Question 1 The table shows the balance sheet for ABC a hypot

Question 1 The table shows the balance sheet for ABC, a hypothetical commercial bank. Assume that the bank has achieved its target ratio before any new loans are made Balance Sheet: ABC Bank Assets Reserves Loans Liabilities $ 200 $ 4200 S4000 S 400 a) (4 marks) What is the bank\'s target reserve ratio? b) 1 mark) What is the value of the owners\' investment in the bank? c) 5 marks) Suppose someone makes a new deposit to the bank of $ 100. Draw a new balance sheet showing the immediate effect of the new deposit. What is the bank\'s new reserve ratio?

Solution

a. Reserve Ratio = (100 * Reserves) / Deposits

or, Reserve ratio = (100 * 200) / 4000 = 5%

b. Value of owner\'s investment in the bank is the Capital on the liabilities side = $400

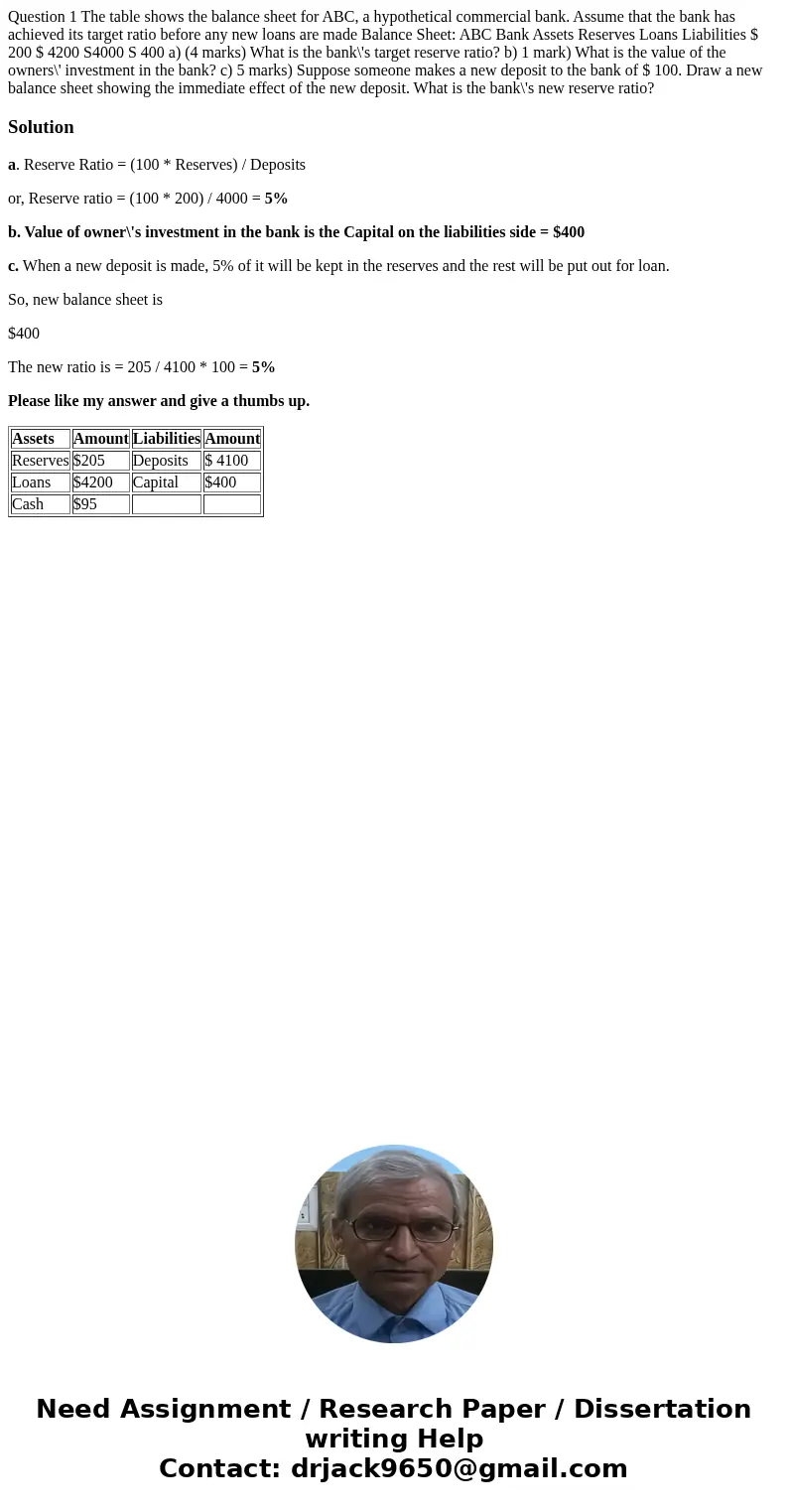

c. When a new deposit is made, 5% of it will be kept in the reserves and the rest will be put out for loan.

So, new balance sheet is

$400

The new ratio is = 205 / 4100 * 100 = 5%

Please like my answer and give a thumbs up.

| Assets | Amount | Liabilities | Amount |

| Reserves | $205 | Deposits | $ 4100 |

| Loans | $4200 | Capital | $400 |

| Cash | $95 |

Homework Sourse

Homework Sourse