Whitman Company has just completed its first year of operati

Whitman Company has just completed its first year of operations. The company\'s absorption costing income statement for the year follows Whitman Company Income Statement Sales (41,000 units x $40.10 per unit) Cost of goods sold (41,000 units x $23 per unit) Gross margin Selling and administrative expenses Net operating income $1,644,100 943,000 701,100 471,500 $ 229,600 The company\'s selling and administrative expenses consist of $307,500 per year in fixed expenses and $4 per unit sold in variable expenses. The $23 unit product cost given above is computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($282,000 47,000 units) Absorption costing unit product cost $ 11 23 Required 1. Redo the company\'s income statement in the contribution format using variable costing 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above

Solution

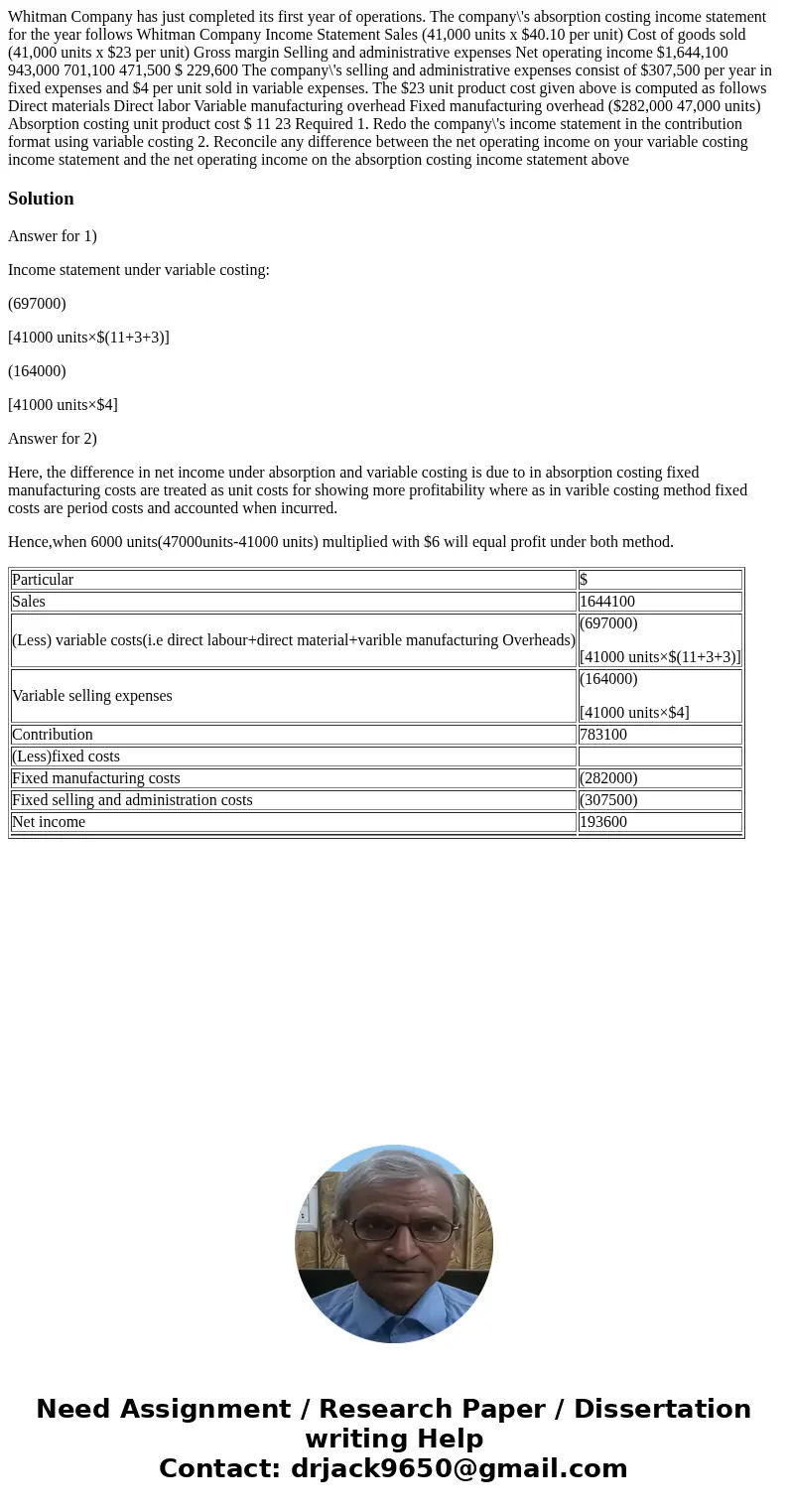

Answer for 1)

Income statement under variable costing:

(697000)

[41000 units×$(11+3+3)]

(164000)

[41000 units×$4]

Answer for 2)

Here, the difference in net income under absorption and variable costing is due to in absorption costing fixed manufacturing costs are treated as unit costs for showing more profitability where as in varible costing method fixed costs are period costs and accounted when incurred.

Hence,when 6000 units(47000units-41000 units) multiplied with $6 will equal profit under both method.

| Particular | $ |

| Sales | 1644100 |

| (Less) variable costs(i.e direct labour+direct material+varible manufacturing Overheads) | (697000) [41000 units×$(11+3+3)] |

| Variable selling expenses | (164000) [41000 units×$4] |

| Contribution | 783100 |

| (Less)fixed costs | |

| Fixed manufacturing costs | (282000) |

| Fixed selling and administration costs | (307500) |

| Net income | 193600 |

Homework Sourse

Homework Sourse