On January 1 2018 Allgood Company purchased equipment and si

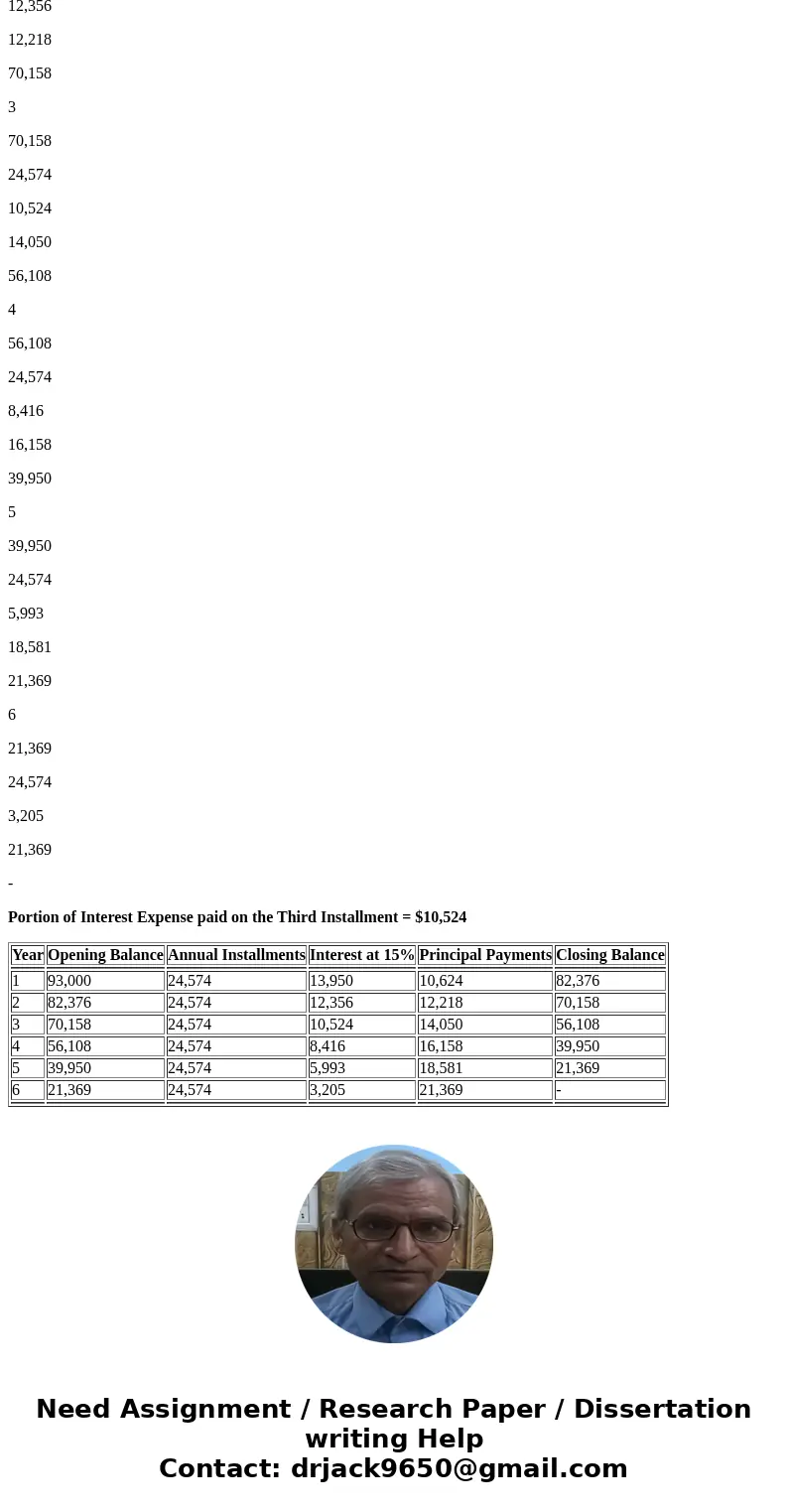

On January 1, 2018, Allgood Company purchased equipment and signed a six-year mortgage note for S93000 at 15% The note will be paid in equal annual installments of $24,574, beginning January 1, 2019. Calculate the portion of interest expense paid on the third installment. (Round your answer to the nearest whole number.) O A. $10,524 O B. $82,376 ??. $24.574 O D. $13,950

Solution

The Answer is “A. $10,524”

Year

Opening Balance

Annual Installments

Interest at 15%

Principal Payments

Closing Balance

1

93,000

24,574

13,950

10,624

82,376

2

82,376

24,574

12,356

12,218

70,158

3

70,158

24,574

10,524

14,050

56,108

4

56,108

24,574

8,416

16,158

39,950

5

39,950

24,574

5,993

18,581

21,369

6

21,369

24,574

3,205

21,369

-

Portion of Interest Expense paid on the Third Installment = $10,524

| Year | Opening Balance | Annual Installments | Interest at 15% | Principal Payments | Closing Balance |

| 1 | 93,000 | 24,574 | 13,950 | 10,624 | 82,376 |

| 2 | 82,376 | 24,574 | 12,356 | 12,218 | 70,158 |

| 3 | 70,158 | 24,574 | 10,524 | 14,050 | 56,108 |

| 4 | 56,108 | 24,574 | 8,416 | 16,158 | 39,950 |

| 5 | 39,950 | 24,574 | 5,993 | 18,581 | 21,369 |

| 6 | 21,369 | 24,574 | 3,205 | 21,369 | - |

Homework Sourse

Homework Sourse