Karl inc has an opportunity to expand one of its production

Karl inc. has an opportunity to expand one of its production facilities at a cost of $425000. If the expansion is undertaken Karl inc. expects their income will increase by $102000 the first year and then increase by $6000 each year after that. The annual expenses are expected to be $10000 the first year and increase by $1500 each year after that. The company will depreciate the equipment using a 5 year MACRS (20%, 32%, 19.2%, 11.52%, 11.52%, and 5.75%) the expected market value at the end of 8 years is $90000 and the tax rate is 34%. What is the IRR of the BTCF? Ans. XX.X%

What is the present worth of the after tax cash flow if MARR =15%? Ans. $xxxx

Karl inc. has an opportunity to expand one of its production facilities at a cost of $425000. If the expansion is undertaken Karl inc. expects their income will increase by $102000 the first year and then increase by $6000 each year after that. The annual expenses are expected to be $10000 the first year and increase by $1500 each year after that. The company will depreciate the equipment using a 5 year MACRS (20%, 32%, 19.2%, 11.52%, 11.52%, and 5.75%) the expected market value at the end of 8 years is $90000 and the tax rate is 34%. What is the IRR of the BTCF? Ans. XX.X%

What is the present worth of the after tax cash flow if MARR =15%? Ans. $xxxx

What is the present worth of the after tax cash flow if MARR =15%? Ans. $xxxx

Solution

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

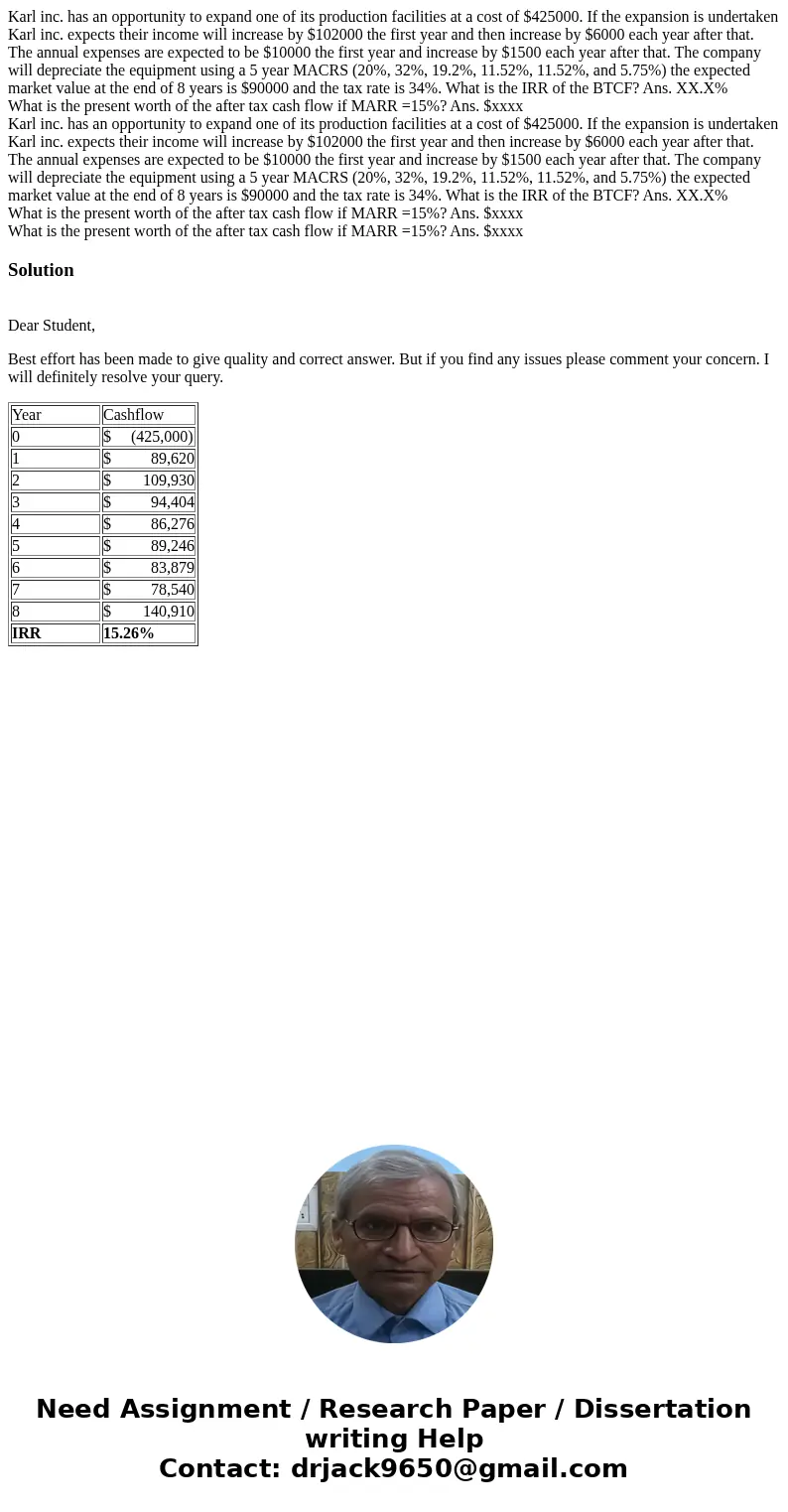

| Year | Cashflow |

| 0 | $ (425,000) |

| 1 | $ 89,620 |

| 2 | $ 109,930 |

| 3 | $ 94,404 |

| 4 | $ 86,276 |

| 5 | $ 89,246 |

| 6 | $ 83,879 |

| 7 | $ 78,540 |

| 8 | $ 140,910 |

| IRR | 15.26% |

Homework Sourse

Homework Sourse