Goodwin Company has three segments 1 2 and 3 Data regarding

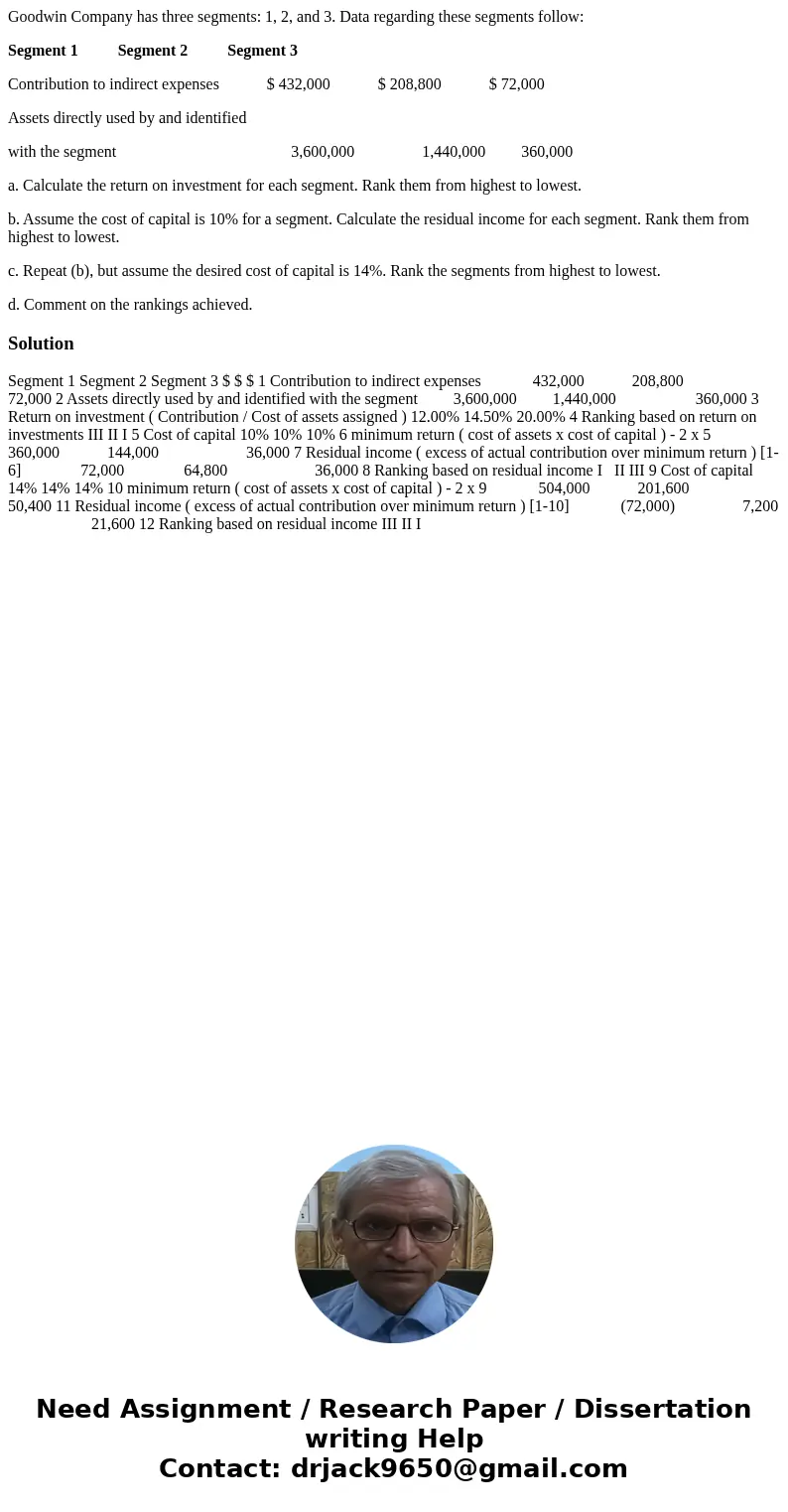

Goodwin Company has three segments: 1, 2, and 3. Data regarding these segments follow:

Segment 1 Segment 2 Segment 3

Contribution to indirect expenses $ 432,000 $ 208,800 $ 72,000

Assets directly used by and identified

with the segment 3,600,000 1,440,000 360,000

a. Calculate the return on investment for each segment. Rank them from highest to lowest.

b. Assume the cost of capital is 10% for a segment. Calculate the residual income for each segment. Rank them from highest to lowest.

c. Repeat (b), but assume the desired cost of capital is 14%. Rank the segments from highest to lowest.

d. Comment on the rankings achieved.

Solution

Segment 1 Segment 2 Segment 3 $ $ $ 1 Contribution to indirect expenses 432,000 208,800 72,000 2 Assets directly used by and identified with the segment 3,600,000 1,440,000 360,000 3 Return on investment ( Contribution / Cost of assets assigned ) 12.00% 14.50% 20.00% 4 Ranking based on return on investments III II I 5 Cost of capital 10% 10% 10% 6 minimum return ( cost of assets x cost of capital ) - 2 x 5 360,000 144,000 36,000 7 Residual income ( excess of actual contribution over minimum return ) [1-6] 72,000 64,800 36,000 8 Ranking based on residual income I II III 9 Cost of capital 14% 14% 14% 10 minimum return ( cost of assets x cost of capital ) - 2 x 9 504,000 201,600 50,400 11 Residual income ( excess of actual contribution over minimum return ) [1-10] (72,000) 7,200 21,600 12 Ranking based on residual income III II I

Homework Sourse

Homework Sourse