Chart of Accounts Current Assets LongTerm Liabilities 27000

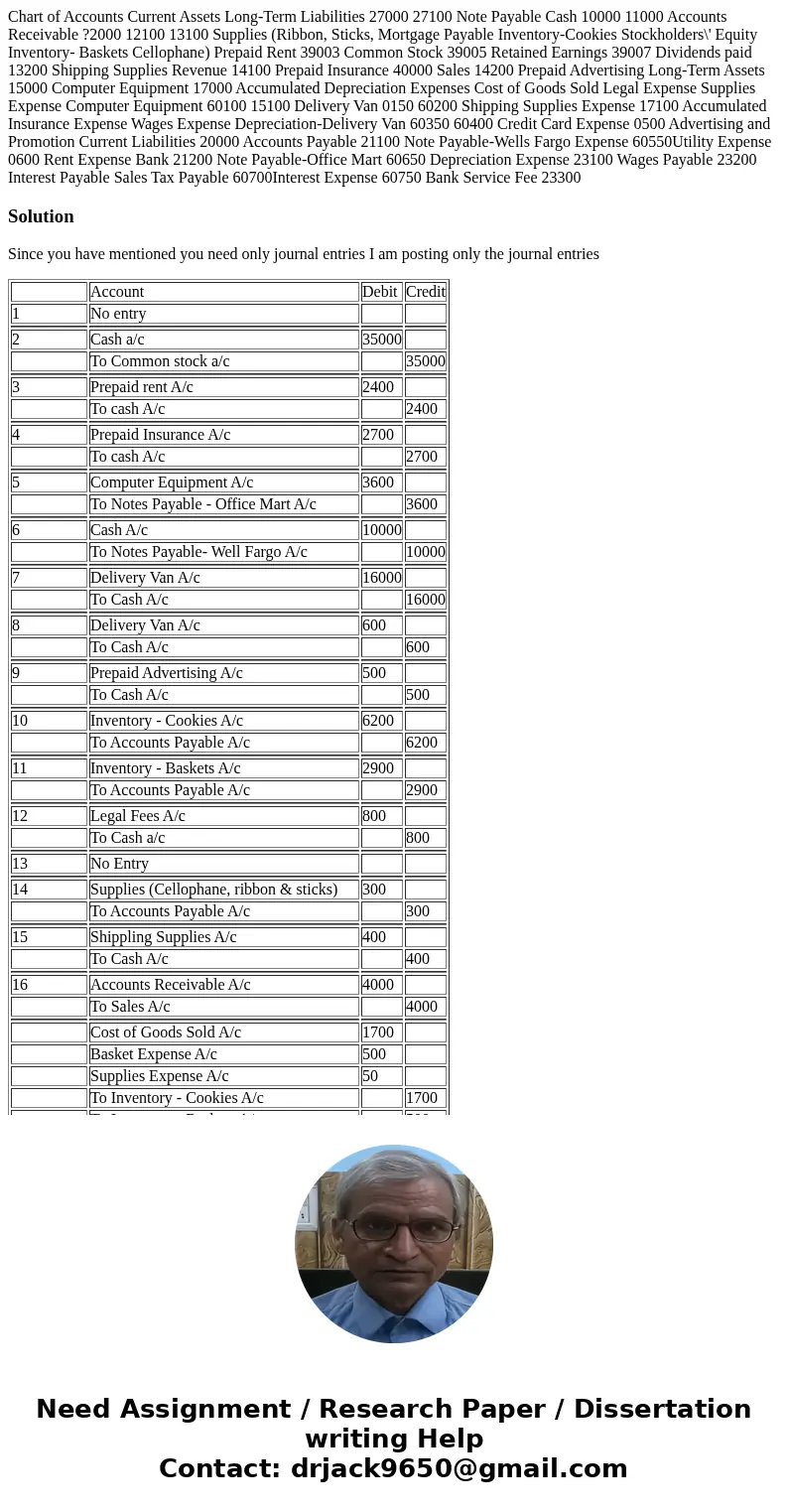

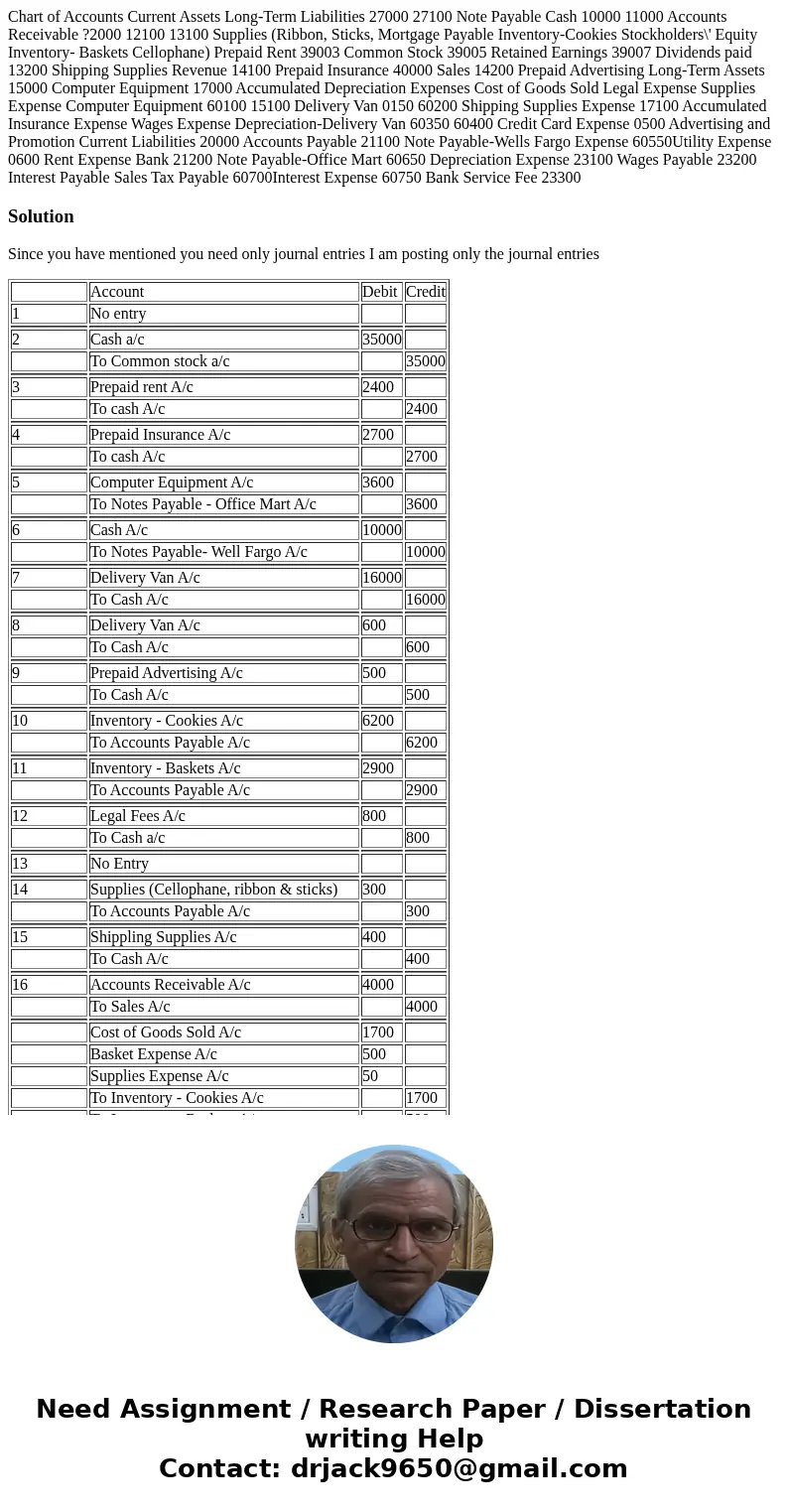

Chart of Accounts Current Assets Long-Term Liabilities 27000 27100 Note Payable Cash 10000 11000 Accounts Receivable ?2000 12100 13100 Supplies (Ribbon, Sticks, Mortgage Payable Inventory-Cookies Stockholders\' Equity Inventory- Baskets Cellophane) Prepaid Rent 39003 Common Stock 39005 Retained Earnings 39007 Dividends paid 13200 Shipping Supplies Revenue 14100 Prepaid Insurance 40000 Sales 14200 Prepaid Advertising Long-Term Assets 15000 Computer Equipment 17000 Accumulated Depreciation Expenses Cost of Goods Sold Legal Expense Supplies Expense Computer Equipment 60100 15100 Delivery Van 0150 60200 Shipping Supplies Expense 17100 Accumulated Insurance Expense Wages Expense Depreciation-Delivery Van 60350 60400 Credit Card Expense 0500 Advertising and Promotion Current Liabilities 20000 Accounts Payable 21100 Note Payable-Wells Fargo Expense 60550Utility Expense 0600 Rent Expense Bank 21200 Note Payable-Office Mart 60650 Depreciation Expense 23100 Wages Payable 23200 Interest Payable Sales Tax Payable 60700Interest Expense 60750 Bank Service Fee 23300

Solution

Since you have mentioned you need only journal entries I am posting only the journal entries

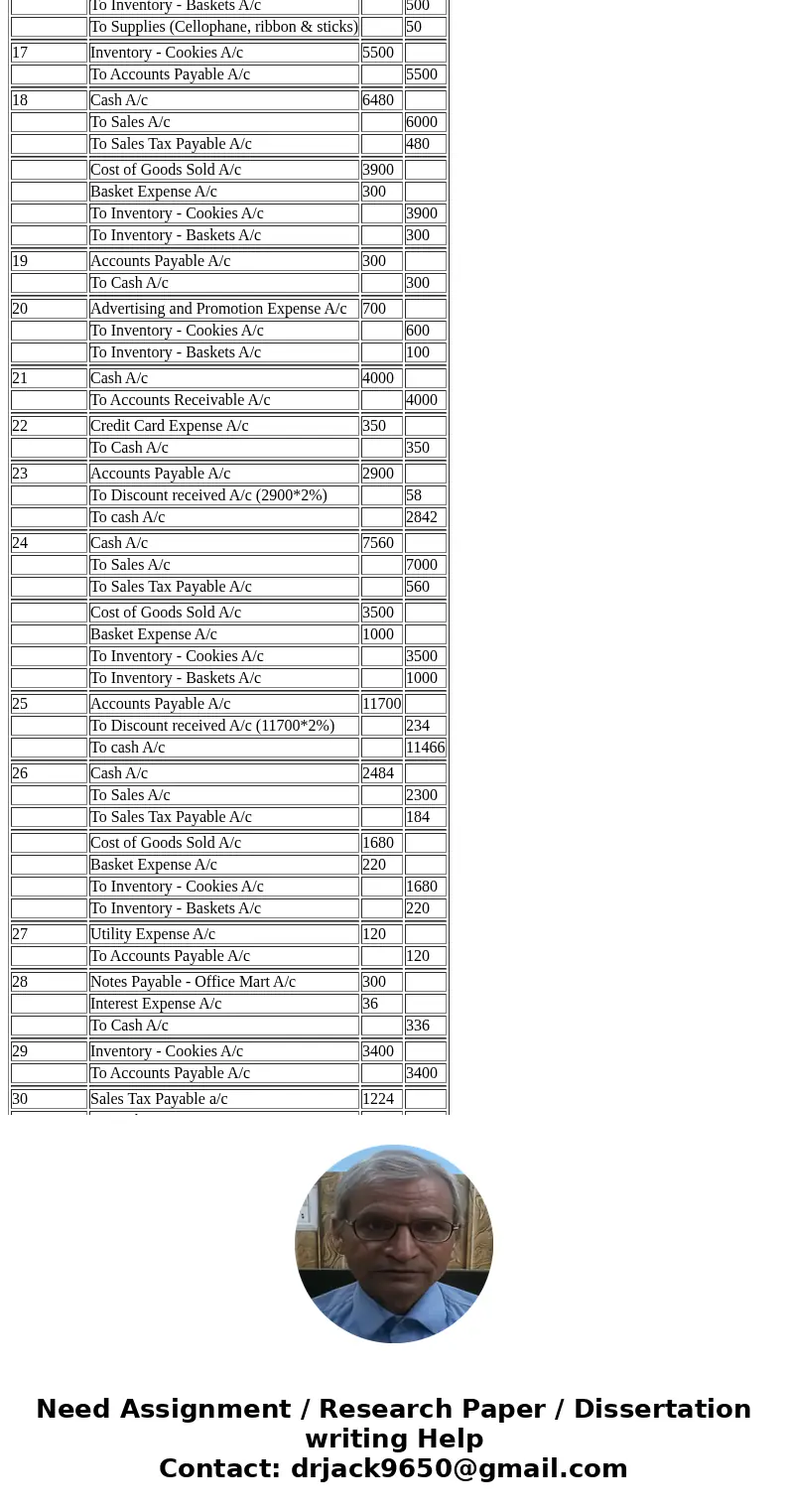

| Account | Debit | Credit | |

| 1 | No entry | ||

| 2 | Cash a/c | 35000 | |

| To Common stock a/c | 35000 | ||

| 3 | Prepaid rent A/c | 2400 | |

| To cash A/c | 2400 | ||

| 4 | Prepaid Insurance A/c | 2700 | |

| To cash A/c | 2700 | ||

| 5 | Computer Equipment A/c | 3600 | |

| To Notes Payable - Office Mart A/c | 3600 | ||

| 6 | Cash A/c | 10000 | |

| To Notes Payable- Well Fargo A/c | 10000 | ||

| 7 | Delivery Van A/c | 16000 | |

| To Cash A/c | 16000 | ||

| 8 | Delivery Van A/c | 600 | |

| To Cash A/c | 600 | ||

| 9 | Prepaid Advertising A/c | 500 | |

| To Cash A/c | 500 | ||

| 10 | Inventory - Cookies A/c | 6200 | |

| To Accounts Payable A/c | 6200 | ||

| 11 | Inventory - Baskets A/c | 2900 | |

| To Accounts Payable A/c | 2900 | ||

| 12 | Legal Fees A/c | 800 | |

| To Cash a/c | 800 | ||

| 13 | No Entry | ||

| 14 | Supplies (Cellophane, ribbon & sticks) | 300 | |

| To Accounts Payable A/c | 300 | ||

| 15 | Shippling Supplies A/c | 400 | |

| To Cash A/c | 400 | ||

| 16 | Accounts Receivable A/c | 4000 | |

| To Sales A/c | 4000 | ||

| Cost of Goods Sold A/c | 1700 | ||

| Basket Expense A/c | 500 | ||

| Supplies Expense A/c | 50 | ||

| To Inventory - Cookies A/c | 1700 | ||

| To Inventory - Baskets A/c | 500 | ||

| To Supplies (Cellophane, ribbon & sticks) | 50 | ||

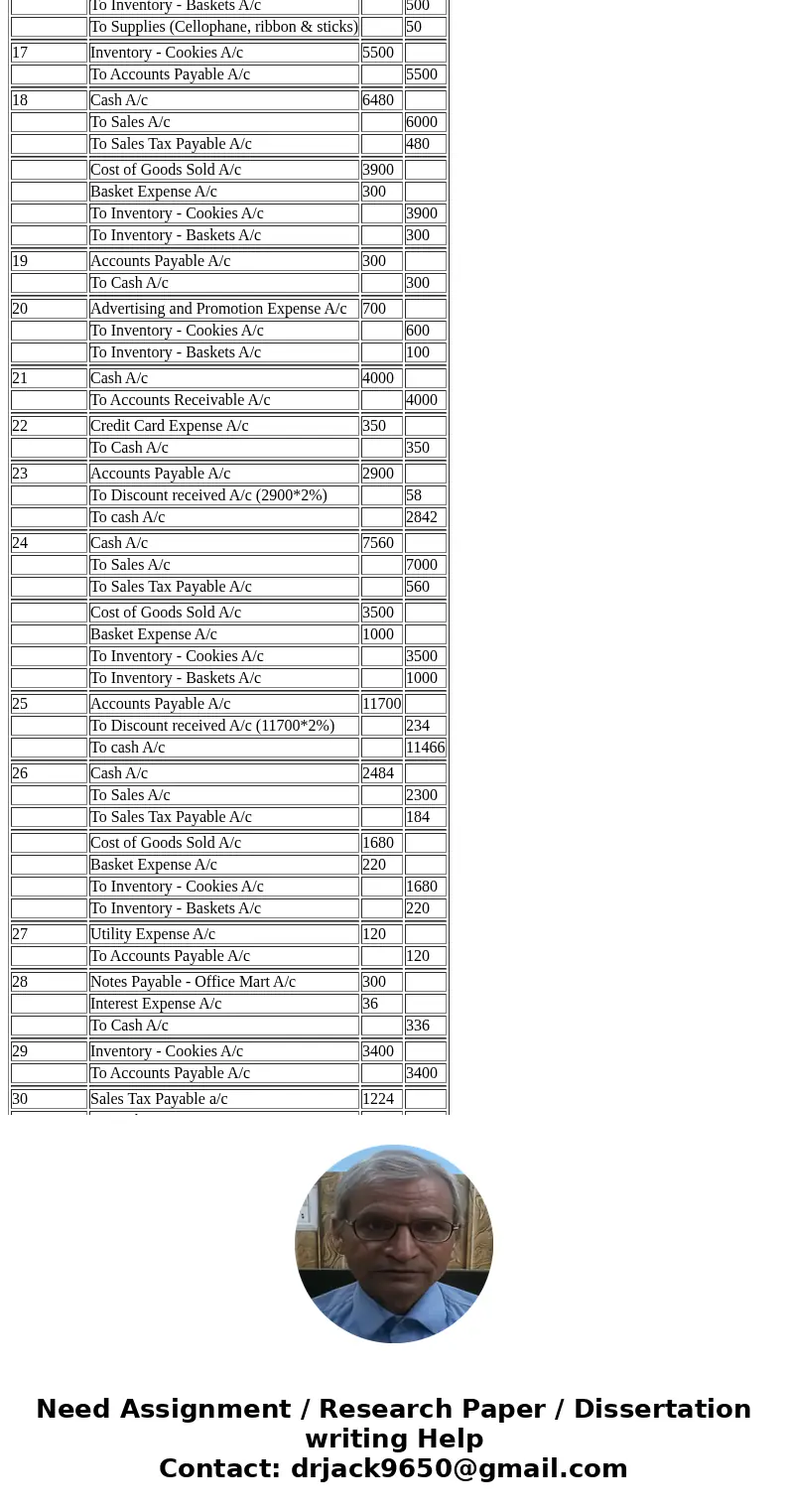

| 17 | Inventory - Cookies A/c | 5500 | |

| To Accounts Payable A/c | 5500 | ||

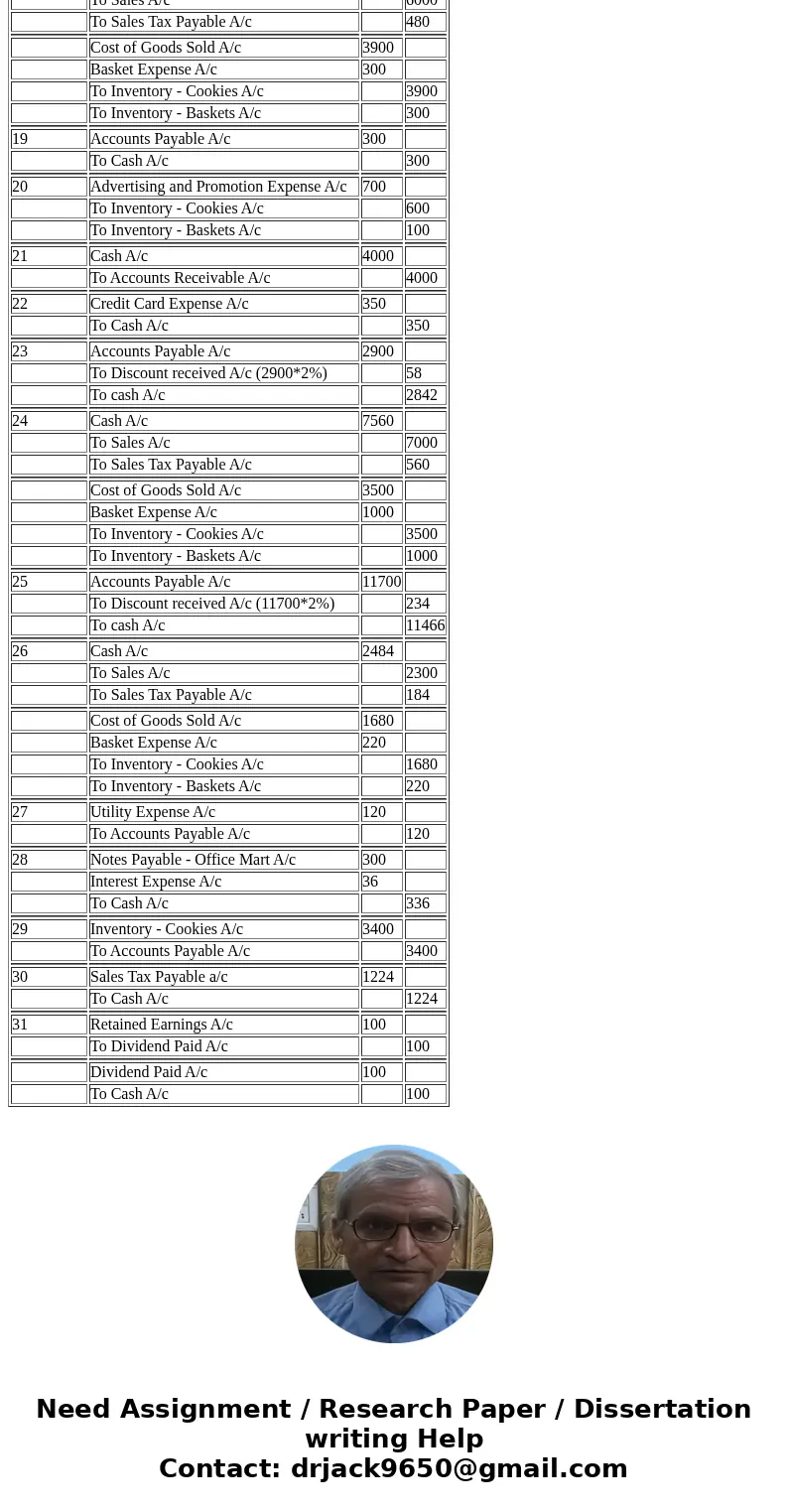

| 18 | Cash A/c | 6480 | |

| To Sales A/c | 6000 | ||

| To Sales Tax Payable A/c | 480 | ||

| Cost of Goods Sold A/c | 3900 | ||

| Basket Expense A/c | 300 | ||

| To Inventory - Cookies A/c | 3900 | ||

| To Inventory - Baskets A/c | 300 | ||

| 19 | Accounts Payable A/c | 300 | |

| To Cash A/c | 300 | ||

| 20 | Advertising and Promotion Expense A/c | 700 | |

| To Inventory - Cookies A/c | 600 | ||

| To Inventory - Baskets A/c | 100 | ||

| 21 | Cash A/c | 4000 | |

| To Accounts Receivable A/c | 4000 | ||

| 22 | Credit Card Expense A/c | 350 | |

| To Cash A/c | 350 | ||

| 23 | Accounts Payable A/c | 2900 | |

| To Discount received A/c (2900*2%) | 58 | ||

| To cash A/c | 2842 | ||

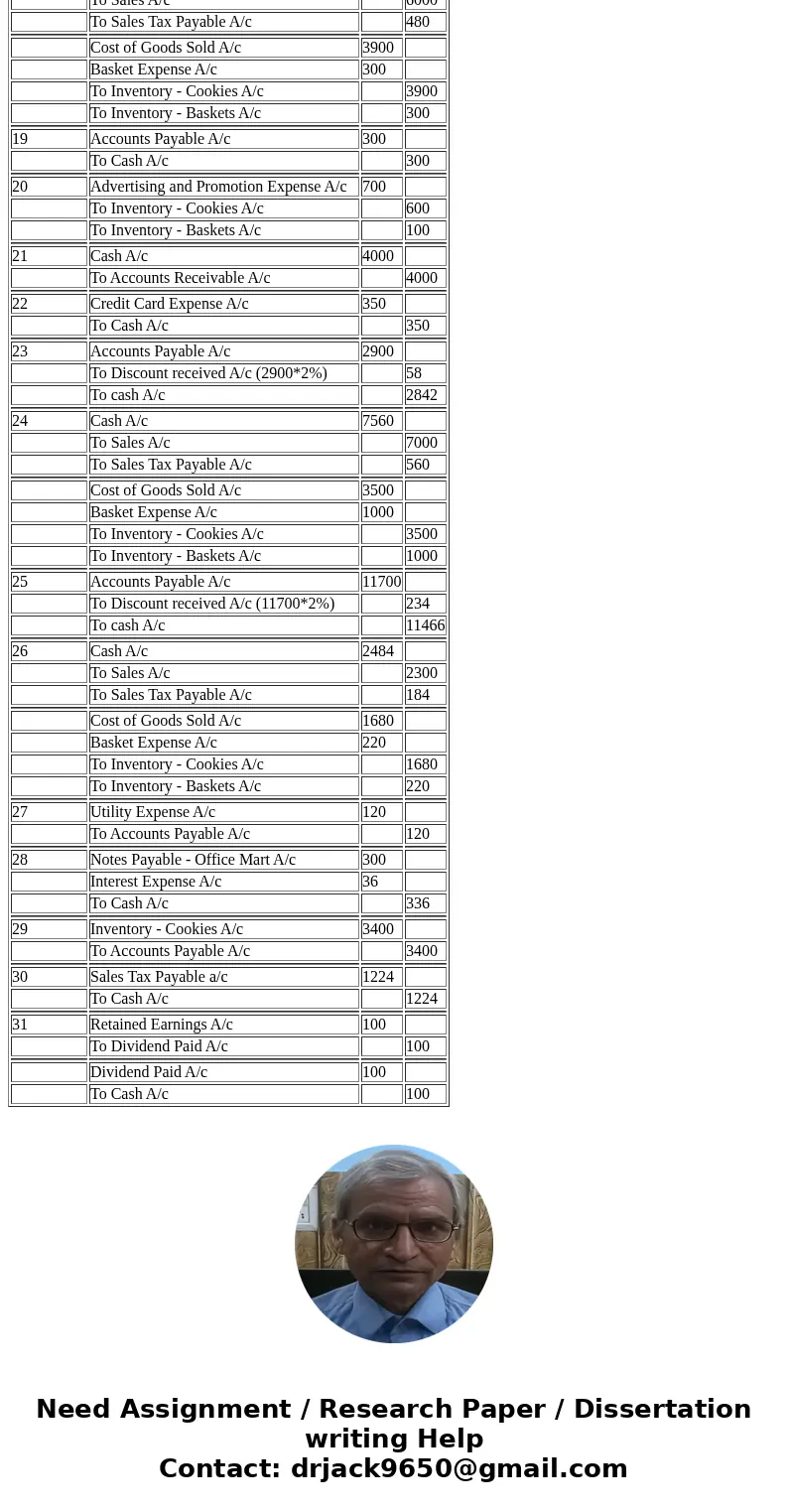

| 24 | Cash A/c | 7560 | |

| To Sales A/c | 7000 | ||

| To Sales Tax Payable A/c | 560 | ||

| Cost of Goods Sold A/c | 3500 | ||

| Basket Expense A/c | 1000 | ||

| To Inventory - Cookies A/c | 3500 | ||

| To Inventory - Baskets A/c | 1000 | ||

| 25 | Accounts Payable A/c | 11700 | |

| To Discount received A/c (11700*2%) | 234 | ||

| To cash A/c | 11466 | ||

| 26 | Cash A/c | 2484 | |

| To Sales A/c | 2300 | ||

| To Sales Tax Payable A/c | 184 | ||

| Cost of Goods Sold A/c | 1680 | ||

| Basket Expense A/c | 220 | ||

| To Inventory - Cookies A/c | 1680 | ||

| To Inventory - Baskets A/c | 220 | ||

| 27 | Utility Expense A/c | 120 | |

| To Accounts Payable A/c | 120 | ||

| 28 | Notes Payable - Office Mart A/c | 300 | |

| Interest Expense A/c | 36 | ||

| To Cash A/c | 336 | ||

| 29 | Inventory - Cookies A/c | 3400 | |

| To Accounts Payable A/c | 3400 | ||

| 30 | Sales Tax Payable a/c | 1224 | |

| To Cash A/c | 1224 | ||

| 31 | Retained Earnings A/c | 100 | |

| To Dividend Paid A/c | 100 | ||

| Dividend Paid A/c | 100 | ||

| To Cash A/c | 100 |

Homework Sourse

Homework Sourse