uses the method to account for uncollectible receivables At

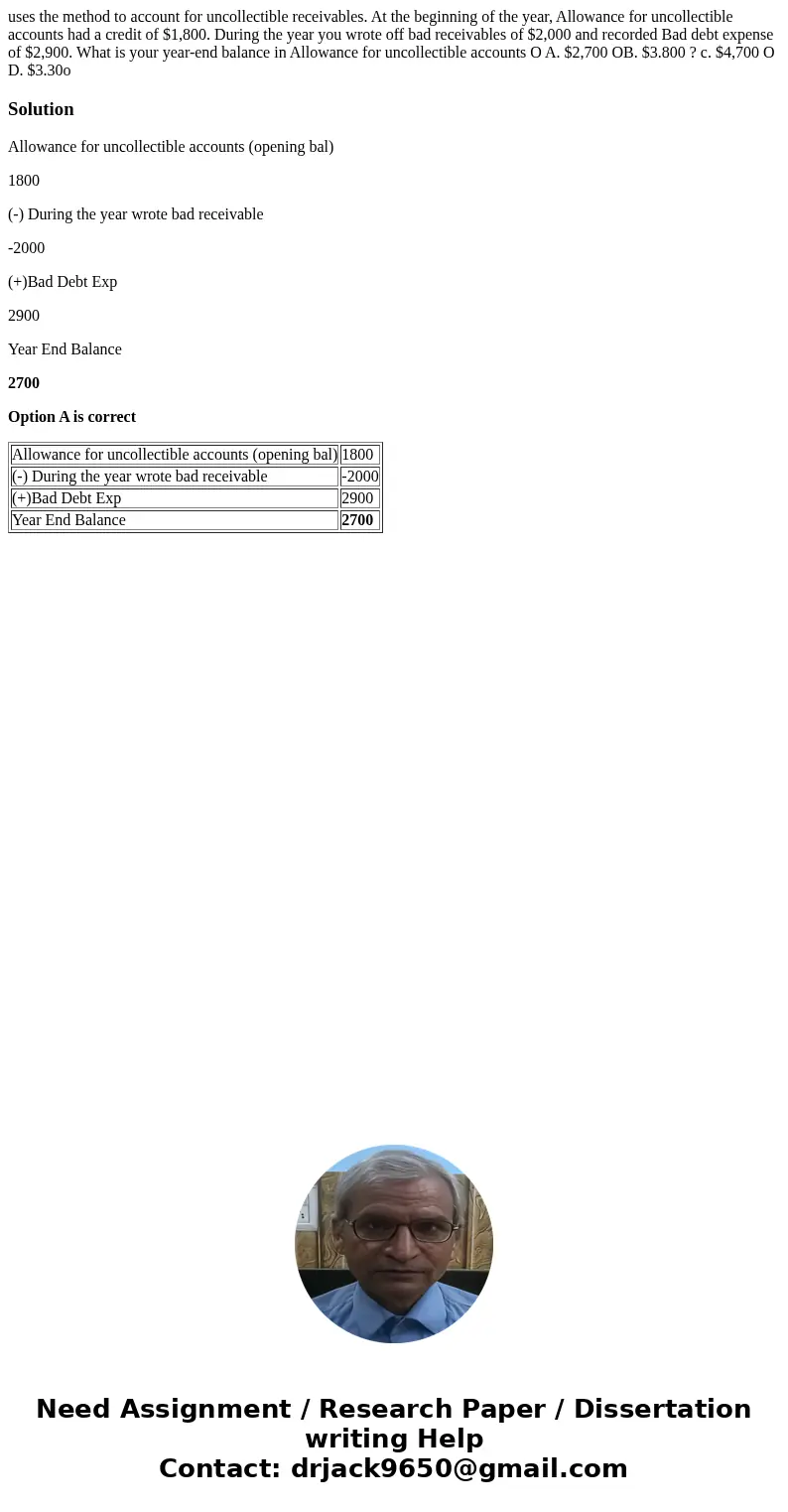

uses the method to account for uncollectible receivables. At the beginning of the year, Allowance for uncollectible accounts had a credit of $1,800. During the year you wrote off bad receivables of $2,000 and recorded Bad debt expense of $2,900. What is your year-end balance in Allowance for uncollectible accounts O A. $2,700 OB. $3.800 ? c. $4,700 O D. $3.30o

Solution

Allowance for uncollectible accounts (opening bal)

1800

(-) During the year wrote bad receivable

-2000

(+)Bad Debt Exp

2900

Year End Balance

2700

Option A is correct

| Allowance for uncollectible accounts (opening bal) | 1800 |

| (-) During the year wrote bad receivable | -2000 |

| (+)Bad Debt Exp | 2900 |

| Year End Balance | 2700 |

Homework Sourse

Homework Sourse