Please answer both part 1 and 2 As a secondyear associate au

Please answer both part 1 and 2

As a second-year associate auditor for Bleazard, Smith & Stephens, LLC (BSS), you have been assigned to the Darryl’s Sporting Goods audit engagement for the year-end December 31, 2014.

Darryl’s Sporting Goods is a large national retail chain selling sporting goods and equipment for a wide variety of sports and outdoor activities. The publicly-traded company maintains more than 100 large retail store locations in the United States, each filled with merchandise and interactive displays (e.g., rock-climbing walls, basketball hoops, batting cages, golf putting greens, rifle and pistol ranges) that are designed to engage customers and demonstrate the benefits of various products. In addition to their store locations, Darryl’s also sells merchandise directly to customers through the company’s website, catalogs distributed by mail, and through phone orders.

In addition to traditional cash-and-carry retail sales to individual consumers, Darryl’s engages in large credit sales on account with a variety of organizations and institutions around the country. These organizations include – among others – athletic departments for colleges and high schools, community and private youth sports leagues, and commercial entities engaged in sports training and outdoor recreational activities.

As part of the year-end financial statement audit of the revenue cycle, your team is sending third-party confirmations to a sample of Darryl’s credit customers with outstanding account balances as of year-end.

Part 1: Understanding the Audit Concept

Take a few minutes to read through the PCAOB’s auditing standard governing the use of third-party confirmations ( AU 330: The Confirmation Process). Refer to this standard as you answer the following questions regarding third-party confirmations.

1. The standard defines confirmation as “the process of obtaining and evaluating a direct communication from a third party in response to a request for information about a particular item affecting financial statement assertions.” According to AU 330, what are the five steps involved in the confirmation process?

2. With respect to the quality of audit evidence, why do you think third-party confirmations are considered such a valuable audit procedure? Why does obtaining evidence from a third party enhance its value to the auditor?

3. The standard suggests that third-party confirmation requests can be effective at addressing one or more of management’s assertions. According to the standard, which management assertion is best addressed by confirming Accounts Receivable balances at year-end?

4. The standard discusses the distinction between two types of third-party confirmations: positive and negative confirmations.

a. Briefly describe positive confirmations.

b. What is a blank positive confirmation? Why might an audit firm choose to use blank confirmations?

c. In the space below, briefly describe negative confirmations.

d. Under what conditions do auditing standards indicate that negative confirmations may be used?

5. The standard emphasizes the importance for the auditor to “maintain control over the confirmation requests and responses” (AU 330.28). What does it mean to “maintain control” of the confirmation process? Why is it important for the auditor to “maintain control” over this process? How would the audit evidence be affected if the auditor failed to control this process?

Part 2: Performing the Audit Procedure

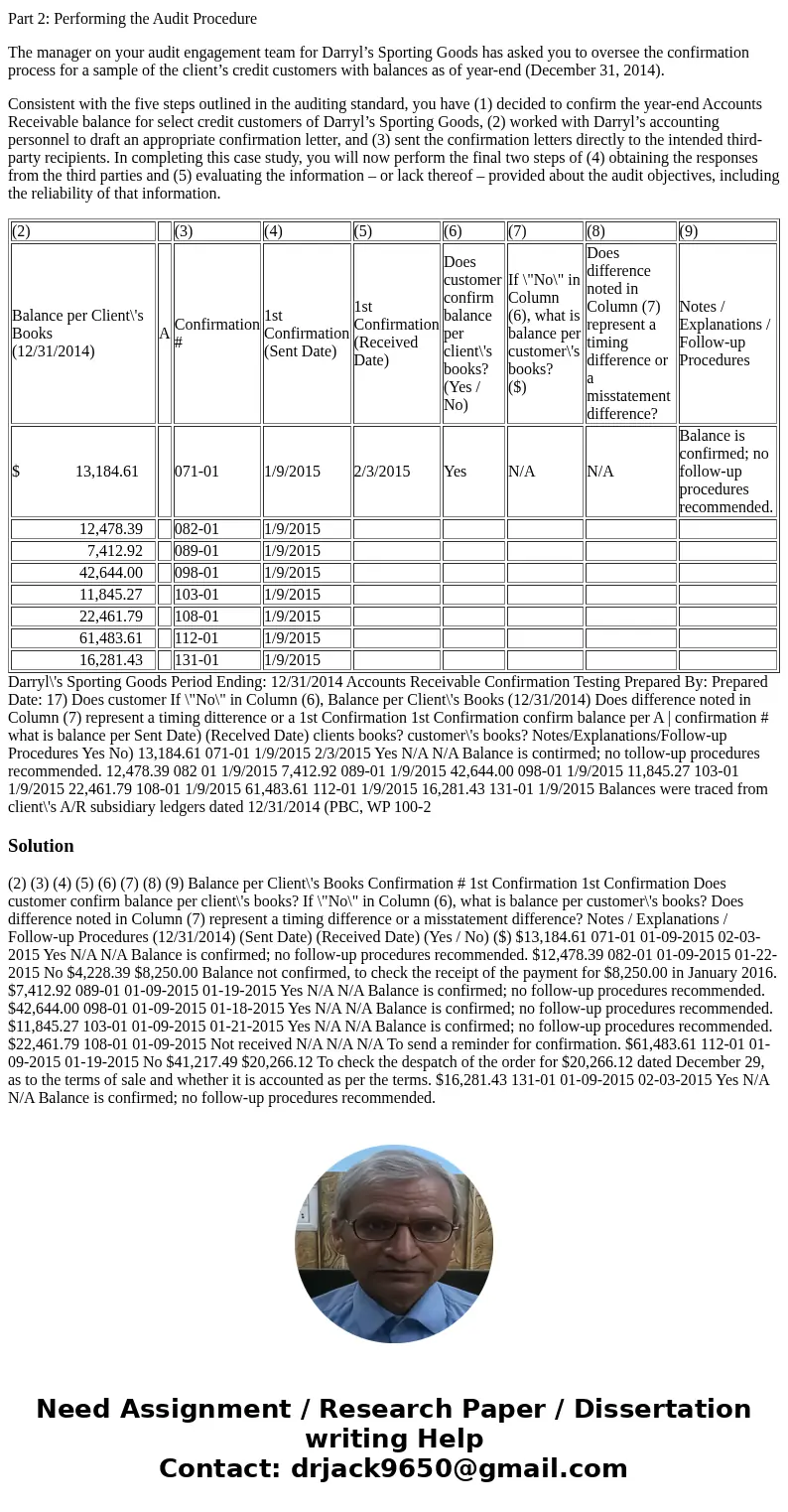

The manager on your audit engagement team for Darryl’s Sporting Goods has asked you to oversee the confirmation process for a sample of the client’s credit customers with balances as of year-end (December 31, 2014).

Consistent with the five steps outlined in the auditing standard, you have (1) decided to confirm the year-end Accounts Receivable balance for select credit customers of Darryl’s Sporting Goods, (2) worked with Darryl’s accounting personnel to draft an appropriate confirmation letter, and (3) sent the confirmation letters directly to the intended third-party recipients. In completing this case study, you will now perform the final two steps of (4) obtaining the responses from the third parties and (5) evaluating the information – or lack thereof – provided about the audit objectives, including the reliability of that information.

| (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | ||

| Balance per Client\'s Books (12/31/2014) | A | Confirmation # | 1st Confirmation (Sent Date) | 1st Confirmation (Received Date) | Does customer confirm balance per client\'s books? (Yes / No) | If \"No\" in Column (6), what is balance per customer\'s books? ($) | Does difference noted in Column (7) represent a timing difference or a misstatement difference? | Notes / Explanations / Follow-up Procedures | |

| $ 13,184.61 | | 071-01 | 1/9/2015 | 2/3/2015 | Yes | N/A | N/A | Balance is confirmed; no follow-up procedures recommended. | |

| 12,478.39 | 082-01 | 1/9/2015 | |||||||

| 7,412.92 | 089-01 | 1/9/2015 | |||||||

| 42,644.00 | 098-01 | 1/9/2015 | |||||||

| 11,845.27 | 103-01 | 1/9/2015 | |||||||

| 22,461.79 | 108-01 | 1/9/2015 | |||||||

| 61,483.61 | 112-01 | 1/9/2015 | |||||||

| 16,281.43 | 131-01 | 1/9/2015 |

Solution

(2) (3) (4) (5) (6) (7) (8) (9) Balance per Client\'s Books Confirmation # 1st Confirmation 1st Confirmation Does customer confirm balance per client\'s books? If \"No\" in Column (6), what is balance per customer\'s books? Does difference noted in Column (7) represent a timing difference or a misstatement difference? Notes / Explanations / Follow-up Procedures (12/31/2014) (Sent Date) (Received Date) (Yes / No) ($) $13,184.61 071-01 01-09-2015 02-03-2015 Yes N/A N/A Balance is confirmed; no follow-up procedures recommended. $12,478.39 082-01 01-09-2015 01-22-2015 No $4,228.39 $8,250.00 Balance not confirmed, to check the receipt of the payment for $8,250.00 in January 2016. $7,412.92 089-01 01-09-2015 01-19-2015 Yes N/A N/A Balance is confirmed; no follow-up procedures recommended. $42,644.00 098-01 01-09-2015 01-18-2015 Yes N/A N/A Balance is confirmed; no follow-up procedures recommended. $11,845.27 103-01 01-09-2015 01-21-2015 Yes N/A N/A Balance is confirmed; no follow-up procedures recommended. $22,461.79 108-01 01-09-2015 Not received N/A N/A N/A To send a reminder for confirmation. $61,483.61 112-01 01-09-2015 01-19-2015 No $41,217.49 $20,266.12 To check the despatch of the order for $20,266.12 dated December 29, as to the terms of sale and whether it is accounted as per the terms. $16,281.43 131-01 01-09-2015 02-03-2015 Yes N/A N/A Balance is confirmed; no follow-up procedures recommended.

Homework Sourse

Homework Sourse