33 During Year 1 JR Company completed the transactions liste

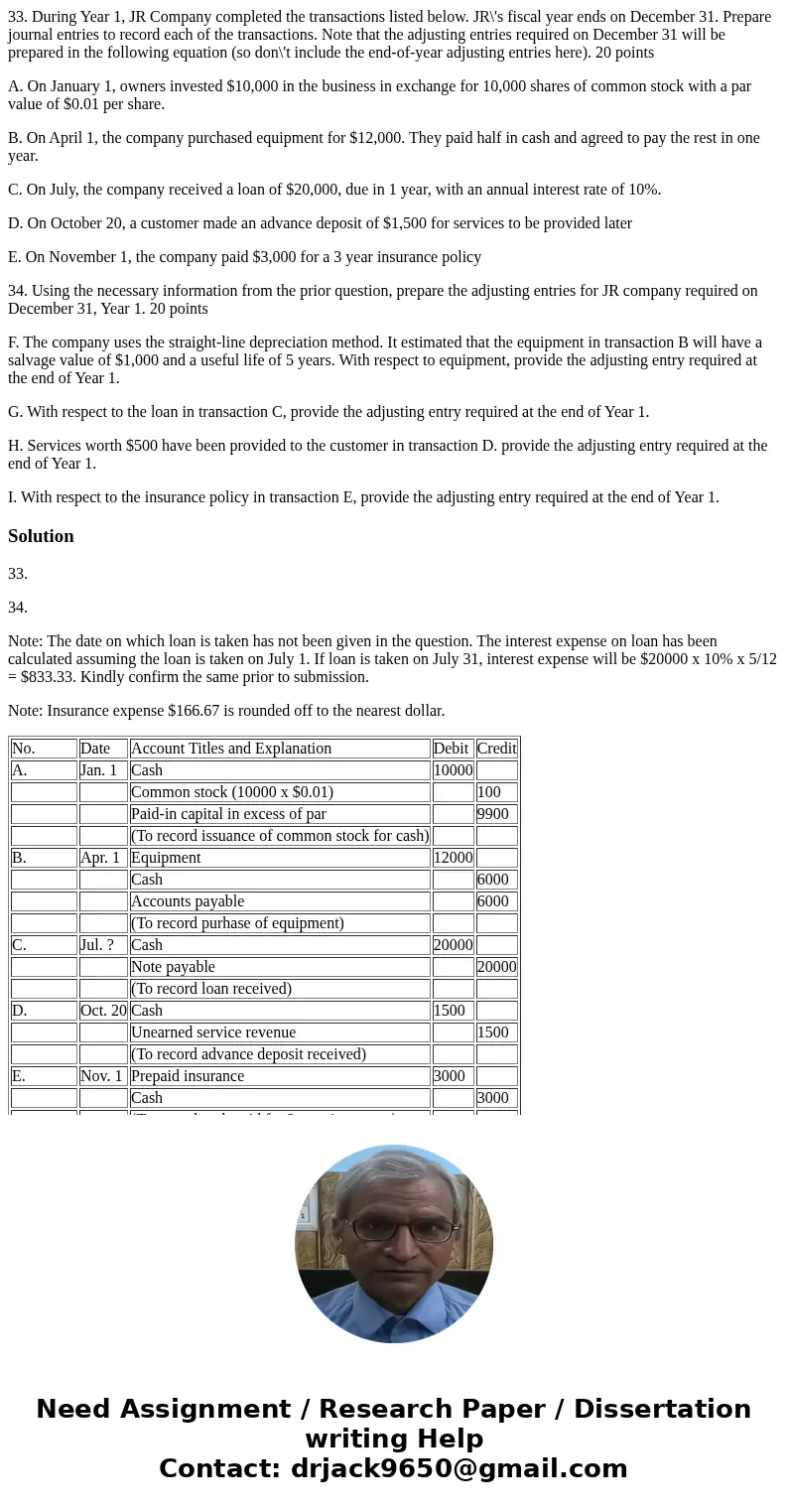

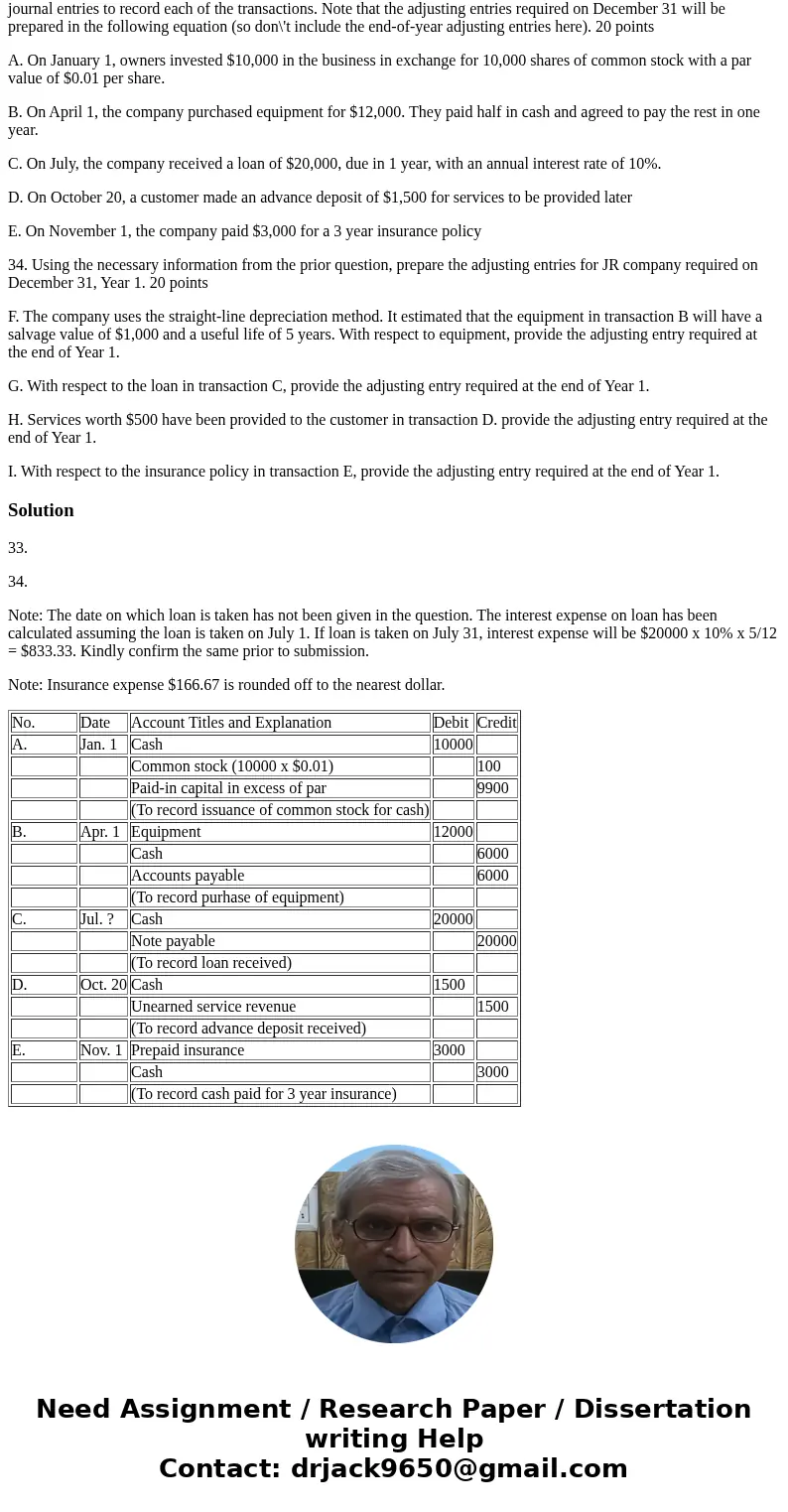

33. During Year 1, JR Company completed the transactions listed below. JR\'s fiscal year ends on December 31. Prepare journal entries to record each of the transactions. Note that the adjusting entries required on December 31 will be prepared in the following equation (so don\'t include the end-of-year adjusting entries here). 20 points

A. On January 1, owners invested $10,000 in the business in exchange for 10,000 shares of common stock with a par value of $0.01 per share.

B. On April 1, the company purchased equipment for $12,000. They paid half in cash and agreed to pay the rest in one year.

C. On July, the company received a loan of $20,000, due in 1 year, with an annual interest rate of 10%.

D. On October 20, a customer made an advance deposit of $1,500 for services to be provided later

E. On November 1, the company paid $3,000 for a 3 year insurance policy

34. Using the necessary information from the prior question, prepare the adjusting entries for JR company required on December 31, Year 1. 20 points

F. The company uses the straight-line depreciation method. It estimated that the equipment in transaction B will have a salvage value of $1,000 and a useful life of 5 years. With respect to equipment, provide the adjusting entry required at the end of Year 1.

G. With respect to the loan in transaction C, provide the adjusting entry required at the end of Year 1.

H. Services worth $500 have been provided to the customer in transaction D. provide the adjusting entry required at the end of Year 1.

I. With respect to the insurance policy in transaction E, provide the adjusting entry required at the end of Year 1.

Solution

33.

34.

Note: The date on which loan is taken has not been given in the question. The interest expense on loan has been calculated assuming the loan is taken on July 1. If loan is taken on July 31, interest expense will be $20000 x 10% x 5/12 = $833.33. Kindly confirm the same prior to submission.

Note: Insurance expense $166.67 is rounded off to the nearest dollar.

| No. | Date | Account Titles and Explanation | Debit | Credit |

| A. | Jan. 1 | Cash | 10000 | |

| Common stock (10000 x $0.01) | 100 | |||

| Paid-in capital in excess of par | 9900 | |||

| (To record issuance of common stock for cash) | ||||

| B. | Apr. 1 | Equipment | 12000 | |

| Cash | 6000 | |||

| Accounts payable | 6000 | |||

| (To record purhase of equipment) | ||||

| C. | Jul. ? | Cash | 20000 | |

| Note payable | 20000 | |||

| (To record loan received) | ||||

| D. | Oct. 20 | Cash | 1500 | |

| Unearned service revenue | 1500 | |||

| (To record advance deposit received) | ||||

| E. | Nov. 1 | Prepaid insurance | 3000 | |

| Cash | 3000 | |||

| (To record cash paid for 3 year insurance) |

Homework Sourse

Homework Sourse