Firefox File Edit View History Bookmarks Tools Window Help 7

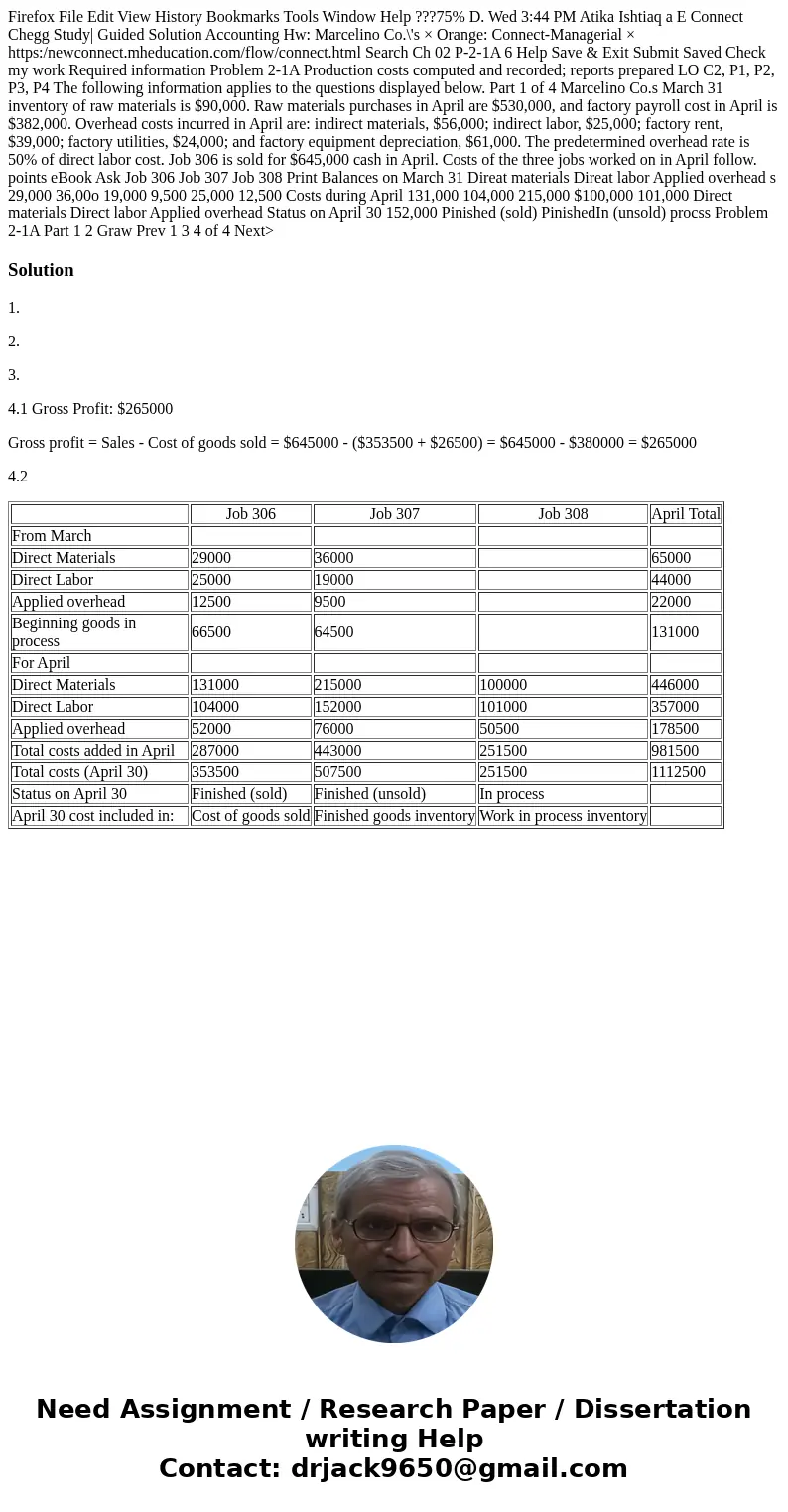

Firefox File Edit View History Bookmarks Tools Window Help ???75% D. Wed 3:44 PM Atika Ishtiaq a E Connect Chegg Study| Guided Solution Accounting Hw: Marcelino Co.\'s × Orange: Connect-Managerial × https:/newconnect.mheducation.com/flow/connect.html Search Ch 02 P-2-1A 6 Help Save & Exit Submit Saved Check my work Required information Problem 2-1A Production costs computed and recorded; reports prepared LO C2, P1, P2, P3, P4 The following information applies to the questions displayed below. Part 1 of 4 Marcelino Co.s March 31 inventory of raw materials is $90,000. Raw materials purchases in April are $530,000, and factory payroll cost in April is $382,000. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $25,000; factory rent, $39,000; factory utilities, $24,000; and factory equipment depreciation, $61,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $645,000 cash in April. Costs of the three jobs worked on in April follow. points eBook Ask Job 306 Job 307 Job 308 Print Balances on March 31 Direat materials Direat labor Applied overhead s 29,000 36,00o 19,000 9,500 25,000 12,500 Costs during April 131,000 104,000 215,000 $100,000 101,000 Direct materials Direct labor Applied overhead Status on April 30 152,000 Pinished (sold) PinishedIn (unsold) procss Problem 2-1A Part 1 2 Graw Prev 1 3 4 of 4 Next>

Solution

1.

2.

3.

4.1 Gross Profit: $265000

Gross profit = Sales - Cost of goods sold = $645000 - ($353500 + $26500) = $645000 - $380000 = $265000

4.2

| Job 306 | Job 307 | Job 308 | April Total | |

| From March | ||||

| Direct Materials | 29000 | 36000 | 65000 | |

| Direct Labor | 25000 | 19000 | 44000 | |

| Applied overhead | 12500 | 9500 | 22000 | |

| Beginning goods in process | 66500 | 64500 | 131000 | |

| For April | ||||

| Direct Materials | 131000 | 215000 | 100000 | 446000 |

| Direct Labor | 104000 | 152000 | 101000 | 357000 |

| Applied overhead | 52000 | 76000 | 50500 | 178500 |

| Total costs added in April | 287000 | 443000 | 251500 | 981500 |

| Total costs (April 30) | 353500 | 507500 | 251500 | 1112500 |

| Status on April 30 | Finished (sold) | Finished (unsold) | In process | |

| April 30 cost included in: | Cost of goods sold | Finished goods inventory | Work in process inventory |

Homework Sourse

Homework Sourse