 200 oc nts af product, which are to be sals ar ss.00 per unit. The ouantees and costs of the inventorles at December 31. 209, are espected to remain utchanged from the balances at the beginning of the year. Butget estimates of manufacturing costs and opersing espenses for the year are summarized as follows Estimated Cests and Expenses Fixed Total for Year) (Per Unit Sold) Cest of goods manufactured and seld Direct materials Direct lsbor Pievious

Solution

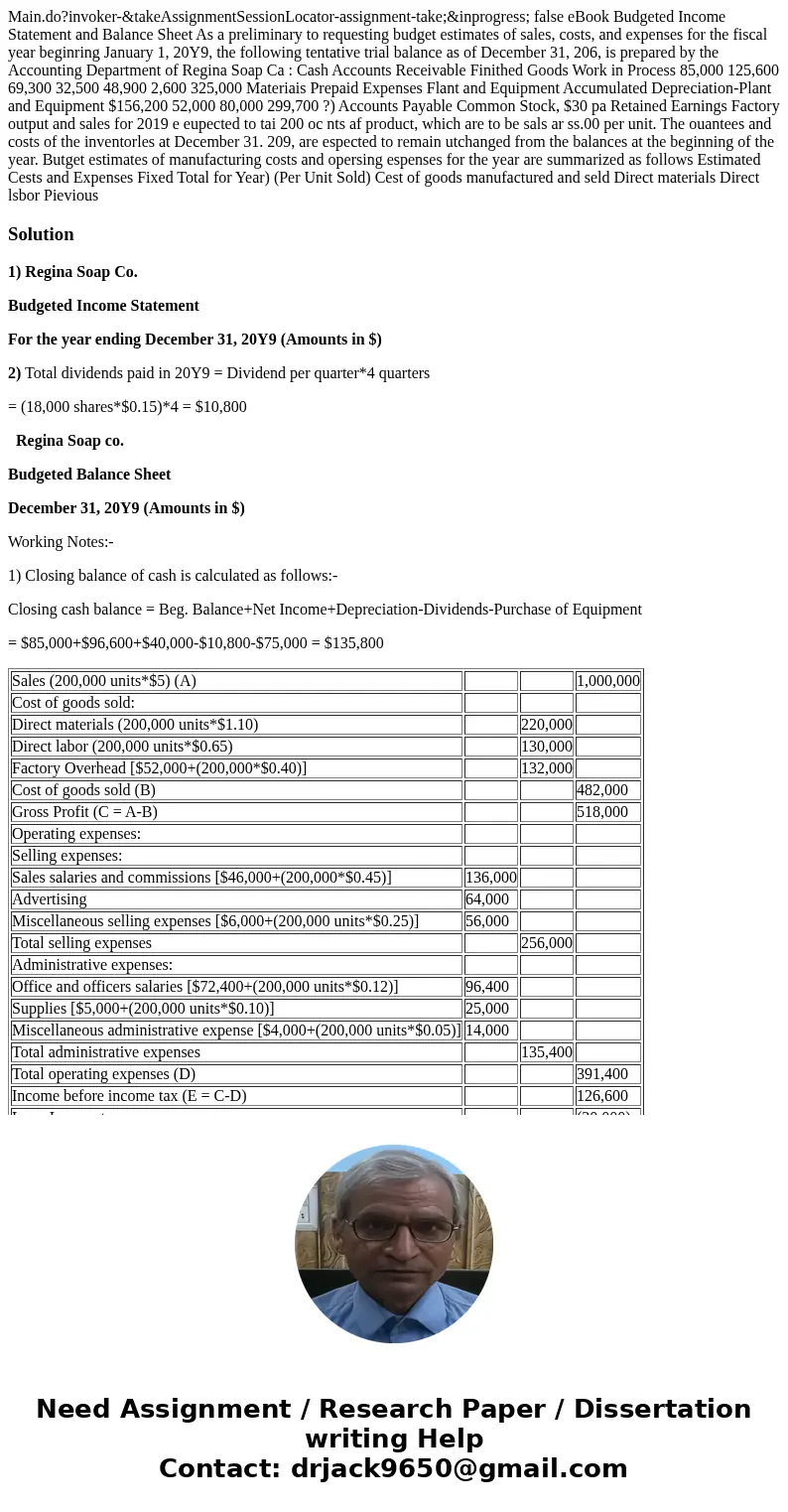

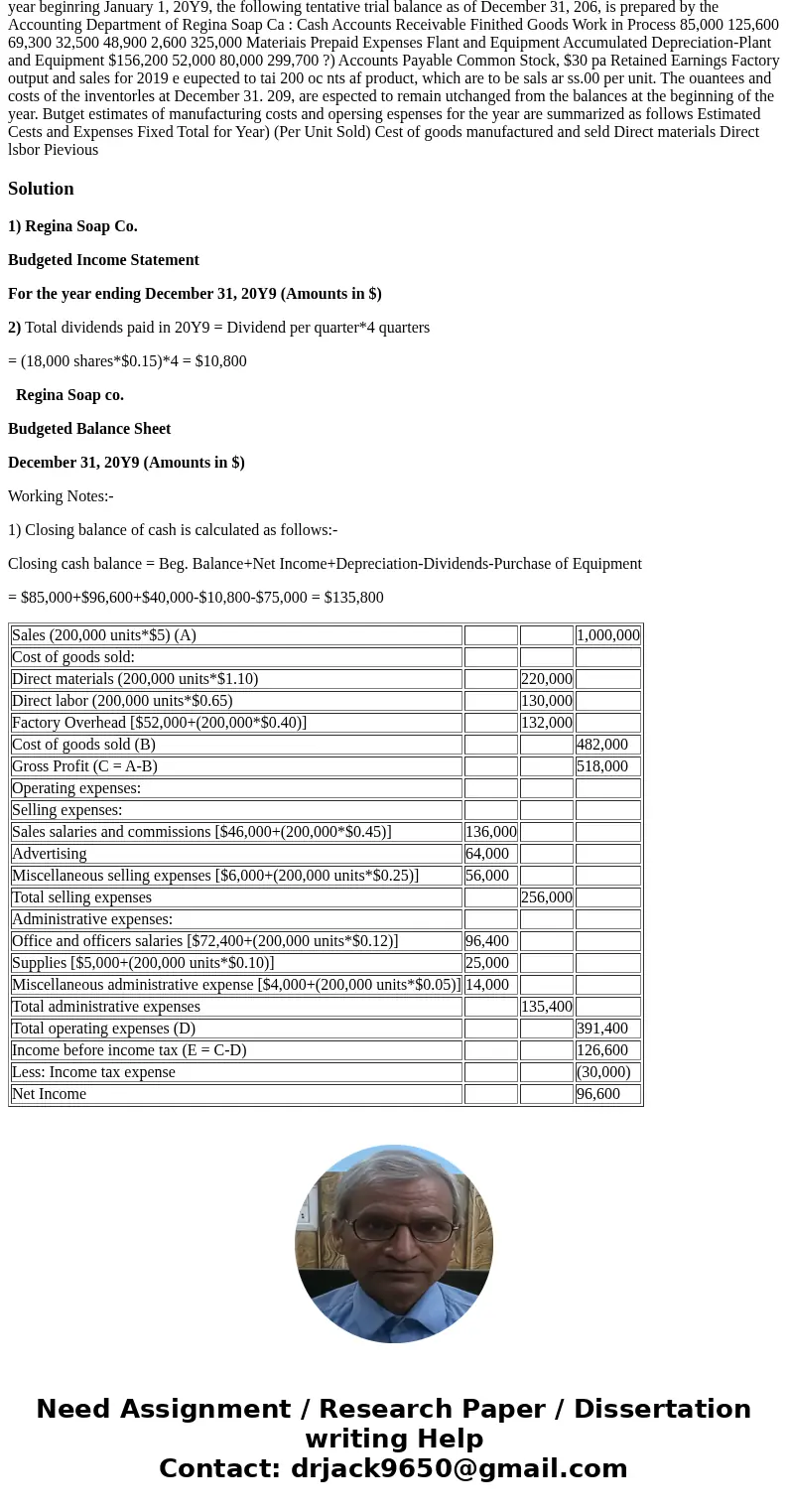

1) Regina Soap Co.

Budgeted Income Statement

For the year ending December 31, 20Y9 (Amounts in $)

2) Total dividends paid in 20Y9 = Dividend per quarter*4 quarters

= (18,000 shares*$0.15)*4 = $10,800

Regina Soap co.

Budgeted Balance Sheet

December 31, 20Y9 (Amounts in $)

Working Notes:-

1) Closing balance of cash is calculated as follows:-

Closing cash balance = Beg. Balance+Net Income+Depreciation-Dividends-Purchase of Equipment

= $85,000+$96,600+$40,000-$10,800-$75,000 = $135,800

| Sales (200,000 units*$5) (A) | 1,000,000 | ||

| Cost of goods sold: | |||

| Direct materials (200,000 units*$1.10) | 220,000 | ||

| Direct labor (200,000 units*$0.65) | 130,000 | ||

| Factory Overhead [$52,000+(200,000*$0.40)] | 132,000 | ||

| Cost of goods sold (B) | 482,000 | ||

| Gross Profit (C = A-B) | 518,000 | ||

| Operating expenses: | |||

| Selling expenses: | |||

| Sales salaries and commissions [$46,000+(200,000*$0.45)] | 136,000 | ||

| Advertising | 64,000 | ||

| Miscellaneous selling expenses [$6,000+(200,000 units*$0.25)] | 56,000 | ||

| Total selling expenses | 256,000 | ||

| Administrative expenses: | |||

| Office and officers salaries [$72,400+(200,000 units*$0.12)] | 96,400 | ||

| Supplies [$5,000+(200,000 units*$0.10)] | 25,000 | ||

| Miscellaneous administrative expense [$4,000+(200,000 units*$0.05)] | 14,000 | ||

| Total administrative expenses | 135,400 | ||

| Total operating expenses (D) | 391,400 | ||

| Income before income tax (E = C-D) | 126,600 | ||

| Less: Income tax expense | (30,000) | ||

| Net Income | 96,600 |

Homework Sourse

Homework Sourse