Exercise 9-5 (Part Level Submission)

Jan. 31

Feb. 28

Mar. 31

Apr. 30

(a)

February

March

April

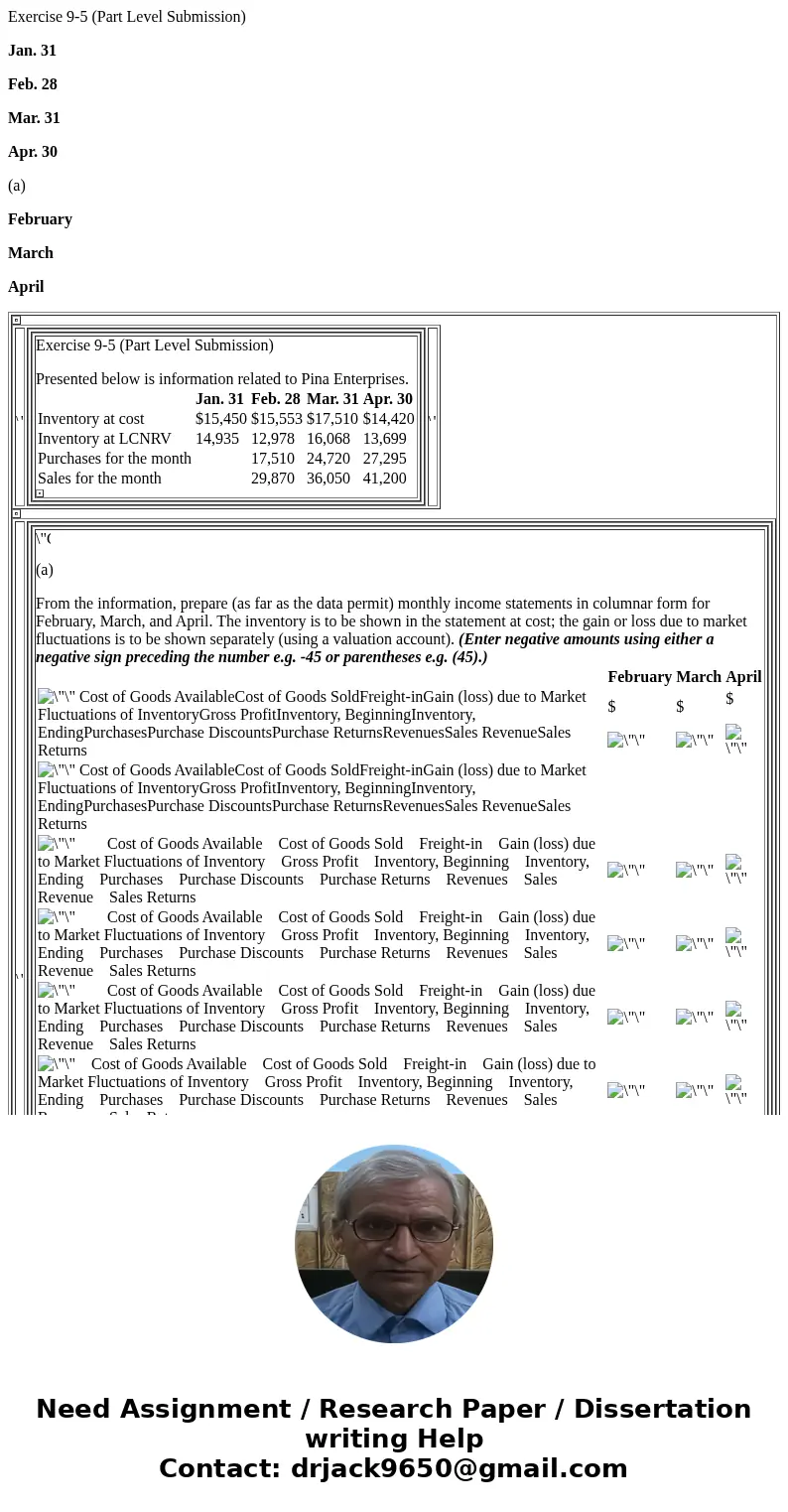

| | Exercise 9-5 (Part Level Submission) Presented below is information related to Pina Enterprises.

| | Jan. 31 | | Feb. 28 | | Mar. 31 | | Apr. 30 | | Inventory at cost | | $15,450 | | $15,553 | | $17,510 | | $14,420 | | Inventory at LCNRV | | 14,935 | | 12,978 | | 16,068 | | 13,699 | | Purchases for the month | | | | 17,510 | | 24,720 | | 27,295 | | Sales for the month | | | | 29,870 | | 36,050 | | 41,200 | | | |  |  |  | |

(a) From the information, prepare (as far as the data permit) monthly income statements in columnar form for February, March, and April. The inventory is to be shown in the statement at cost; the gain or loss due to market fluctuations is to be shown separately (using a valuation account). (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

| | February | | March | | April | |  Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns

| | $

| | $

| | $

| |  Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns

| | | | | | | |  Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns

| |

| |

| |

| |  Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns

| |

| |

| |

| |  Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns

| |

| |

| |

| |  Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns

| |

| |

| |

| |  Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns Cost of Goods Available Cost of Goods Sold Freight-in Gain (loss) due to Market Fluctuations of Inventory Gross Profit Inventory, Beginning Inventory, Ending Purchases Purchase Discounts Purchase Returns Revenues Sales Revenue Sales Returns

| |

| |

| |

| |  Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns

| |

| |

| |

| |  Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns Cost of Goods AvailableCost of Goods SoldFreight-inGain (loss) due to Market Fluctuations of InventoryGross ProfitInventory, BeginningInventory, EndingPurchasesPurchase DiscountsPurchase ReturnsRevenuesSales RevenueSales Returns

| |

| |

| |

| | | $

| | $

| | $

| | | | |

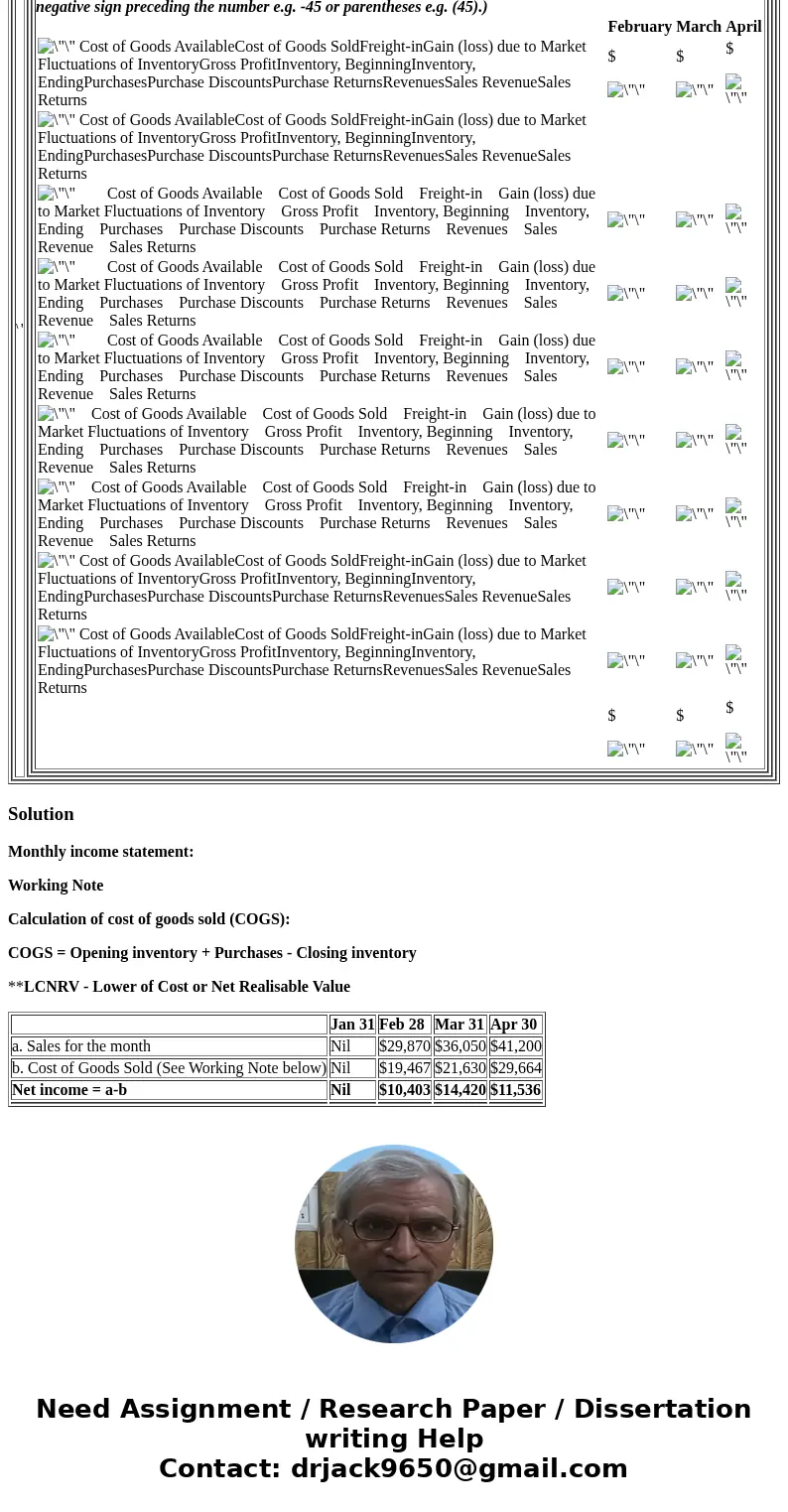

Monthly income statement:

Working Note

Calculation of cost of goods sold (COGS):

COGS = Opening inventory + Purchases - Closing inventory

**LCNRV - Lower of Cost or Net Realisable Value

| Jan 31 | Feb 28 | Mar 31 | Apr 30 |

| a. Sales for the month | Nil | $29,870 | $36,050 | $41,200 |

| b. Cost of Goods Sold (See Working Note below) | Nil | $19,467 | $21,630 | $29,664 |

| Net income = a-b | Nil | $10,403 | $14,420 | $11,536 |

| | | | |

Homework Sourse

Homework Sourse