Statement of Cash FlowsIndirect Method The comparative balan

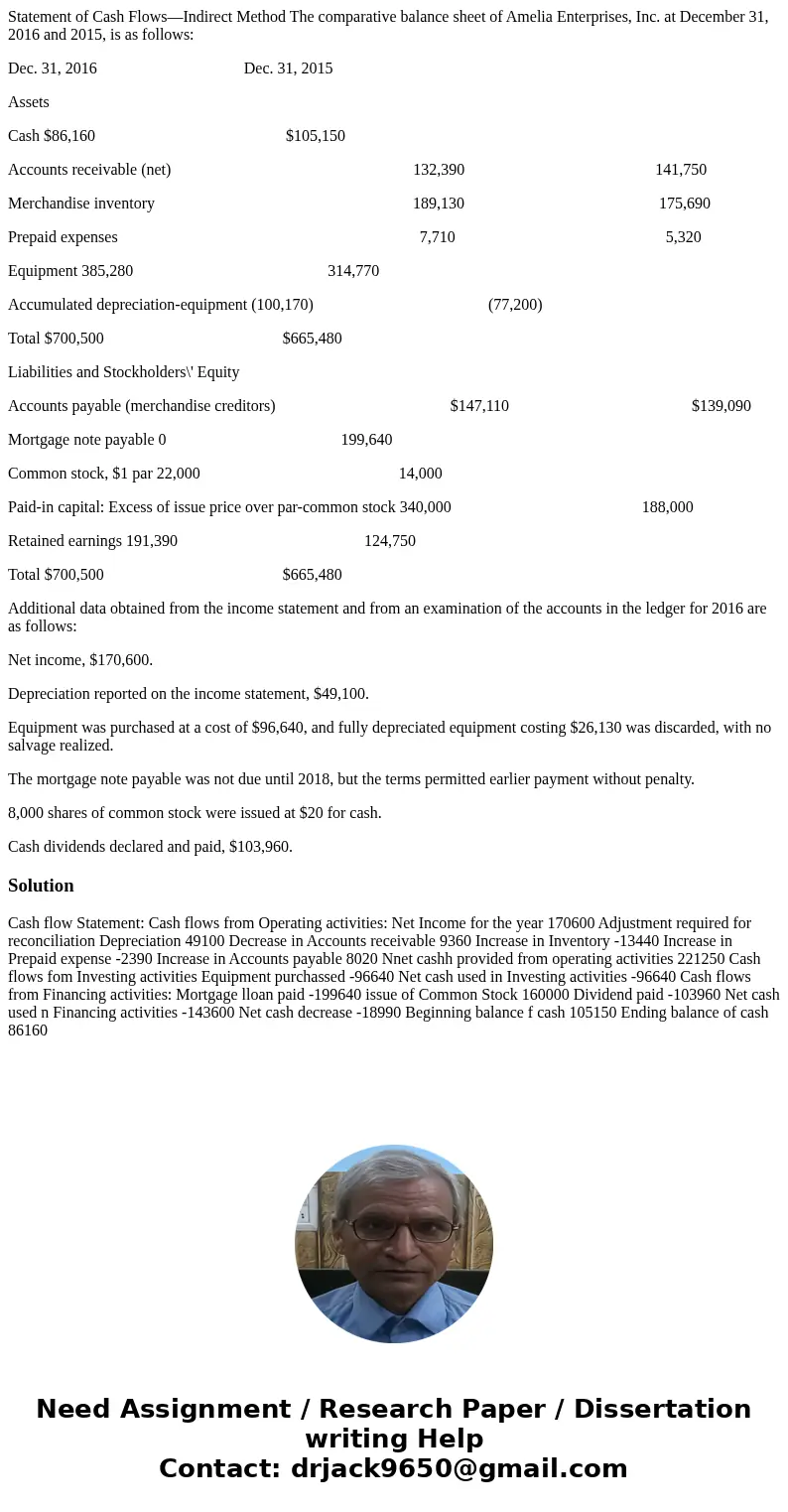

Statement of Cash Flows—Indirect Method The comparative balance sheet of Amelia Enterprises, Inc. at December 31, 2016 and 2015, is as follows:

Dec. 31, 2016 Dec. 31, 2015

Assets

Cash $86,160 $105,150

Accounts receivable (net) 132,390 141,750

Merchandise inventory 189,130 175,690

Prepaid expenses 7,710 5,320

Equipment 385,280 314,770

Accumulated depreciation-equipment (100,170) (77,200)

Total $700,500 $665,480

Liabilities and Stockholders\' Equity

Accounts payable (merchandise creditors) $147,110 $139,090

Mortgage note payable 0 199,640

Common stock, $1 par 22,000 14,000

Paid-in capital: Excess of issue price over par-common stock 340,000 188,000

Retained earnings 191,390 124,750

Total $700,500 $665,480

Additional data obtained from the income statement and from an examination of the accounts in the ledger for 2016 are as follows:

Net income, $170,600.

Depreciation reported on the income statement, $49,100.

Equipment was purchased at a cost of $96,640, and fully depreciated equipment costing $26,130 was discarded, with no salvage realized.

The mortgage note payable was not due until 2018, but the terms permitted earlier payment without penalty.

8,000 shares of common stock were issued at $20 for cash.

Cash dividends declared and paid, $103,960.

Solution

Cash flow Statement: Cash flows from Operating activities: Net Income for the year 170600 Adjustment required for reconciliation Depreciation 49100 Decrease in Accounts receivable 9360 Increase in Inventory -13440 Increase in Prepaid expense -2390 Increase in Accounts payable 8020 Nnet cashh provided from operating activities 221250 Cash flows fom Investing activities Equipment purchassed -96640 Net cash used in Investing activities -96640 Cash flows from Financing activities: Mortgage lloan paid -199640 issue of Common Stock 160000 Dividend paid -103960 Net cash used n Financing activities -143600 Net cash decrease -18990 Beginning balance f cash 105150 Ending balance of cash 86160

Homework Sourse

Homework Sourse