adapted from CGACanada now CPA PS43B Wingfoot Co began opera

adapted from CGA-Canada, now CPA PS-43B Wingfoot Co. began operations on July 1, 2015. By the end of its first f had sold 10,000 wingers. Selected on are as at June 30, 2016.) (SO 1) Prepare an income statement under vari- scal year ended lune 30,2016 Winghont data on operations for the year ended June 30, 2016, follow. (Any balance sheet f Selling price Wingers produced Ending work in process Total manufacturing overhead Wage rate Machine hours used Wages payable Direct materials costs Selling and administrative expenses $100 the advantages of variable costing over absorption costing. 18,000 $15,000 9,000 $8 per hour $10 per kilogram $40,000 Additional information: 1. Each winger requires 2 kg of direct materials, 0.5 machine hours, and one direct labour hour. 2. Except for machinery depreciation of $5,000 and a $1,000 miscellaneous fixed cost, all manufacturing overbead is 3. Except for $4,000 in advertising expenses, all selling and administrative expenses are variable 4. The tax rate is 40%. Instructions Assume that the company uses variable costing and prepare a contribution-method income statement in good form for (adapted from CGA-Canada, now CPA Canada) Net income - $401,400 the year ended June 30, 2016.

Solution

Calculations and explanations:

1. sales = 10,000 wingers*$100 = $1,000,000

2. Variable costs of goods sold = variable manufacturing overhead+direct material+direct labor

Variable manufacturing overhead = (15000-5000-1000)*10,000/18,000 = 5000

Direct material = $10*2*10,000 = $200,000

Direct labor = 8*1*10,000 = 80,000

Thus variable cost of goods sold = 5000+200000+80000 = 285,000

3. Variable selling & administrative expense = 40000-4000 = 36000

4. Fixed manufacturing overhead = 5000+1000 = 6000

5. Tax = 0.4*669,000 = 267600

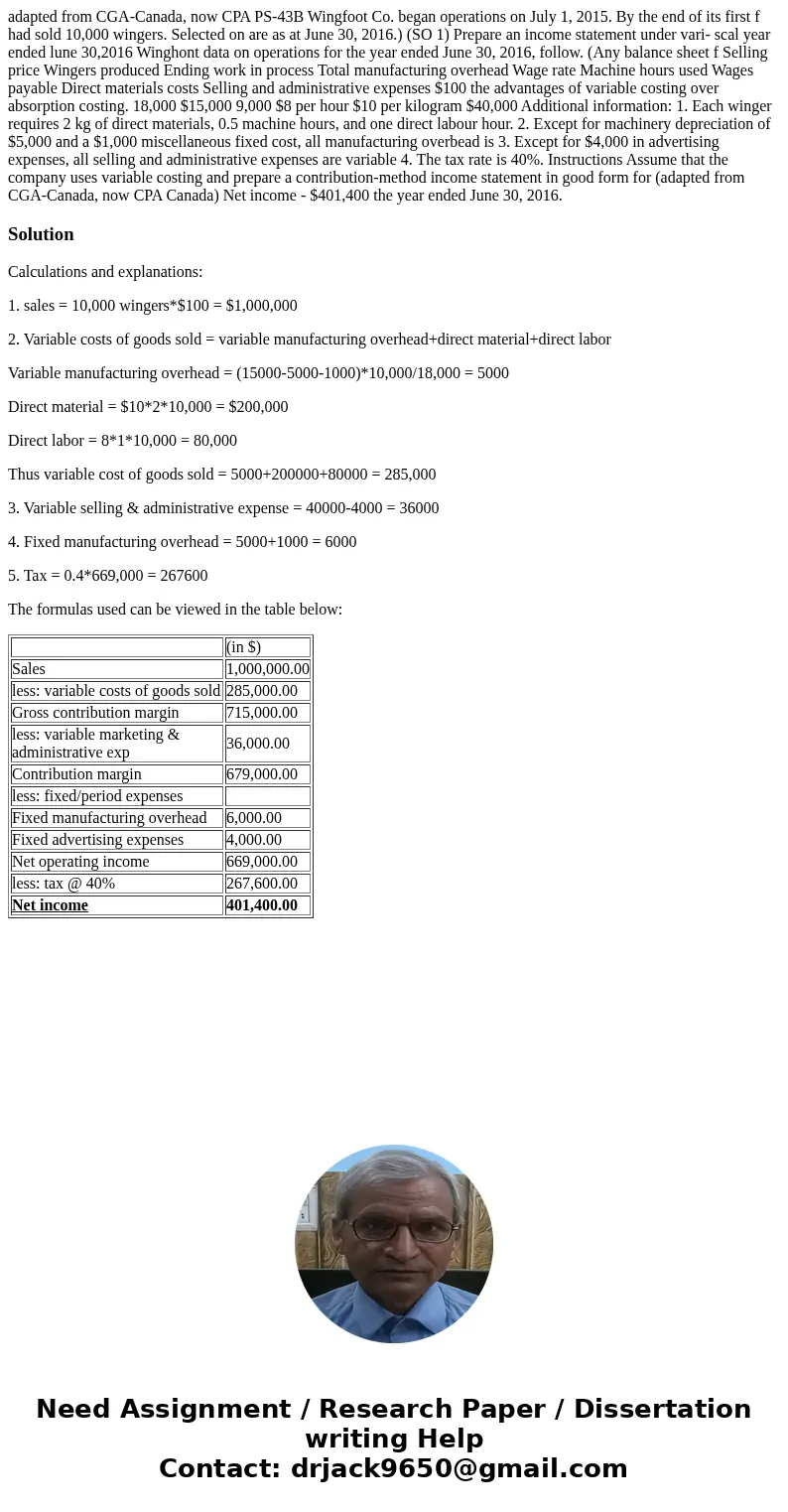

The formulas used can be viewed in the table below:

| (in $) | |

| Sales | 1,000,000.00 |

| less: variable costs of goods sold | 285,000.00 |

| Gross contribution margin | 715,000.00 |

| less: variable marketing & administrative exp | 36,000.00 |

| Contribution margin | 679,000.00 |

| less: fixed/period expenses | |

| Fixed manufacturing overhead | 6,000.00 |

| Fixed advertising expenses | 4,000.00 |

| Net operating income | 669,000.00 |

| less: tax @ 40% | 267,600.00 |

| Net income | 401,400.00 |

Homework Sourse

Homework Sourse