The accounting department of your company has just delivered

The accounting department of your company has just delivered a draft of the current year\'s financial statements to you. The summary is as follows: of the Year of the Year otal Assets otal Liabilities Total 550,000 210,000 340,000 201,000 40,000 7.700 21,000 t Income for the Year Shares Out 21,000 You discovered that they have not adjusted for estimated bad debt expenses of $8,700. For each of the following ratios, calculate: 1. The ratio that would have resulted had the error not been discovered i.e. the incorrect ratio). 2. The correct ratio. Correct 2 ROA 3 ROE 4 Debt Ratio 5 EPS 10

Solution

* Journal entry for recording estimated bad debt expense:

Journal entry -1

Debit Credit

Bad debt expense a/c $8,700

To Accounts receivable a/c $8,700

(Being bad debt recognised)

Journal entry -2

Profit or Loss a/c $8,700

To Bad debt expense $8,700

(Being bad debt expense transfered to P&L a/c)

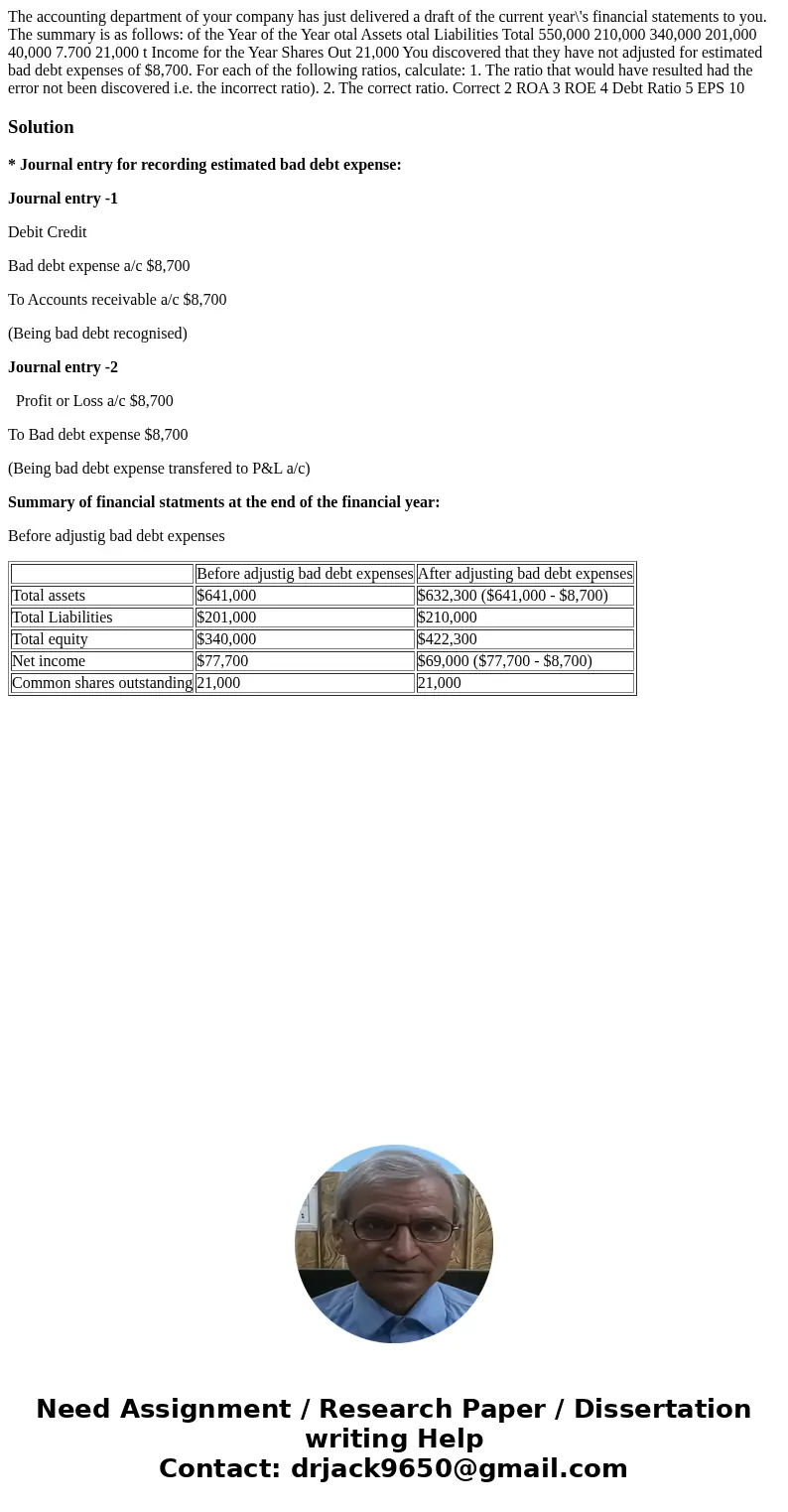

Summary of financial statments at the end of the financial year:

Before adjustig bad debt expenses

| Before adjustig bad debt expenses | After adjusting bad debt expenses | |

| Total assets | $641,000 | $632,300 ($641,000 - $8,700) |

| Total Liabilities | $201,000 | $210,000 |

| Total equity | $340,000 | $422,300 |

| Net income | $77,700 | $69,000 ($77,700 - $8,700) |

| Common shares outstanding | 21,000 | 21,000 |

Homework Sourse

Homework Sourse