The vice president of operations of Free Ride Bike Company i

The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows:

The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Sales Cost of goods sold Operating expenses Invested assets Road Bike Division $1,728,000 1,380,000 175,200 1,440,000 Mountain Bike Division $1,760,000 1,400,000 236,800 800,000 Divisional Income Statements I. Prepare condensed divisional income statements for the year ended December 31, 2016, assuming that there were no service department charges Free Ride Bike Company Divisional Income Statement Road Bike DivisionMountain Bike DivisionSolution

Answers

Working

Road Bike Division

Mountain Bike Division

A

Sales

$ 1,728,000.00

$ 1,760,000.00

B

Cost of Goods Sold

$ 1,380,000.00

$ 1,400,000.00

C = A - B

Gross Profit

$ 348,000.00

$ 360,000.00

D

Operating Expense

$ 175,200.00

$ 236,800.00

E = C - D

Net Income

$ 172,800.00

$ 123,200.00

DuPont formula for ROI = Profit Margin x Total Asset Turnover

General Calculation of ROI

Working

Road Bike Division

Mountain Bike Division

A

Net Income

$ 172,800.00

$ 123,200.00

B

Invested Assets

$ 1,440,000.00

$ 800,000.00

C= A/B

Return On Investment

12.00%

15.40%

----DuPont: Profit Margin

Working

Road Bike Division

Mountain Bike Division

A

Net Income

$ 172,800.00

$ 123,200.00

B

Sales

$ 1,728,000.00

$ 1,760,000.00

C= A/B

Profit Margin

10.00%

7.00%

----DuPont: Asset Turnover

Working

Road Bike Division

Mountain Bike Division

A

Sales

$ 1,728,000.00

$ 1,760,000.00

B

Invested Assets

$ 1,440,000.00

$ 800,000.00

C= A/B

Asset Turnover Ratio

1.2

2.2

-----DuPont: Return on Investment [Answer]

Working

Road Bike Division

Mountain Bike Division

A

Profit Margin

10.00%

7.00%

B

Asset Turnover Ratio

1.2

2.2

C = A x B

Return on Investment

12.00%

15.40%

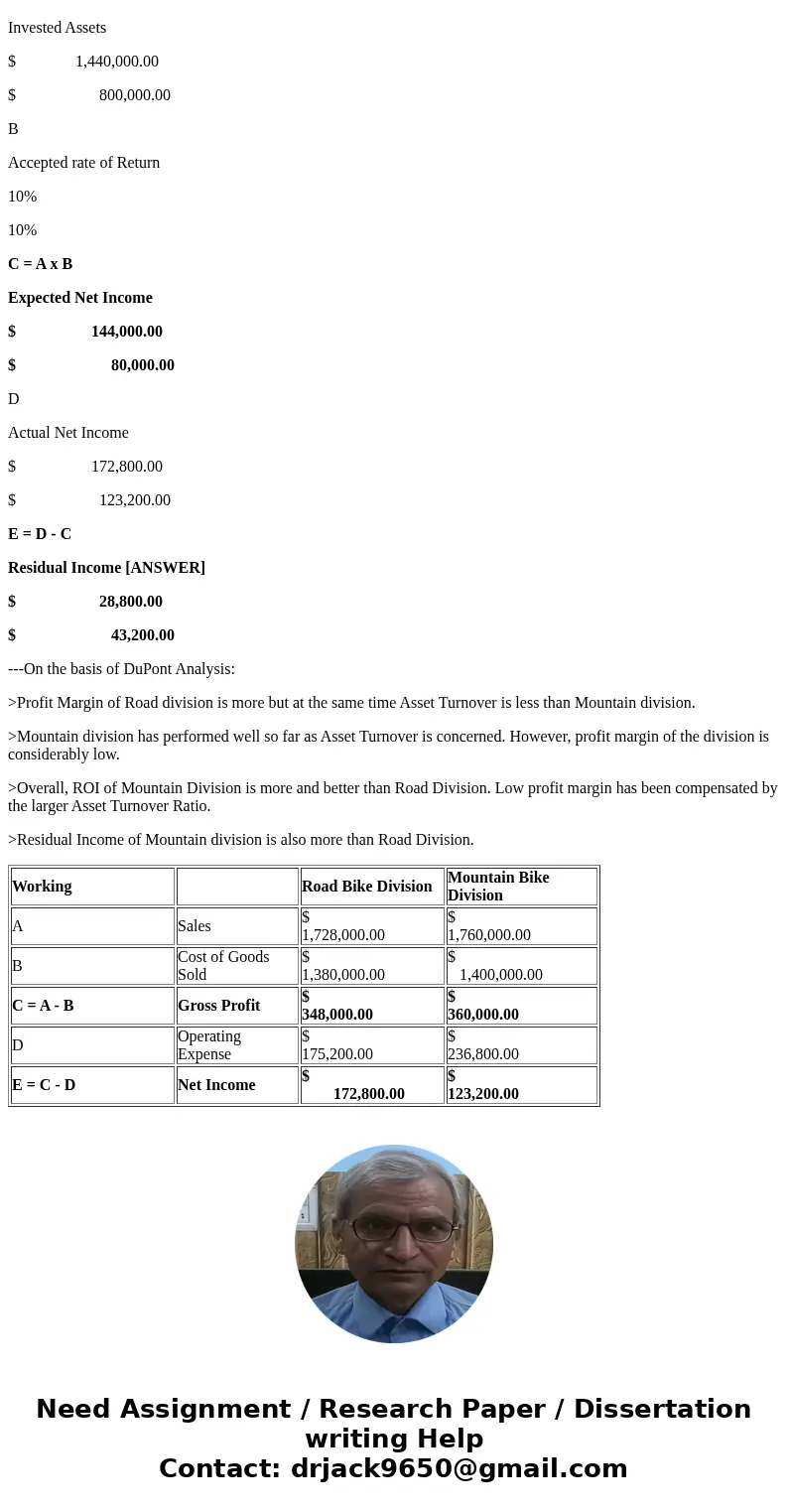

Working

Road Bike Division

Mountain Bike Division

A

Invested Assets

$ 1,440,000.00

$ 800,000.00

B

Accepted rate of Return

10%

10%

C = A x B

Expected Net Income

$ 144,000.00

$ 80,000.00

D

Actual Net Income

$ 172,800.00

$ 123,200.00

E = D - C

Residual Income [ANSWER]

$ 28,800.00

$ 43,200.00

---On the basis of DuPont Analysis:

>Profit Margin of Road division is more but at the same time Asset Turnover is less than Mountain division.

>Mountain division has performed well so far as Asset Turnover is concerned. However, profit margin of the division is considerably low.

>Overall, ROI of Mountain Division is more and better than Road Division. Low profit margin has been compensated by the larger Asset Turnover Ratio.

>Residual Income of Mountain division is also more than Road Division.

| Working | Road Bike Division | Mountain Bike Division | |

| A | Sales | $ 1,728,000.00 | $ 1,760,000.00 |

| B | Cost of Goods Sold | $ 1,380,000.00 | $ 1,400,000.00 |

| C = A - B | Gross Profit | $ 348,000.00 | $ 360,000.00 |

| D | Operating Expense | $ 175,200.00 | $ 236,800.00 |

| E = C - D | Net Income | $ 172,800.00 | $ 123,200.00 |

Homework Sourse

Homework Sourse