McGuire Company acquired 90 percent of Hogan Company on Janu

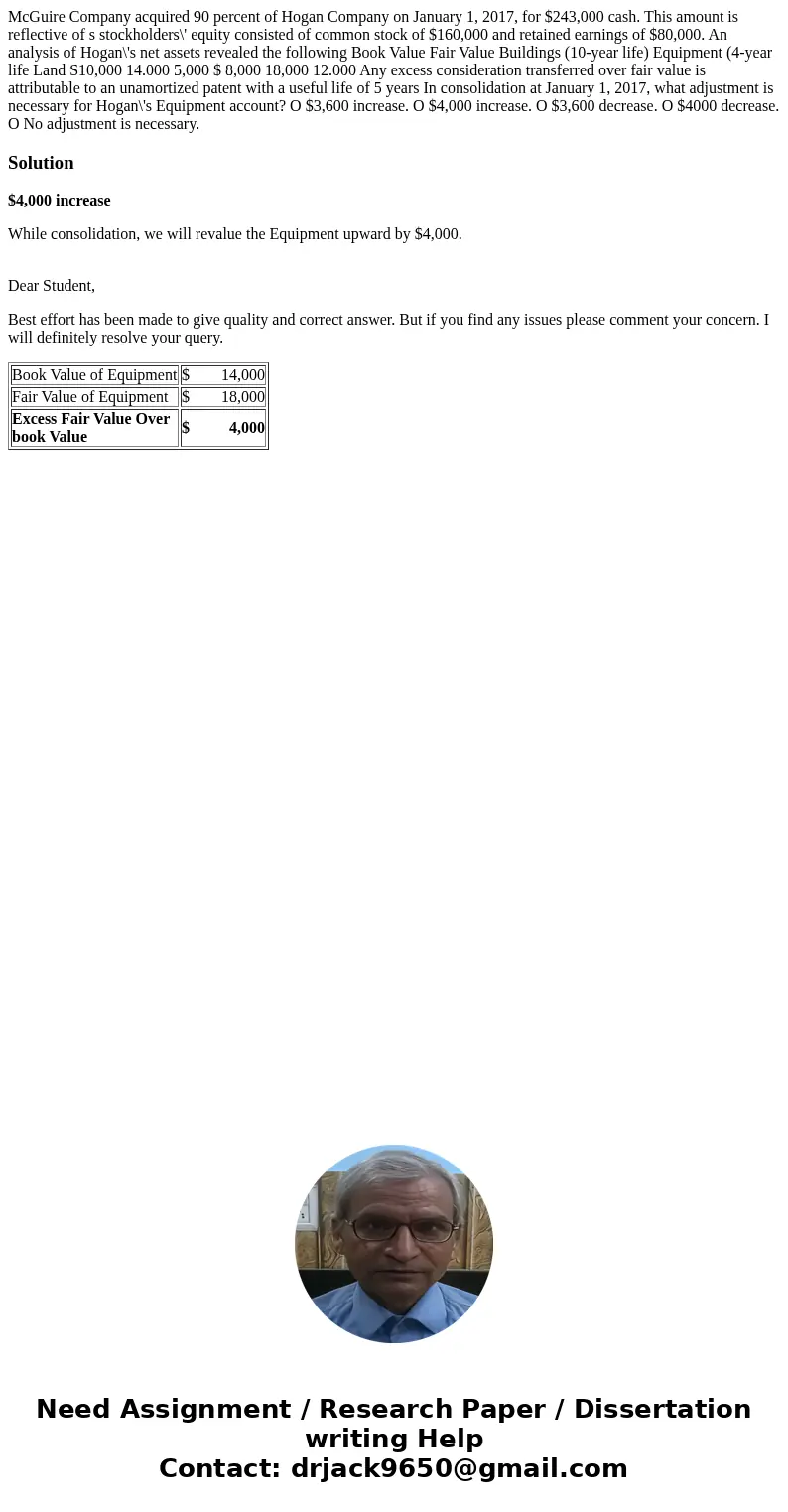

McGuire Company acquired 90 percent of Hogan Company on January 1, 2017, for $243,000 cash. This amount is reflective of s stockholders\' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan\'s net assets revealed the following Book Value Fair Value Buildings (10-year life) Equipment (4-year life Land S10,000 14.000 5,000 $ 8,000 18,000 12.000 Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years In consolidation at January 1, 2017, what adjustment is necessary for Hogan\'s Equipment account? O $3,600 increase. O $4,000 increase. O $3,600 decrease. O $4000 decrease. O No adjustment is necessary.

Solution

$4,000 increase

While consolidation, we will revalue the Equipment upward by $4,000.

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

| Book Value of Equipment | $ 14,000 |

| Fair Value of Equipment | $ 18,000 |

| Excess Fair Value Over book Value | $ 4,000 |

Homework Sourse

Homework Sourse