Record the following transactions in the journal of TLC Comp

Solution

12% Note a/c

To Account payable a/c

$6,000

$6,000

Accrued interest a/c

To Interst on 12% note a/c

[$6,000 x 12% x (13 days ÷ 360)]

$26

Cash a/c

To 12% notes a/c

To Accrued interest a/c

$6,120

$6,000

$120

11% note a/c

To cash a/c

$9,000

$9,000

14% note a/c

To Accounts receivable a/c

$1,000

$1,000

Cash a/c

To 11% note a/c

To Accrued interest a/c

[$9,000 x 11% x (6 months ÷ 12]

$9,495

$9,000

$495

Accrued interest a/c

To Interest on 14% note a/c

[$1,000 x 14% x 62 days ÷ 360)]

$24

$24

Hope this is useful and thank you!!!!!!

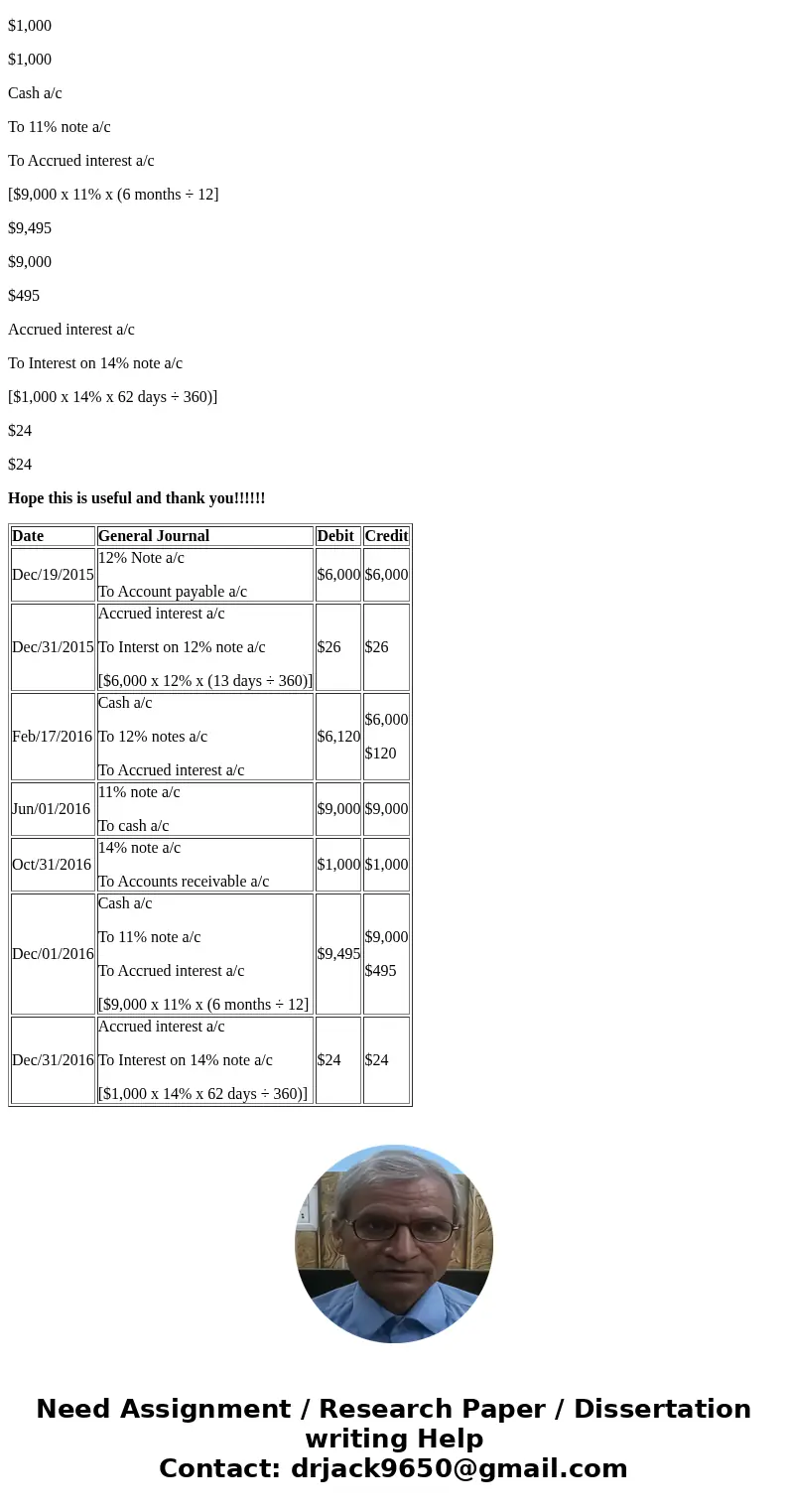

| Date | General Journal | Debit | Credit |

| Dec/19/2015 | 12% Note a/c To Account payable a/c | $6,000 | $6,000 |

| Dec/31/2015 | Accrued interest a/c To Interst on 12% note a/c [$6,000 x 12% x (13 days ÷ 360)] | $26 | $26 |

| Feb/17/2016 | Cash a/c To 12% notes a/c To Accrued interest a/c | $6,120 | $6,000 $120 |

| Jun/01/2016 | 11% note a/c To cash a/c | $9,000 | $9,000 |

| Oct/31/2016 | 14% note a/c To Accounts receivable a/c | $1,000 | $1,000 |

| Dec/01/2016 | Cash a/c To 11% note a/c To Accrued interest a/c [$9,000 x 11% x (6 months ÷ 12] | $9,495 | $9,000 $495 |

| Dec/31/2016 | Accrued interest a/c To Interest on 14% note a/c [$1,000 x 14% x 62 days ÷ 360)] | $24 | $24 |

Homework Sourse

Homework Sourse