You have observed the following returns over time A What are

You have observed the following returns over time:

A.) What are the required rates of return on stocks X and Y

B.) What is the required rate of return on a portfolio consisting of 80% of stock X and 20% of stock Y -If stock X\'s expected return is 22%, is stock X under or overvalued?

**Please show work in excel with formulas, I need to make a functioning workbook. Thanks!**

| Year | Stock X | Stock Y | Market |

| 2009 | 14 % | 13% | 12% |

| 2010 | 19 | 7 | 10 |

| 2011 | -16 | -5 | -12 |

| 2012 | 3 | 1 | 1 |

| 2013 | 20 | 11 | 15 |

Solution

For Excel Formulas, see the link:

http://www.investopedia.com/articles/financial-theory/09/calculating-beta.asp

We need to calculate the beta for stock X and Y.

We need an assumption for risk free rate of return. I am assuming it to be 3%. Note, that the answers would depend a lot on this assumption.

So,

according to CAPM equation,

Required rate of return on stock X = 3 + 1.35 ( 5.2 - 3) = 5.9 %

Required rate of return on stock Y = 3 + 0.65 ( 5.2 - 3) = 4.4 %

Portfolio beta = 0.8 (1.35) + 0.2(0.65)

= 1.21

Thus, required rate of return on the portfolio

= 3 + 1.21 ( 5.2 - 3)

= 5.66%

b)

If the expected return of X = 22%, then the stock is highly undervalued as it lies above the Security market line.

Hope this helps. Ask if you have doubts.

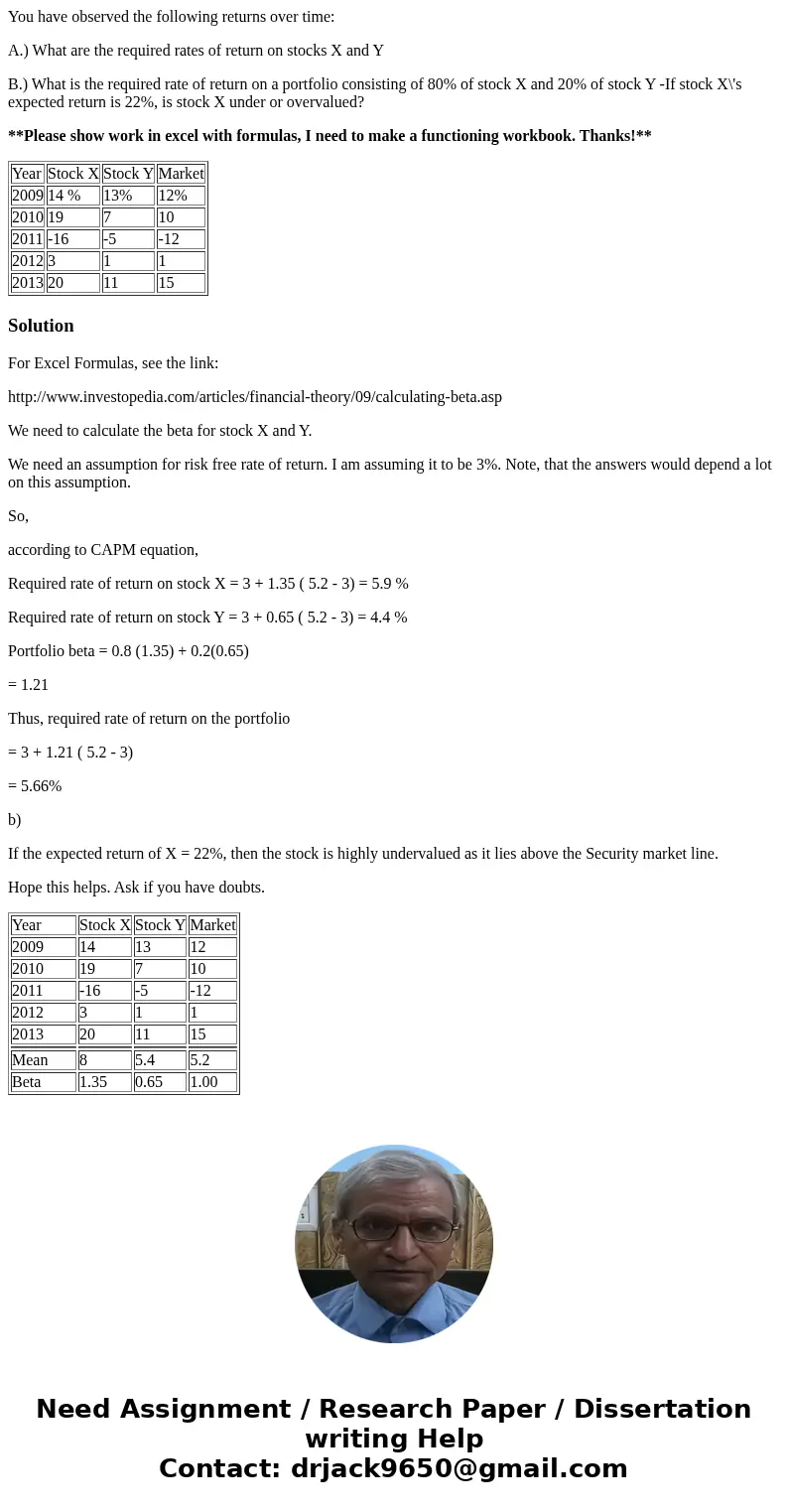

| Year | Stock X | Stock Y | Market |

| 2009 | 14 | 13 | 12 |

| 2010 | 19 | 7 | 10 |

| 2011 | -16 | -5 | -12 |

| 2012 | 3 | 1 | 1 |

| 2013 | 20 | 11 | 15 |

| Mean | 8 | 5.4 | 5.2 |

| Beta | 1.35 | 0.65 | 1.00 |

Homework Sourse

Homework Sourse