Question 6 20 Points On April 1 2018 ABC purchased an existi

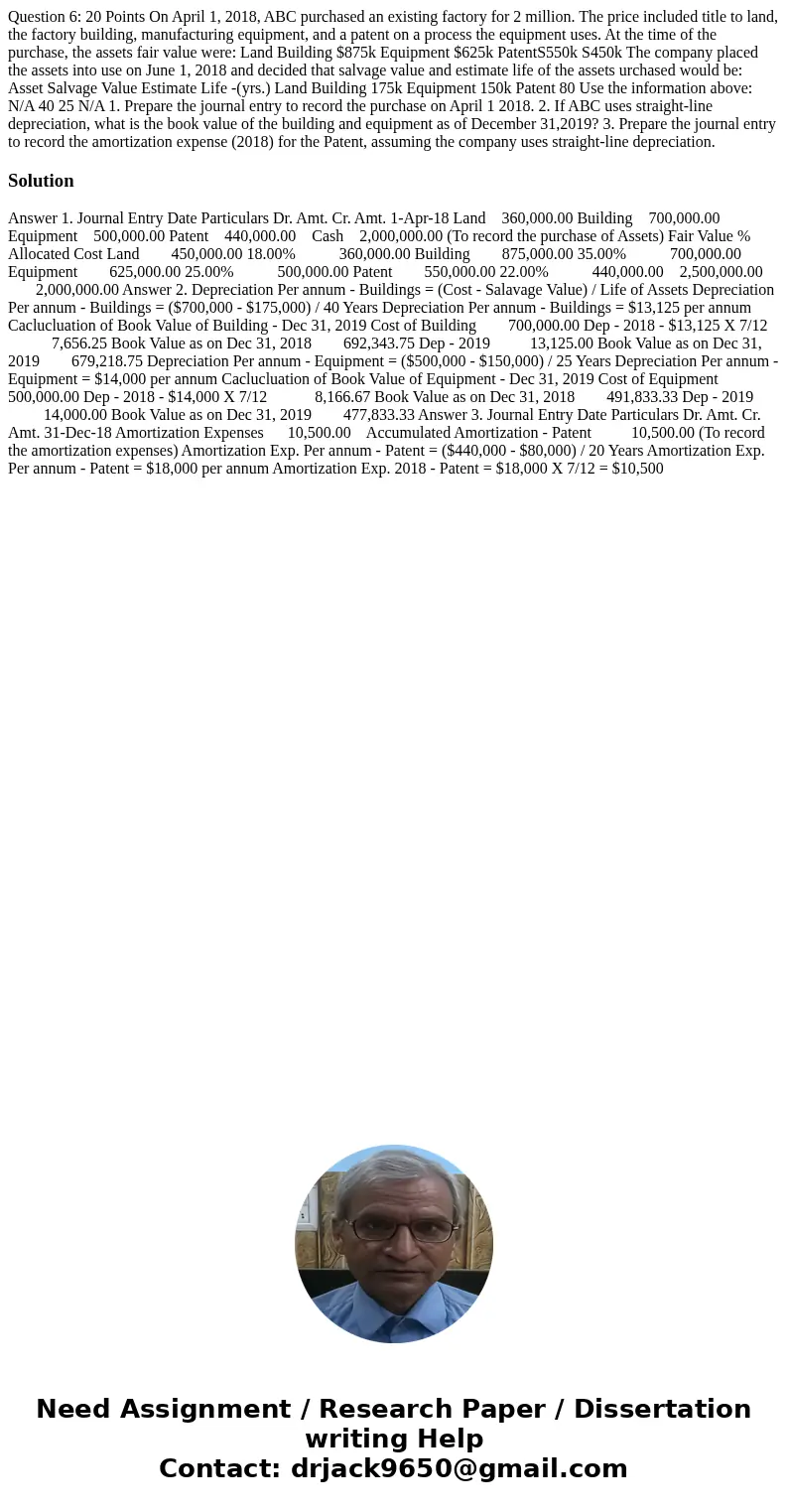

Question 6: 20 Points On April 1, 2018, ABC purchased an existing factory for 2 million. The price included title to land, the factory building, manufacturing equipment, and a patent on a process the equipment uses. At the time of the purchase, the assets fair value were: Land Building $875k Equipment $625k PatentS550k S450k The company placed the assets into use on June 1, 2018 and decided that salvage value and estimate life of the assets urchased would be: Asset Salvage Value Estimate Life -(yrs.) Land Building 175k Equipment 150k Patent 80 Use the information above: N/A 40 25 N/A 1. Prepare the journal entry to record the purchase on April 1 2018. 2. If ABC uses straight-line depreciation, what is the book value of the building and equipment as of December 31,2019? 3. Prepare the journal entry to record the amortization expense (2018) for the Patent, assuming the company uses straight-line depreciation.

Solution

Answer 1. Journal Entry Date Particulars Dr. Amt. Cr. Amt. 1-Apr-18 Land 360,000.00 Building 700,000.00 Equipment 500,000.00 Patent 440,000.00 Cash 2,000,000.00 (To record the purchase of Assets) Fair Value % Allocated Cost Land 450,000.00 18.00% 360,000.00 Building 875,000.00 35.00% 700,000.00 Equipment 625,000.00 25.00% 500,000.00 Patent 550,000.00 22.00% 440,000.00 2,500,000.00 2,000,000.00 Answer 2. Depreciation Per annum - Buildings = (Cost - Salavage Value) / Life of Assets Depreciation Per annum - Buildings = ($700,000 - $175,000) / 40 Years Depreciation Per annum - Buildings = $13,125 per annum Caclucluation of Book Value of Building - Dec 31, 2019 Cost of Building 700,000.00 Dep - 2018 - $13,125 X 7/12 7,656.25 Book Value as on Dec 31, 2018 692,343.75 Dep - 2019 13,125.00 Book Value as on Dec 31, 2019 679,218.75 Depreciation Per annum - Equipment = ($500,000 - $150,000) / 25 Years Depreciation Per annum - Equipment = $14,000 per annum Caclucluation of Book Value of Equipment - Dec 31, 2019 Cost of Equipment 500,000.00 Dep - 2018 - $14,000 X 7/12 8,166.67 Book Value as on Dec 31, 2018 491,833.33 Dep - 2019 14,000.00 Book Value as on Dec 31, 2019 477,833.33 Answer 3. Journal Entry Date Particulars Dr. Amt. Cr. Amt. 31-Dec-18 Amortization Expenses 10,500.00 Accumulated Amortization - Patent 10,500.00 (To record the amortization expenses) Amortization Exp. Per annum - Patent = ($440,000 - $80,000) / 20 Years Amortization Exp. Per annum - Patent = $18,000 per annum Amortization Exp. 2018 - Patent = $18,000 X 7/12 = $10,500

Homework Sourse

Homework Sourse