EXERCISES14 The following data for the property and equipmen

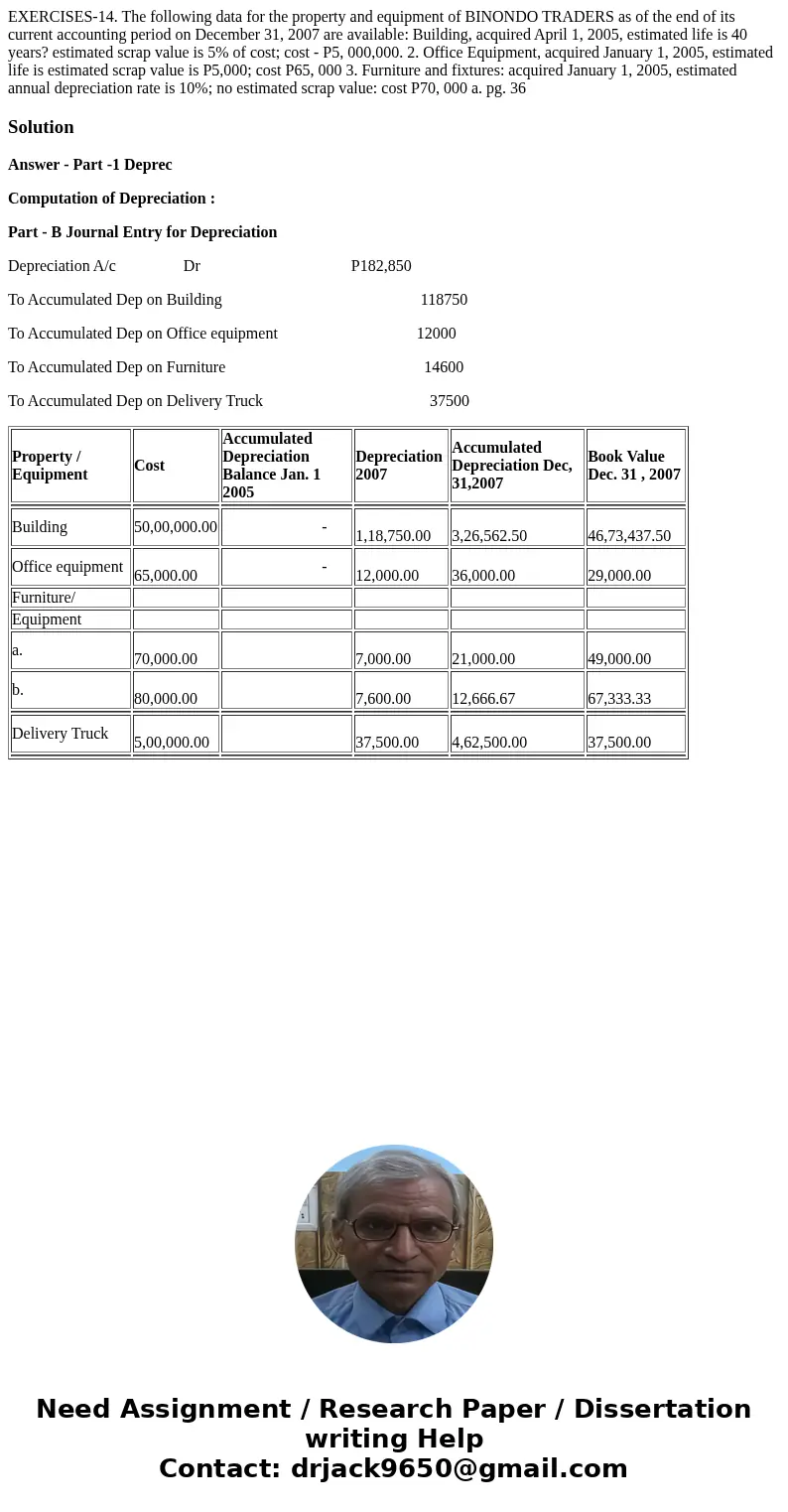

EXERCISES-14. The following data for the property and equipment of BINONDO TRADERS as of the end of its current accounting period on December 31, 2007 are available: Building, acquired April 1, 2005, estimated life is 40 years? estimated scrap value is 5% of cost; cost - P5, 000,000. 2. Office Equipment, acquired January 1, 2005, estimated life is estimated scrap value is P5,000; cost P65, 000 3. Furniture and fixtures: acquired January 1, 2005, estimated annual depreciation rate is 10%; no estimated scrap value: cost P70, 000 a. pg. 36

Solution

Answer - Part -1 Deprec

Computation of Depreciation :

Part - B Journal Entry for Depreciation

Depreciation A/c Dr P182,850

To Accumulated Dep on Building 118750

To Accumulated Dep on Office equipment 12000

To Accumulated Dep on Furniture 14600

To Accumulated Dep on Delivery Truck 37500

| Property / Equipment | Cost | Accumulated Depreciation Balance Jan. 1 2005 | Depreciation 2007 | Accumulated Depreciation Dec, 31,2007 | Book Value Dec. 31 , 2007 |

| Building | 50,00,000.00 | - | 1,18,750.00 | 3,26,562.50 | 46,73,437.50 |

| Office equipment | 65,000.00 | - | 12,000.00 | 36,000.00 | 29,000.00 |

| Furniture/ | |||||

| Equipment | |||||

| a. | 70,000.00 | 7,000.00 | 21,000.00 | 49,000.00 | |

| b. | 80,000.00 | 7,600.00 | 12,666.67 | 67,333.33 | |

| Delivery Truck | 5,00,000.00 | 37,500.00 | 4,62,500.00 | 37,500.00 | |

Homework Sourse

Homework Sourse